Wells Fargo 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

Comparison of 2006 with 2005

Net income in 2006 increased 10% to a record $8.4 billion

in 2006 from $7.7 billion in 2005. Diluted earnings per

common share increased 10% to a record $2.47 in 2006

from $2.25 in 2005.

Our 10% growth in earnings per share was driven by rev-

enue growth. Revenue grew 8% to a record $35.7 billion in

2006 from $32.9 billion in 2005. The breadth and depth of

our business model resulted in very strong and balanced

growth across product sources (net interest income up 8%,

noninterest income up 9%) and across businesses (double-

digit revenue and/or profit growth in regional banking, busi-

ness direct, wealth management, credit and debit card, cor-

porate trust, commercial banking, asset-based lending, asset

management, real estate brokerage, insurance, international,

commercial real estate, corporate banking and specialized

financial services).

We continued to make investments in 2006 by opening

109 regional banking stores and growing our sales and service

force by adding 4,497 team members (full-time equivalents)

in 2006, including 1,914 retail platform bankers. In 2006, we

continued to be #1 in many categories of financial services

nationally, including retail mortgage originations, home equity

lending, small business lending, agricultural lending, internet

banking, and provider of financial services to middle-market

companies in the western U.S.

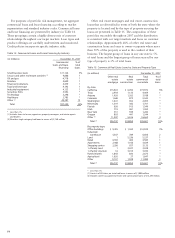

Our core products grew in 2006 from 2005:

• Average loans grew by 4% (up 14% excluding real estate

1-4 family first mortgages);

• Average core deposits grew by 10%; and

• Assets managed and administered were up 26%.

Return on average total assets was 1.73% and return on

average stockholders’ equity was 19.52% in 2006, compared

with 1.72% and 19.59%, respectively, in 2005.

Net interest income on a taxable-equivalent basis was

$20.1 billion in 2006, compared with $18.6 billion a year

ago, reflecting solid loan growth (excluding ARMs) and a

relatively stable net interest margin. With short-term interest

Capital Management

We have an active program for managing stockholder capital.

We use capital to fund organic growth, acquire banks and

other financial services companies, pay dividends and repur-

chase our shares. Our objective is to produce above-market

long-term returns by opportunistically using capital when

returns are perceived to be high and issuing/accumulating

capital when the costs of doing so are perceived to be low.

From time to time the Board of Directors authorizes

the Company to repurchase shares of our common stock.

Although we announce when the Board authorizes share

repurchases, we typically do not give any public notice

before we repurchase our shares. Various factors determine

the amount and timing of our share repurchases, including

our capital requirements, the number of shares we expect to

issue for acquisitions and employee benefit plans, market

conditions (including the trading price of our stock), and

legal considerations. These factors can change at any time,

and there can be no assurance as to the number of shares we

will repurchase or when we will repurchase them.

Historically, our policy has been to repurchase shares

under the “safe harbor” conditions of Rule 10b-18 of the

Securities Exchange Act of 1934 including a limitation on

the daily volume of repurchases. Rule 10b-18 imposes an

additional daily volume limitation on share repurchases

during a pending merger or acquisition in which shares of

our stock will constitute some or all of the consideration.

Our management may determine that during a pending stock

merger or acquisition when the safe harbor would otherwise

be available, it is in our best interest to repurchase shares

in excess of this additional daily volume limitation. In such

cases, we intend to repurchase shares in compliance with the

other conditions of the safe harbor, including the standing

daily volume limitation that applies whether or not there is

a pending stock merger or acquisition.

In March, August and November 2007, the Board autho-

rized the repurchase of up to 75 million, 50 million and

75 million additional shares of our outstanding common

stock, respectively. During 2007, we repurchased 220 million

shares of our common stock. In 2007, we issued approximately

82 million shares of common stock (including shares issued

for our ESOP plan) under various employee benefit and director

plans and under our dividend reinvestment and direct stock

purchase programs and approximately 58 million shares for

acquisitions. At December 31, 2007, the total remaining

common stock repurchase authority was 42 million shares.

Our potential sources of capital include retained earnings

and issuances of common and preferred stock. In 2007, retained

earnings increased $3.8 billion, predominantly as a result of

net income of $8.1 billion less dividends of $4.0 billion. In

2007, we issued $2.3 billion of common stock under various

employee benefit and director plans and $2.1 billion of

common stock for acquisitions.

The Company and each of our subsidiary banks are sub-

ject to various regulatory capital adequacy requirements

administered by the Federal Reserve Board and the OCC.

Risk-based capital guidelines establish a risk-adjusted ratio

relating capital to different categories of assets and off-balance

sheet exposures. At December 31, 2007, the Company and

each of our covered subsidiary banks were “well capitalized”

under applicable regulatory capital adequacy guidelines. See

Note 26 (Regulatory and Agency Capital Requirements) to

Financial Statements for additional information.