Wells Fargo 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

sourced through wholesale (brokers) and correspondents. Our

real estate 1-4 family first mortgage portfolio continued to

perform well, with net charge-offs of $87 million (0.14% of

average loans) for 2007, up from $77 million (0.13%) for 2006.

Because of our responsible lending and risk management

practices, we have not faced many of the issues others have

in the mortgage industry. We do not make or purchase any

negative amortizing mortgages, including option ARMs.

We have minimal ARM reset risk across our owned loan

portfolios. While our disciplined underwriting standards

have resulted in first mortgage delinquencies below industry

levels, we continued to tighten our underwriting standards

in the last half of 2007. Home Mortgage closed its nonprime

wholesale channel early in third quarter, after closing its

nonprime correspondent channel in second quarter 2007.

Rates were increased for non-conforming mortgage loans

during third quarter reflecting the reduced liquidity in the

capital markets.

Credit quality in Wells Fargo Financial’s real estate-

secured lending business has not experienced the level of

credit degradation that many nonprime lenders have because

of our disciplined underwriting practices. Wells Fargo

Financial does not use brokers or correspondents in its U.S.

debt consolidation business. We endeavor to ensure that there

is a tangible benefit to the borrower before we make a loan.

The recent guidance issued by the federal financial regulatory

agencies in June 2007, Statement on Subprime Mortgage

Lending, which addresses issues relating to certain ARM

products, will not have a significant impact on Wells Fargo

Financial’s operations, since many of those guidelines have

long been part of our normal business practices.

Higher net charge-offs in non-real estate consumer loans

(credit card and other revolving credit and installment) were

primarily due to increases in the indirect auto portfolio, with

auto net charge-offs for 2007 up $164 million from 2006.

The increase in all other consumer portfolios, including credit

cards, was due to an overall weakening in the economy.

Credit performance in the commercial and commercial

real estate portfolio remained strong, with net charge-offs

of $536 million (0.40% of average loans), compared with

$297 million (0.26%) in 2006. As is typical, the vast majority

of these charge-offs came from loans originated through our

business direct channel. Business direct consists primarily of

unsecured lines of credit to small firms and properties that

tend to perform in a manner similar to credit cards. Because

of our Wholesale Banking business model, focused primarily

on business customers, we do not actively participate in

certain higher-risk activities. Our capital market business

was largely not impacted by the credit crunch or market

dislocations in 2007, including industry problem areas of

CDOs, CLOs and SIVs. On the investment side of this

business, we operate within disciplined credit standards

and regularly monitor and manage our securities portfolios.

From an underwriting standpoint, we have not participated

in a significant way in any of the large leveraged buyouts

that were “covenant lite” and we have minimal direct expo-

sure to hedge funds. Similarly, we have not made a market in

subprime securities. Leveraged-buyout-related outstandings

are diversified by business and borrower and totaled less than

2% of total Wells Fargo loans. Our residential real estate

development portfolio of approximately $6 billion, or 2% of

total loans, continued to perform in a satisfactory manner.

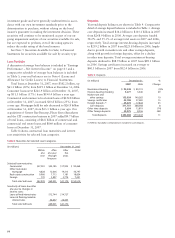

Table 18 presents the allocation of the allowance for

credit losses by type of loans. The $1.55 billion increase in

the allowance for credit losses from year-end 2006 to year-end

2007 was due to actions taken in 2007 primarily related to

the Home Equity portfolio and approximately $100 million

acquired from bank acquisitions. The decrease of $93 million

in the allowance for credit losses from year-end 2005 to

year-end 2006 was primarily due to the release of the

remaining portion of the provision made for Hurricane

Katrina in 2005. Changes in the allowance reflect changes in

statistically derived loss estimates, historical loss experience,

current trends in borrower risk and/or general economic

activity on portfolio performance, and management’s estimate

for imprecision and uncertainty. Effective December 31, 2006,

the entire allowance was assigned to individual portfolio types

to better reflect our view of risk in these portfolios. The

allowance for credit losses includes a combination of base-

line loss estimates and a range of imprecision or uncertainty

specific to each portfolio segment previously categorized as

unallocated in prior years.