Wells Fargo 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

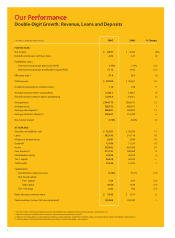

2

First, in the fourth quarter Visa Inc., the world’s largest credit

and debit card provider, completed its global restructuring and

announced it would be going public, contemplating an initial

public offering early in 2008. Wells Fargo owns approximately

2.8 percent of Visa. With the concurrence of the U.S. Securities

and Exchange Commission, Wells Fargo recorded a pretax charge

of $203 million, or 4 cents per share, during the year (third and

fourth quarters) for its share of Visa’s anticipated litigation

expenses. These charges were not expected, but we anticipate

they will be more than offset as a result of our ownership in the

valuable Visa franchise. Second, in the fourth quarter Wells Fargo

recorded a special credit provision of $1.4 billion pretax, or

27 cents per share, largely for higher loan losses we expect in our

home equity portfolio from indirect channels through which

we’re no longer accepting new business. These two items reduced

our 2007 diluted earnings per share by 31 cents.

So, what happened and why did it happen? What did we

do right? What did we do wrong?

For the last several years in our annual reports and other

investor communications, we’ve been saying to you, our owners,

that the financial credit markets were acting as if there’s little or

no risk to lending money.* “Liquidity” — the amount of money

readily available for investing — had reached unprecedented high

levels for individuals, corporations and central banks worldwide.

This led, in part, to careless, undisciplined lending, borrowing,

investing and overall risk management across many segments of

the economy. Many categories of debt became significantly

overvalued. Lenders were not being paid enough for credit risk.

Credit spreads were at record lows across all asset classes.

Aggressive subprime mortgage lenders, many of them unregulated

brokers, used “teaser” rates and “negative amortization” loans

(which add to the unpaid balance) to put many people in homes

they could not afford. Easy access to cheap money encouraged

excessive risk taking, highly leveraged transactions and complex

pools of mortgage-backed debt obligations (many of which were

underestimated for risk by some rating agencies).

This foolishness could not go on forever. Something had to

give. Housing prices — inflated by speculation and aggressive

lending — plunged in many parts of the country. Trust and

confidence in the mortgage securities market collapsed. Large

global and domestic financial services companies took losses

exceeding $163 billion, writing down mortgage loans, leveraged

loan commitments and other assets. A long-overdue upward

repricing of risk continues into 2008. Despite the pain it has caused

many individuals and organizations, long term it is healthy for

our industry and our economy. Credibility, trust and confidence

in pricing for risk are being restored in the credit markets. This

swift retribution is one of the strengths of capitalism.

To Our Owners

Our 2007 results were disappointing. They were not what you,

our owners, expect from Wells Fargo. They were not what we expect

of ourselves. Our diluted earnings per share of $2.38 declined

nine cents from 2006. Two items, in particular, caused this.

* Some things never change! We said 10 years ago in our Norwest Corporation Annual Report, “What’s

happening? Well, we’re probably nearing the end of this economic cycle. Many banks and finance companies

are not pricing for risk. They’re chasing bad loans. They’re relaxing loan covenants beyond prudent levels just

to attract more business. This is irrational. It usually happens near the end of an economic cycle.”