Wells Fargo 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

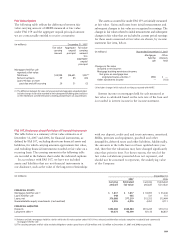

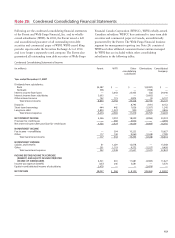

The table below provides information for pension plans

with benefit obligations in excess of plan assets, substantially

due to our nonqualified pension plans.

(in millions) December 31,

2007 2006

Projected benefit obligation $463 $399

Accumulated benefit obligation 422 345

Fair value of plan assets 88 70

The accumulated benefit obligation for the defined benefit

pension plans was $4,734 million and $4,550 million at

December 31, 2007 and 2006, respectively.

We seek to achieve the expected long-term rate of return

with a prudent level of risk given the benefit obligations of

the pension plans and their funded status. We target the

Cash Balance Plan’s asset allocation for a target mix range of

40–70% equities, 20–50% fixed income, and approximately

10% in real estate, venture capital, private equity and other

investments. The target ranges referenced above account for

the employment of an asset allocation methodology designed

to overweight stocks or bonds when a compelling opportunity

exists. The Employee Benefit Review Committee (EBRC),

which includes several members of senior management,

formally reviews the investment risk and performance of

the Cash Balance Plan on a quarterly basis. Annual Plan

liability analysis and periodic asset/liability evaluations are

also conducted.

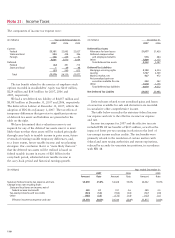

The components of net periodic benefit cost were:

(in millions) Year ended December 31,

2007 2006 2005

Pension benefits Pension benefits Pension benefits

Non- Other Non- Other Non- Other

Qualified qualified benefits Qualified qualified benefits Qualified qualified benefits

Service cost $ 281 $ 15 $ 15 $ 247 $16 $ 15 $ 208 $21 $ 21

Interest cost 246 18 41 224 16 39 220 14 41

Expected return

on plan assets (452) — (36) (421) — (31) (393) — (25)

Amortization of

net actuarial loss (1) 32 13 5 5665 6836

Amortization of

prior service cost —(3)(4) — (1) (4) (4) (2) (1)

Special termination benefits ——— 2—— ———

Curtailment gain ——— —— (9) ———

Settlement 1 — — 5 3 — — — —

Net periodic benefit cost 108 43 21 $ 113 $40 $ 15 $ 99 $36 $ 42

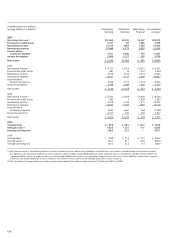

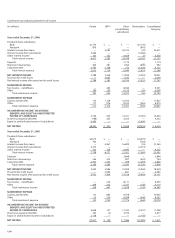

Other changes in

plan assets and

benefit obligations

recognized in other

comprehensive income:

Net actuarial loss (gain) (213) 16 (126)

Amortization of net

actuarial loss (33) (13) (5)

Prior service cost — (24) —

Amortization of prior

service cost —34

Translation adjustments 3 — 2

Total recognized in other

comprehensive income (243) (18) (125)

Total recognized in

net periodic benefit

cost and other

comprehensive income $(135) $ 25 $(104)

(1) Net actuarial loss is generally amortized over five years.

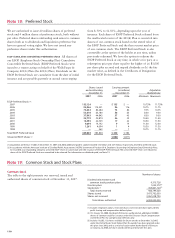

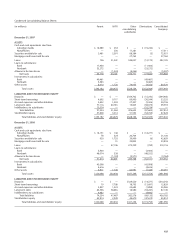

The weighted-average allocation of plan assets was:

Percentage of plan assets at December 31,

2007 2006

Pension Other Pension Other

plan benefit plan benefit

assets plan assets assets plan assets

Equity securities 67% 63% 70% 62%

Debt securities 26 34 24 35

Real estate 42 42

Other 3 1 2 1

Total 100% 100% 100% 100%