Wells Fargo 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

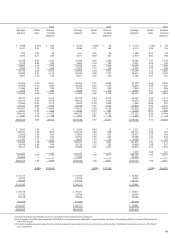

Noninterest income increased 23% to $12.17 billion in 2007

from $9.92 billion in 2006, primarily due to retail banking

fee revenue growth in brokerage, deposit service charges,

cards and investments. Noninterest income also included

higher mortgage banking revenue, which increased $505 million

(18%) largely due to higher servicing income. The provision

for credit losses for 2007 increased to $3.19 billion in 2007

from $887 million in 2006 including the fourth quarter 2007

$1.4 billion credit reserve build, with over half of the remaining

increase in the Home Equity portfolio. Noninterest expense

for 2007 increased 8% to $15.00 billion in 2007 from

$13.92 billion in 2006, due to growth in personnel expenses.

WHOLESALE BANKING’S net income increased 13% to a record

$2.28 billion in 2007 from $2.02 billion in 2006. Revenue

increased 15% to a record $8.34 billion from $7.23 billion

in 2006. Net interest income increased 16% to $3.38 billion

for 2007 from $2.92 billion for 2006 primarily due to higher

earning asset volumes and earning asset yields and related

fees, partially offset by higher funding costs. Average loans

increased 20% to $85.6 billion in 2007 from $71.4 billion

in 2006. Average core deposits grew 51% to $53.3 billion

primarily due to large corporate and middle-market relation-

ships, international and correspondent banking customers

and from higher Eurodollar sweep and liquidity balances from

our asset management customers. The increase in provision

for credit losses to $69 million in 2007 from $16 million in

2006 was due to higher net charge-offs. Noninterest income

increased 15% to $4.96 billion in 2007, due to higher deposit

service charges, trust and investment income, foreign exchange

fees, insurance revenue, commercial real estate brokerage fees

and capital markets activity. Noninterest expense increased

16% to $4.77 billion in 2007 from $4.11 billion in 2006,

due to higher personnel-related costs, expenses related to

higher sales volumes, investments in new offices and busi-

nesses and acquisitions.

WELLS FARGO FINANCIAL’S net income decreased 44% to

$481 million in 2007 from $852 million in 2006 reflecting

higher credit losses and our decision in late 2006 to slow the

growth in our auto portfolio as well as the divestiture of some

of our Latin American operations and a $50 million reversal

of Hurricane Katrina-related reserves, both in 2006. Revenue

was up 2% to $5.51 billion in 2007 from $5.43 billion in

2006. Net interest income increased 8% to $4.23 billion

from $3.91 billion in 2006 due to growth in average loans.

Average loans increased 13% to $65.2 billion in 2007 from

$57.5 billion in 2006. The provision for credit losses increased

$382 million in 2007 from 2006, primarily due to an increase

in net charge-offs in the auto lending and credit card portfo-

lios, and lower net charge-offs in early 2006 relating to

the bankruptcy law change in October 2005. Noninterest

income decreased $231 million in 2007 from 2006 in part,

as a result of the Latin American sale. Noninterest expense

increased $246 million (9%) in 2007 from 2006, primarily

due to higher employee compensation and benefit costs. A

significant portion of this increase was due to Wells Fargo

Financial’s continued focus on reducing losses and delin-

quencies in auto lending and credit card portfolios by

improving processes and staffing levels in collections.

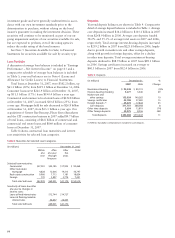

Balance Sheet Analysis

Securities Available for Sale

Our securities available for sale consist of both debt and

marketable equity securities. We hold debt securities available

for sale primarily for liquidity, interest rate risk management

and long-term yield enhancement. Accordingly, this portfolio

primarily includes very liquid, high-quality federal agency and

privately issued mortgage-backed securities. At December 31,

2007, we held $70.2 billion of debt securities available for

sale, with net unrealized gains of $775 million, compared

with $41.8 billion at December 31, 2006, with net unrealized

gains of $722 million. We also held $2.8 billion of marketable

equity securities available for sale at December 31, 2007,

and $796 million at December 31, 2006, with net unrealized

losses of $95 million and net gains of $204 million for the

same periods, respectively. The increase in marketable equity

securities was primarily due to our adoption of Topic

D-109 effective July 1, 2007, which resulted in the transfer

of approximately $1.2 billion of securities, consisting of

investments in preferred stock callable by the issuer, from

trading assets to securities available for sale.

The weighted-average expected maturity of debt securities

available for sale was 5.9 years at December 31, 2007. Since 78%

of this portfolio is mortgage-backed securities, the expected

remaining maturity may differ from contractual maturity

because borrowers may have the right to prepay obligations

before the underlying mortgages mature. The estimated effect

of a 200 basis point increase or decrease in interest rates on the

fair value and the expected remaining maturity of the mort-

gage-backed securities available for sale is shown in Table 7.

Table 7: Mortgage-Backed Securities

(in billions) Fair Net Remaining

value unrealized maturity

gain (loss)

At December 31, 2007 $55.0 $ 0.9 4.0 yrs.

At December 31, 2007,

assuming a 200 basis point:

Increase in interest rates 50.7 (3.4) 6.4 yrs.

Decrease in interest rates 56.7 2.6 1.7 yrs.

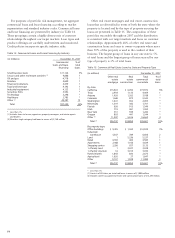

We have approximately $3 billion of investments in secu-

rities, primarily municipal bonds, that are guaranteed against

loss by bond insurers. These securities are almost exclusively