Wells Fargo 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

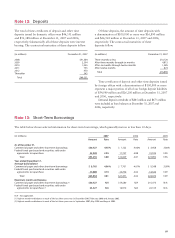

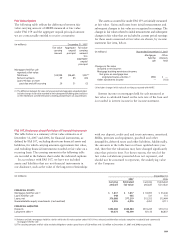

107

(in millions) December 31, 2007

Total Level 1 Level 2 Level 3

Trading assets $ 7,727 $ 1,041 $ 6,268 $ 418

Securities available for sale 72,951 38,178 29,392 5,381(2)

Mortgages held for sale 24,998 — 24,852 146

Mortgage servicing rights

(residential) 16,763 — — 16,763

Other assets (1) 1,393 1,145 207 41

Total $123,832 $40,364 $60,719 $22,749

Other liabilities (1) $ (2,591) $ (1,670) $ (606) $ (315)

(1) Derivatives are included in this category.

(2) Asset-backed securities where we underwrite the underlying collateral

(auto lease receivables) represent substantially all of this balance.

using a valuation model that calculates the present value of

estimated future net servicing income. The model incorporates

assumptions that market participants use in estimating future

net servicing income, including estimates of prepayment

speeds (including housing price volatility), discount rate,

cost to service (including delinquency and foreclosure costs),

escrow account earnings, contractual servicing fee income,

ancillary income and late fees. Since the adoption of FAS 156

on January 1, 2006, we record residential MSRs at fair value

on a recurring basis. Commercial MSRs continue to be carried

at lower of cost or market value, and therefore can be subject

to fair value measurements on a nonrecurring basis. For other

interests held in securitizations (such as interest-only strips)

we use a valuation model that calculates the present value

of estimated future cash flows. The model incorporates our

own estimates of assumptions market participants use in

determining the fair value, including estimates of prepayment

speeds, discount rates, defaults and contractual fee income.

Interest-only strips are recorded as trading assets. Fair value

measurements of our MSRs and interest-only strips use

significant unobservable inputs and, accordingly, we classify

as Level 3. We may also retain securities from our loan

securitization activities. The valuation technique for these

securities is discussed in Securities available for sale.

FORECLOSED ASSETS Foreclosed assets include foreclosed

properties securing residential, auto and GNMA loans.

Foreclosed assets are adjusted to fair value less costs to sell

upon transfer of the loans to foreclosed assets. Subsequently,

foreclosed assets are carried at the lower of carrying value or

fair value less costs to sell. Fair value is generally based upon

independent market prices or appraised values of the collateral

and, accordingly, we classify foreclosed assets as Level 2.

NONMARKETABLE EQUITY INVESTMENTS Nonmarketable equity

investments are recorded under the cost or equity method of

accounting. There are generally restrictions on the sale and/or

liquidation of these investments, including federal bank stock.

Federal bank stock carrying value approximates fair value.

We use facts and circumstances available to estimate the fair

value of our nonmarketable equity investments. We typically

consider our access to and need for capital (including recent

or projected financing activity), qualitative assessments of the

viability of the investee, evaluation of the financial statements

of the investee and prospects for its future.

Liabilities

DEPOSIT LIABILITIES Deposit liabilities are carried at historical

cost. FAS 107 states that the fair value of deposits with no

stated maturity, such as noninterest-bearing demand deposits,

interest-bearing checking, and market rate and other savings,

is equal to the amount payable on demand at the measurement

date. The fair value of other time deposits is calculated based

on the discounted value of contractual cash flows. The

discount rate is estimated using the rates currently offered

for like wholesale deposits with similar remaining maturities.

SHORT-TERM FINANCIAL LIABILITIES Short-term financial liabilities

are carried at historical cost and include federal funds purchased

and securities sold under repurchase agreements, commercial

paper and other short-term borrowings. The carrying amount

is a reasonable estimate of fair value because of the relatively

short time between the origination of the instrument and its

expected realization.

OTHER LIABILITIES Other liabilities recorded at fair value on a

recurring basis, excluding derivative liabilities (see Derivatives

section for derivative liabilities), includes liabilities for

securities sold, but not yet purchased (short sale liabilities),

and repurchase obligations (due to standard representations

and warranties) under our residential mortgage loan contracts.

Short sale liabilities are priced based upon quoted prices in

active exchange markets of the underlying security and are

classified as Level 1. The value of the repurchase obligations

is determined using a cash flow valuation technique consistent

with what market participants would use in estimating the fair

value. Key assumptions in the valuation process are estimates

for repurchase demands and losses subsequent to repurchase.

Such assumptions are unobservable and, accordingly, we

classify repurchase obligations as Level 3.

LONG-TERM DEBT Long-term debt is carried at amortized cost.

However, we are required to estimate the fair value of long-

term debt under FAS 107. Generally, the discounted cash flow

method is used to estimate the fair value of our long-term

debt. Contractual cash flows are discounted using rates

currently offered for new notes with similar remaining

maturities and, as such, these discount rates include our

current spread levels. The fair value estimates generated are

corroborated against observable market prices. For foreign-

currency denominated debt, we estimate fair value based

upon observable market prices for the instruments.

Assets and Liabilities Recorded at Fair Value on a

Recurring Basis

The table below presents the balances of assets and liabilities

measured at fair value on a recurring basis.