Wells Fargo 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

• Wells Fargo Home Mortgage had a relatively good year and

was the nation’s #1 retail mortgage originator for the 15th

consecutive year despite the sharp housing downturn and

turbulent secondary markets. Mortgage originations declined

seven percent to $272 billion, but our owned home mortgage

servicing (processing the monthly payments of your home loan)

portfolio reached $1.53 trillion, up 12 percent from 2006.

Growth Opportunities

As we’ve said for years, our greatest opportunities for growth are

right in front of us: satisfying all our customers’ financial needs

and helping them succeed financially. Here’s a progress report on

three of our biggest growth opportunities: wealth management,

insurance and business banking.

Wealth Management Group Our #1 strategic initiative is to grow

our investments and insurance businesses to 25 percent of our

company’s total earnings. We continue to make good progress.

The total assets we managed in our Wealth Management Group

— Investment Management, Insurance, Brokerage, Trust and

Estate, and Private Banking — grew 10 percent in 2007. We

want to give our highest-value customers the most personalized

service possible. To that end, we introduced Wells Fargo Private

Bank across the country, including several markets outside

our 23 Community Banking states. The Private Bank provides

personalized wealth management solutions for clients with

$1 million or more in Wells Fargo relationship balances,

excluding mortgages. Our dedicated relationship teams help

clients manage their daily financial needs, preserve and build

wealth, achieve philanthropic goals and build a legacy for

future generations.

Our Wealth Management Group grew core deposits 28 percent

and loans 15 percent — and our offer of 100 commission-free

trades through WellsTrade®online brokerage for our Wells Fargo®

PMA®Package customers helped us grow self-directed brokerage

assets under administration by 35 percent. We also launched The

Private Bank online, which generated significant new balances.

Insurance We’re the world’s fifth-largest insurance brokerage,

third-largest U.S. commercial insurance brokerage, and the

largest bank-owned U.S. insurance brokerage, but we’re a long

way from being #1 for all our customers’ insurance needs. The

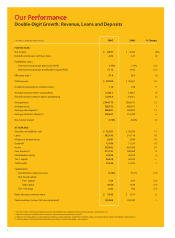

revenue also grew faster than our expenses (up 9.5 percent),

which we consider the best long-term measure of a company’s

efficiency. Our return on equity (after-tax profit for every

shareholder dollar) was a very respectable 17.1 percent. Most

of our businesses achieved very solid financial results. Among

their achievements:

• Wholesale Banking – Record net income of $2.3 billion, up

13 percent, and revenue up 15 percent, its ninth consecutive

year of double-digit growth. Average loans rose 20 percent.

Cross-sell reached a record 6.1 products per Wholesale

customer relationship (4.9 five years ago) and 7.6 products

per middle-market commercial banking relationship. Almost

a third of our regional commercial banking offices had

more than eight products per relationship. Some averaged

more than 10!

• Asset Management Group – Double-digit growth in revenue,

earnings and assets under management. Wells Fargo Advantage

Funds®— with assets up 24 percent — is the nation’s third-

largest fund manager among banks.

• Community Banking – Revenue up 11 percent, average loans

up nine percent, average retail core deposits up six percent,

record retail bank household cross-sell of 5.5 products per

household (5.2 a year ago, about three, nine years ago), and

we opened 87 new banking stores. One of every five of our

retail banking customers has more than eight products with

us, and in our top region almost one of every three customers

does. Core product solutions (checking, savings, credit cards

and referrals of mortgage, insurance and brokerage) rose

11 percent, 16 percent in California. Wells Fargo Packages®

sales (checking account and at least three other products)

rose 21 percent — purchased by almost three of every four

of our new checking customers. Consumer checking accounts

rose a net 4.7 percent.

• Team member engagement – An important leading indicator

of satisfied customers who give us more of their business —

rose again. Our ratio of engaged to actively disengaged team

members in Community Banking now stands at 8.5 to 1 (7.1

to 1 last year, 2.5 to 1 five years ago) — the fifth consecutive

year of improvement. The national average for all surveyed

companies is only 2 to 1.

“ ‘Capital’ is an important attribute

of an outstanding financial

services company. It’s what’s left

for shareholders after subtracting

a company’s liabilities from its

assets. Our capital levels outpace

our peers.”

7. 0 %

5.0 %

Tangible Common Equity + Allowance/Tangible Assets Measures a bank’s “cushion”

for both expected and unexpected losses as a percent of tangible assets. We had $7.00

of such cushion for every $100 of tangible assets (12/31/07) — 200 basis points greater

than our large peers’ average.

Wells Fargo Large peers

Source: Wells Fargo, SNL

Our Capital Strength