Wells Fargo 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We regularly explore opportunities to acquire financial services

companies and businesses. Generally, we do not make a public

announcement about an acquisition opportunity until a

definitive agreement has been signed.

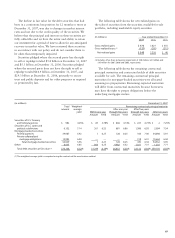

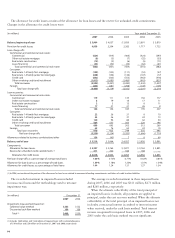

Note 2: Business Combinations

Business combinations completed in 2007, 2006 and

2005 are presented below.

For information on additional consideration related to

acquisitions, which is considered to be a guarantee, see Note 15.

84

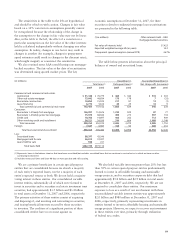

When we discontinue hedge accounting because a deriva-

tive no longer qualifies as an effective fair value hedge, we

continue to carry the derivative in the balance sheet at its

fair value with changes in fair value included in earnings,

and no longer adjust the previously hedged asset or liability

for changes in fair value. Previous adjustments to the hedged

item are accounted for in the same manner as other compo-

nents of the carrying amount of the asset or liability.

When we discontinue cash flow hedge accounting because

the hedging instrument is sold, terminated, or no longer des-

ignated (de-designated), the amount reported in other com-

prehensive income up to the date of sale, termination or de-

designation continues to be reported in other comprehensive

income until the forecasted transaction affects earnings.

When we discontinue cash flow hedge accounting because

it is probable that a forecasted transaction will not occur, we

continue to carry the derivative in the balance sheet at its

fair value with changes in fair value included in earnings,

and immediately recognize gains and losses that were accu-

mulated in other comprehensive income in earnings.

In all other situations in which we discontinue hedge

accounting, the derivative will be carried at its fair value in

the balance sheet, with changes in its fair value recognized in

current period earnings.

We occasionally purchase or originate financial instru-

ments that contain an embedded derivative. At inception of

the financial instrument, we assess (1) if the economic char-

acteristics of the embedded derivative are not clearly and

closely related to the economic characteristics of the financial

instrument (host contract), (2) if the financial instrument

that embodies both the embedded derivative and the host

contract is not measured at fair value with changes in fair

value reported in earnings, and (3) if a separate instrument

with the same terms as the embedded instrument would meet

the definition of a derivative. If the embedded derivative

meets all of these conditions, we separate it from the host

contract by recording the bifurcated derivative at fair value

and the remaining host contract at the difference between

the basis of the hybrid instrument and the fair value of the

bifurcated derivative. The bifurcated derivative is carried as a

free-standing derivative at fair value with changes recorded

in current period earnings.

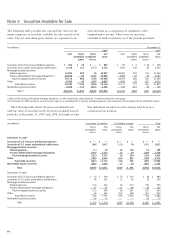

(in millions) Date Assets

2007

Placer Sierra Bancshares, Sacramento, California June 1 $ 2,644

Certain assets of The CIT Group/Equipment Financing, Inc., Tempe, Arizona June 29 2,888

Greater Bay Bancorp, East Palo Alto, California October 1 8,204

Certain Illinois branches of National City Bank, Cleveland, Ohio December 7 61

Other (1) Various 61

$13,858

2006

Secured Capital Corp/Secured Capital LLC, Los Angeles, California January 18 $ 132

Martinius Corporation, Rogers, Minnesota March 1 91

Commerce Funding Corporation, Vienna, Virginia April 17 82

Fremont National Bank of Canon City/Centennial Bank of Pueblo,

Canon City and Pueblo, Colorado June 7 201

Certain assets of the Reilly Mortgage Companies, McLean, Virginia August 1 303

Barrington Associates, Los Angeles, California October 2 65

EFC Partners LP (Evergreen Funding), Dallas, Texas December 15 93

Other (2) Various 20

$ 987

2005

Certain branches of PlainsCapital Bank, Amarillo, Texas July 22 $ 190

First Community Capital Corporation, Houston, Texas July 31 644

Other (3) Various 40

$ 874

(1) Consists of six acquisitions of insurance brokerage and third party health care payment processing businesses.

(2) Consists of seven acquisitions of insurance brokerage businesses.

(3) Consists of eight acquisitions of insurance brokerage and lockbox processing businesses.