Wells Fargo 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

These key economic assumptions and the sensitivity of the

fair value of MSRs to an immediate adverse change in those

assumptions are shown in Note 8 (Securitizations and

Variable Interest Entities) to Financial Statements.

Fair Valuation of Financial Instruments

We use fair value measurements to record fair value

adjustments to certain financial instruments and to deter-

mine fair value disclosures. Trading assets, securities avail-

able for sale, derivatives and substantially all mortgages held

for sale (MHFS) are financial instruments recorded at fair

value on a recurring basis. Additionally, from time to time,

we may be required to record at fair value other financial

assets on a nonrecurring basis, such as nonprime residential

and commercial MHFS, loans held for sale, loans held for

investment and certain other assets. These nonrecurring fair

value adjustments typically involve application of lower-of-

cost-or-market accounting or write-downs of individual

assets. Further, we include in Notes to Financial Statements

information about the extent to which fair value is used to

measure assets and liabilities, the valuation methodologies

used and its impact to earnings. Additionally, for financial

instruments not recorded at fair value we disclose the

estimate of their fair value.

FAS 157, Fair Value Measurements (FAS 157), defines fair

value as the price that would be received to sell the financial

asset or paid to transfer the financial liability in an orderly

transaction between market participants at the measurement

date.

FAS 157 establishes a three-level hierarchy for disclosure

of assets and liabilities recorded at fair value. The classifica-

tion of assets and liabilities within the hierarchy is based on

whether the inputs to the valuation methodology used for

measurement are observable or unobservable. Observable

inputs reflect market-derived or market-based information

obtained from independent sources, while unobservable

inputs reflect our estimates about market data.

• Level 1 – Valuation is based upon quoted prices for

identical instruments traded in active markets. Level 1

instruments include securities traded on active exchange

markets, such as the New York Stock Exchange, as well

as U.S. Treasury, other U.S. government and agency

mortgage-backed securities that are traded by dealers

or brokers in active over-the-counter markets.

• Level 2 – Valuation is based upon quoted prices for

similar instruments in active markets, quoted prices for

identical or similar instruments in markets that are not

active, and model-based valuation techniques for which

all significant assumptions are observable in the market.

Level 2 instruments include securities traded in less active

dealer or broker markets and MHFS that are valued

based on prices for other mortgage whole loans with

similar characteristics.

• Level 3 – Valuation is generated from model-based tech-

niques that use significant assumptions not observable

in the market. These unobservable assumptions reflect

our own estimates of assumptions market participants

would use in pricing the asset or liability. Valuation tech-

niques include use of option pricing models, discounted

cash flow models and similar techniques.

In accordance with FAS 157, it is our policy to maximize

the use of observable inputs and minimize the use of unob-

servable inputs when developing fair value measurements.

When available, we use quoted market prices to measure fair

value. If market prices are not available, fair value measure-

ment is based upon models that use primarily market-based

or independently-sourced market parameters, including inter-

est rate yield curves, prepayment speeds, option volatilities

and currency rates. Substantially all of our financial instru-

ments use either of the foregoing methodologies, collectively

Level 1 and Level 2 measurements, to determine fair value

adjustments recorded to our financial statements. However,

in certain cases, when market observable inputs for model-

based valuation techniques may not be readily available, we

are required to make judgments about assumptions market

participants would use in estimating the fair value of the

financial instrument.

The degree of management judgment involved in deter-

mining the fair value of a financial instrument is dependent

upon the availability of quoted market prices or observable

market parameters. For financial instruments that trade

actively and have quoted market prices or observable market

parameters, there is minimal subjectivity involved in measur-

ing fair value. When observable market prices and parameters

are not fully available, management judgment is necessary to

estimate fair value. In addition, changes in the market condi-

tions may reduce the availability of quoted prices or observ-

able data. For example, reduced liquidity in the capital mar-

kets or changes in secondary market activities could result in

observable market inputs becoming unavailable. Therefore,

when market data is not available, we would use valuation

techniques requiring more management judgment to estimate

the appropriate fair value measurement.

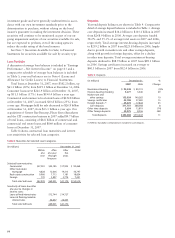

At December 31, 2007, approximately 22% of total

assets, or $123.8 billion, consisted of financial instruments

recorded at fair value on a recurring basis. Approximately

82% of these financial instruments used valuation method-

ologies involving market-based or market-derived informa-

tion, collectively Level 1 and 2 measurements, to measure

fair value. Approximately 18% of these financial assets are

measured using model-based techniques, or Level 3 measure-

ments. Virtually all of our financial assets valued using Level

3 measurements represented MSRs (previously described) or

investments in asset-backed securities where we underwrite

the underlying collateral (auto lease receivables). At

December 31, 2007, approximately 0.5% of total liabilities,

or $2.6 billion, consisted of financial instruments recorded at

fair value on a recurring basis.

See Note 17 (Fair Values of Assets and Liabilities) to

Financial Statements for a complete discussion on our use of

fair valuation of financial instruments, our related measure-

ment techniques and its impact to our financial statements.