Wells Fargo 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

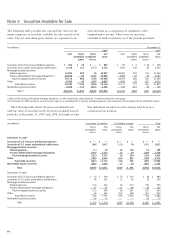

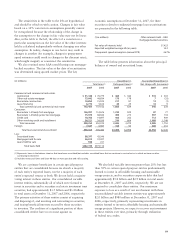

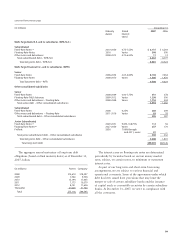

(in millions) Year ended December 31,

2007 2006 2005 2004 2003

Balance, beginning of year $ 3,964 $ 4,057 $ 3,950 $ 3,891 $ 3,819

Provision for credit losses 4,939 2,204 2,383 1,717 1,722

Loan charge-offs:

Commercial and commercial real estate:

Commercial (629) (414) (406) (424) (597)

Other real estate mortgage (6) (5) (7) (25) (33)

Real estate construction (14) (2) (6) (5) (11)

Lease financing (33) (30) (35) (62) (41)

Total commercial and commercial real estate (682) (451) (454) (516) (682)

Consumer:

Real estate 1-4 family first mortgage (109) (103) (111) (53) (47)

Real estate 1-4 family junior lien mortgage (648) (154) (136) (107) (77)

Credit card (832) (505) (553) (463) (476)

Other revolving credit and installment (1,913) (1,685) (1,480) (919) (827)

Total consumer (3,502) (2,447) (2,280) (1,542) (1,427)

Foreign (265) (281) (298) (143) (105)

Total loan charge-offs (4,449) (3,179) (3,032) (2,201) (2,214)

Loan recoveries:

Commercial and commercial real estate:

Commercial 119 111 133 150 177

Other real estate mortgage 819 16 17 11

Real estate construction 2313 611

Lease financing 17 21 21 26 8

Total commercial and commercial real estate 146 154 183 199 207

Consumer:

Real estate 1-4 family first mortgage 22 26 21 6 10

Real estate 1-4 family junior lien mortgage 53 36 31 24 13

Credit card 120 96 86 62 50

Other revolving credit and installment 504 537 365 220 196

Total consumer 699 695 503 312 269

Foreign 65 76 63 24 19

Total loan recoveries 910 925 749 535 495

Net loan charge-offs (3,539) (2,254) (2,283) (1,666) (1,719)

Allowances related to business combinations/other 154 (43) 7 8 69

Balance, end of year $ 5,518 $ 3,964 $ 4,057 $ 3,950 $ 3,891

Components:

Allowance for loan losses $ 5,307 $ 3,764 $ 3,871 $ 3,762 $ 3,891

Reserve for unfunded credit commitments (1) 211 200 186 188 —

Allowance for credit losses $ 5,518 $ 3,964 $ 4,057 $ 3,950 $ 3,891

Net loan charge-offs as a percentage of average total loans 1.03% 0.73% 0.77% 0.62% 0.81%

Allowance for loan losses as a percentage of total loans 1.39% 1.18% 1.25% 1.31% 1.54%

Allowance for credit losses as a percentage of total loans 1.44 1.24 1.31 1.37 1.54

(1) In 2004, we transferred the portion of the allowance for loan losses related to commercial lending commitments and letters of credit to other liabilities.

The allowance for credit losses consists of the allowance for loan losses and the reserve for unfunded credit commitments.

Changes in the allowance for credit losses were:

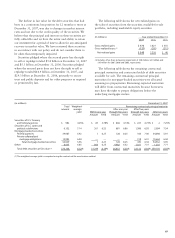

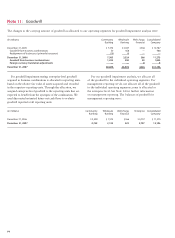

The recorded investment in impaired loans included

in nonaccrual loans and the methodology used to measure

impairment was:

The average recorded investment in these impaired loans

during 2007, 2006 and 2005 was $313 million, $173 million

and $260 million, respectively.

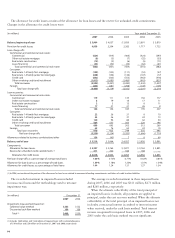

When the ultimate collectibility of the total principal of

an impaired loan is in doubt, all payments are applied to

principal, under the cost recovery method. When the ultimate

collectibility of the total principal of an impaired loan is not

in doubt, contractual interest is credited to interest income

when received, under the cash basis method. Total interest

income recognized for impaired loans in 2007, 2006 and

2005 under the cash basis method was not significant.

(in millions) December 31,

2007 2006

Impairment measurement based on:

Collateral value method $285 $122

Discounted cash flow method 184 108

Total (1) $469 $230

(1) Includes $369 million and $146 million of impaired loans with a related allowance

of $50 million and $29 million at December 31, 2007 and 2006, respectively.