Wells Fargo 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

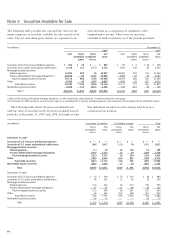

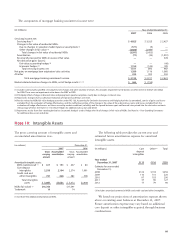

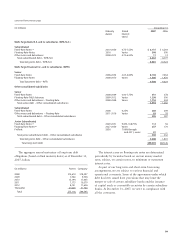

(in millions) December 31, Year ended December 31,

Total loans(1) Delinquent loans(2) Net charge-offs (recoveries)

2007 2006 2007 2006 2007 2006

Commercial and commercial real estate:

Commercial $ 91,186 $ 70,779 $ 464 $ 346 $ 510 $ 303

Other real estate mortgage 75,642 44,834 179 178 7(33)

Real estate construction 18,854 15,935 317 81 12 (1)

Lease financing 6,772 5,614 45 29 16 9

Total commercial and commercial real estate 192,454 137,162 1,005 634 545 278

Consumer:

Real estate 1-4 family first mortgage 146,997 114,676 1,745 929 87 77

Real estate 1-4 family junior lien mortgage 75,974 68,926 495 275 597 118

Credit card 18,762 14,697 402 262 712 409

Other revolving credit and installment 56,521 54,036 744 804 1,409 1,148

Total consumer 298,254 252,335 3,386 2,270 2,805 1,752

Foreign 7,647 6,983 104 94 206 210

Total loans owned and securitized 498,355 396,480 $4,495 $2,998 $3,556 $2,240

Less:

Securitized loans 88,397 43,546

Mortgages held for sale 26,815 33,097

Loans held for sale 948 721

Total loans held $382,195 $319,116

(1) Represents loans in the balance sheet or that have been securitized, but excludes securitized loans that we continue to service but as to which we have no other

continuing involvement.

(2) Includes nonaccrual loans and loans 90 days or more past due and still accruing.

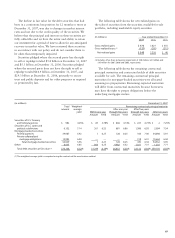

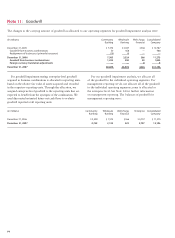

economic assumptions at December 31, 2007, for these

securities related to residential mortgage loan securitizations

are presented in the following table.

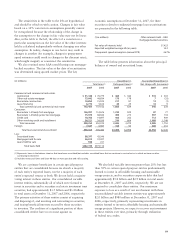

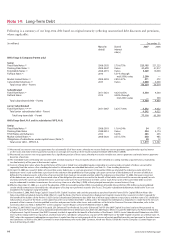

We are a primary beneficiary in certain special-purpose

entities that are consolidated because we absorb a majority

of each entity’s expected losses, receive a majority of each

entity’s expected returns or both. We do not hold a majority

voting interest in these entities. Our consolidated variable

interest entities, substantially all of which were formed to

invest in securities and to securitize real estate investment trust

securities, had approximately $3.5 billion and $3.4 billion

in total assets at December 31, 2007 and 2006, respectively.

The primary activities of these entities consist of acquiring

and disposing of, and investing and reinvesting in securities,

and issuing beneficial interests secured by those securities

to investors. The creditors of a significant portion of these

consolidated entities have no recourse against us.

We also hold variable interests greater than 20% but less

than 50% in certain special-purpose entities predominantly

formed to invest in affordable housing and sustainable

energy projects, and to securitize corporate debt that had

approximately $5.8 billion and $2.9 billion in total assets

at December 31, 2007 and 2006, respectively. We are not

required to consolidate these entities. Our maximum

exposure to loss as a result of our involvement with these

unconsolidated variable interest entities was approximately

$2.0 billion and $980 million at December 31, 2007 and

2006, respectively, primarily representing investments in

entities formed to invest in affordable housing and sustainable

energy projects. However, we expect to recover our investment

in these entities over time, primarily through realization

of federal tax credits.

The sensitivities in the table to the left are hypothetical

and should be relied on with caution. Changes in fair value

based on a 10% variation in assumptions generally cannot

be extrapolated because the relationship of the change in

the assumption to the change in fair value may not be linear.

Also, in the table to the left, the effect of a variation in a

particular assumption on the fair value of the other interests

held is calculated independently without changing any other

assumption. In reality, changes in one factor may result in

changes in another (for example, changes in prepayment

speed estimates could result in changes in the discount rates),

which might magnify or counteract the sensitivities.

We also retained some AAA-rated floating-rate mortgage-

backed securities. The fair value at the date of securitization

was determined using quoted market prices. The key

($ in millions) Other interests held – AAA

mortgage-backed securities

Fair value of interests held $7,423

Expected weighted-average life (in years) 10.3

Prepayment speed assumption (annual CPR) 26.7%

The table below presents information about the principal

balances of owned and securitized loans.