Wells Fargo 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

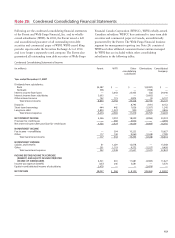

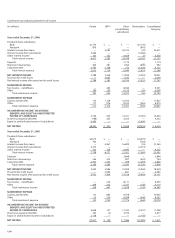

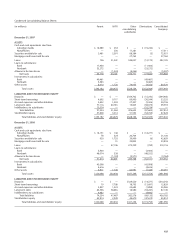

Condensed Consolidating Statement of Cash Flows

(in millions) Parent WFFI Other Consolidated

consolidating Company

subsidiaries/

eliminations

Year ended December 31, 2005

Cash flows from operating activities:

Net cash provided (used) by operating activities $ 5,396 $ 1,159 $(18,540)$(11,985)

Cash flows from investing activities:

Securities available for sale:

Sales proceeds 631 281 18,147 19,059

Prepayments and maturities 90 248 6,634 6,972

Purchases (231) (486) (27,917) (28,634)

Loans:

Increase in banking subsidiaries’ loan

originations, net of collections — (953) (41,356) (42,309)

Proceeds from sales (including participations) of loans

originated for investment by banking subsidiaries — 232 42,007 42,239

Purchases (including participations) of loans by

banking subsidiaries — — (8,853) (8,853)

Principal collected on nonbank entities’ loans — 19,542 3,280 22,822

Loans originated by nonbank entities — (29,757) (3,918) (33,675)

Net repayments from (advances to) subsidiaries (3,166) — 3,166 —

Capital notes and term loans made to subsidiaries (10,751) — 10,751 —

Principal collected on notes/loans made to subsidiaries 2,950 — (2,950) —

Net decrease (increase) in investment in subsidiaries 194 — (194) —

Net cash acquired from acquisitions — — 66 66

Other, net — (1,059) (4,045) (5,104)

Net cash used by investing activities (10,283) (11,952) (5,182) (27,417)

Cash flows from financing activities:

Net change in:

Deposits — — 38,961 38,961

Short-term borrowings 1,048 3,344 (2,514) 1,878

Long-term debt:

Proceeds from issuance 18,297 11,891 (3,715) 26,473

Repayment (8,216) (4,450) (5,910) (18,576)

Common stock:

Proceeds from issuance 1,367 — — 1,367

Repurchased (3,159) — — (3,159)

Cash dividends paid (3,375) — — (3,375)

Other, net — — (1,673) (1,673)

Net cash provided by financing activities 5,962 10,785 25,149 41,896

Net change in cash and due from banks 1,075 (8) 1,427 2,494

Cash and due from banks at beginning of year 9,719 482 2,702 12,903

Cash and due from banks at end of year $ 10,794 $ 474 $ 4,129 $ 15,397

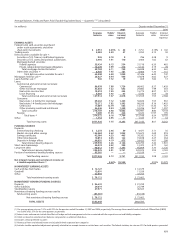

Note 26: Regulatory and Agency Capital Requirements

The Company and each of its subsidiary banks are subject to

various regulatory capital adequacy requirements administered

by the Federal Reserve Board (FRB) and the OCC, respectively.

The Federal Deposit Insurance Corporation Improvement

Act of 1991 (FDICIA) required that the federal regulatory

agencies adopt regulations defining five capital tiers for banks:

well capitalized, adequately capitalized, undercapitalized,

significantly undercapitalized and critically undercapitalized.

Failure to meet minimum capital requirements can initiate

certain mandatory, and possibly additional discretionary,

actions by regulators that, if undertaken, could have a

direct material effect on our financial statements.

Quantitative measures, established by the regulators to

ensure capital adequacy, require that the Company and each

of the subsidiary banks maintain minimum ratios (set forth

in the following table) of capital to risk-weighted assets.

There are three categories of capital under the guidelines.

Tier 1 capital includes common stockholders’ equity, qualifying

preferred stock and trust preferred securities, less goodwill

and certain other deductions (including a portion of servicing

assets and the unrealized net gains and losses, after taxes, on

securities available for sale). Tier 2 capital includes preferred

stock not qualifying as Tier 1 capital, subordinated debt,

the allowance for credit losses and net unrealized gains on