Wells Fargo 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

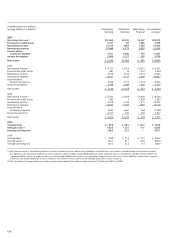

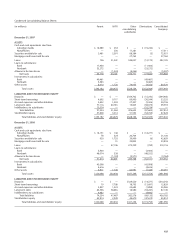

(income/expense in millions,

average balances in billions) Community Wholesale Wells Fargo Consolidated

Banking Banking Financial

Company

2007

Net interest income (1) $13,365 $3,382 $4,227 $20,974

Provision for credit losses 3,187 69 1,683 4,939

Noninterest income 12,173 4,959 1,284 18,416

Noninterest expense 15,000 4,772 3,052 22,824

Income before

income tax expense 7,351 3,500 776 11,627

Income tax expense 2,058 1,217 295 3,570

Net income $ 5,293 $2,283 $ 481 $ 8,057

2006

Net interest income (1) $ 13,117 $ 2,924 $ 3,910 $ 19,951

Provision for credit losses 887 16 1,301 2,204

Noninterest income 9,915 4,310 1,515 15,740

Noninterest expense 13,917 4,114 2,806 20,837

Income before

income tax expense 8,228 3,104 1,318 12,650

Income tax expense 2,678 1,086 466 4,230

Net income $ 5,550 $ 2,018 $ 852 $ 8,420

2005

Net interest income (1) $ 12,702 $ 2,393 $ 3,409 $ 18,504

Provision for credit losses 895 1 1,487 2,383

Noninterest income 9,418 3,756 1,271 14,445

Noninterest expense 12,972 3,487 2,559 19,018

Income before

income tax expense 8,253 2,661 634 11,548

Income tax expense 2,717 931 229 3,877

Net income $ 5,536 $ 1,730 $ 405 $ 7,671

2007

Average loans $ 194.0 $ 85.6 $ 65.2 $ 344.8

Average assets (2) 330.8 113.1 71.1 520.8

Average core deposits 249.8 53.3 — 303.1

2006

Average loans $ 178.0 $ 71.4 $ 57.5 $ 306.9

Average assets (2) 320.2 97.1 62.9 486.0

Average core deposits 233.5 35.3 0.1 268.9

(1) Net interest income is the difference between interest earned on assets and the cost of liabilities to fund those assets. Interest earned includes actual interest earned

on segment assets and, if the segment has excess liabilities, interest credits for providing funding to other segments. The cost of liabilities includes interest expense on

segment liabilities and, if the segment does not have enough liabilities to fund its assets, a funding charge based on the cost of excess liabilities from another segment.

In general, Community Banking has excess liabilities and receives interest credits for the funding it provides to other segments.

(2) The Consolidated Company balance includes unallocated goodwill held at the enterprise level of $5.8 billion for 2007 and 2006.