Wells Fargo 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

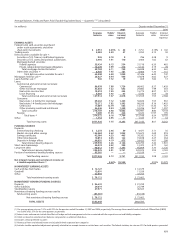

Quarterly Financial Data

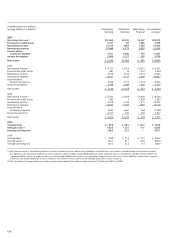

Condensed Consolidated Statement of Income — Quarterly (Unaudited)

(in millions, except per share amounts) 2007 2006

Quarter ended Quarter ended

Dec. 31 Sept. 30

(1)

June 30 Mar. 31 Dec. 31 Sept. 30 June 30

(1)

Mar. 31

INTEREST INCOME $ 9,242 $ 9,223 $ 8,573 $ 8,139 $ 8,231 $ 8,399 $ 8,077 $ 7,532

INTEREST EXPENSE 3,754 3,943 3,377 3,129 3,181 3,352 3,093 2,662

NET INTEREST INCOME 5,488 5,280 5,196 5,010 5,050 5,047 4,984 4,870

Provision for credit losses 2,612 892 720 715 726 613 432 433

Net interest income after provision for credit losses 2,876 4,388 4,476 4,295 4,324 4,434 4,552 4,437

NONINTEREST INCOME

Service charges on deposit accounts 788 837 740 685 695 707 665 623

Trust and investment fees 802 777 839 731 735 664 675 663

Card fees 588 561 517 470 481 464 418 384

Other fees 577 566 638 511 550 509 510 488

Mortgage banking 831 823 689 790 677 484 735 415

Operating leases 153 171 187 192 190 192 200 201

Insurance 370 329 432 399 299 313 364 364

Net gains (losses) on debt securities available for sale 60 160 (42) 31 51 121 (156) (35)

Net gains from equity investments 222 173 242 97 256 159 133 190

Other 326 176 453 525 429 274 261 392

Total noninterest income 4,717 4,573 4,695 4,431 4,363 3,887 3,805 3,685

NONINTEREST EXPENSE

Salaries 2,055 1,933 1,907 1,867 1,812 1,769 1,754 1,672

Incentive compensation 840 802 900 742 793 710 714 668

Employee benefits 558 518 581 665 501 458 487 589

Equipment 370 295 292 337 339 294 284 335

Net occupancy 413 398 369 365 367 357 345 336

Operating leases 124 136 148 153 157 155 157 161

Other 1,540 1,589 1,530 1,397 1,442 1,338 1,530 1,313

Total noninterest expense 5,900 5,671 5,727 5,526 5,411 5,081 5,271 5,074

INCOME BEFORE INCOME TAX EXPENSE 1,693 3,290 3,444 3,200 3,276 3,240 3,086 3,048

Income tax expense 332 1,117 1,165 956 1,095 1,046 1,059 1,030

NET INCOME $ 1,361 $ 2,173 $ 2,279 $ 2,244 $ 2,181 $ 2,194 $ 2,027 $ 2,018

EARNINGS PER COMMON SHARE $ 0.41 $ 0.65 $ 0.68 $ 0.66 $ 0.65 $ 0.65 $ 0.60 $ 0.60

DILUTED EARNINGS PER COMMON SHARE $ 0.41 $ 0.64 $ 0.67 $ 0.66 $ 0.64 $ 0.64 $ 0.59 $ 0.60

DIVIDENDS DECLARED PER COMMON SHARE (2) $ 0.31 $ 0.31 $ 0.28 $ 0.28 $ 0.28 $ — $ 0.54 $ 0.26

DIVIDENDS PAID PER COMMON SHARE $ 0.31 $ 0.31 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.26 $ 0.26

Average common shares outstanding 3,327.6 3,339.6 3,351.2 3,376.0 3,379.4 3,371.9 3,363.8 3,358.3

Diluted average common shares outstanding 3,352.2 3,374.0 3,389.3 3,416.1 3,424.0 3,416.0 3,404.4 3,395.7

Market price per common share (3)

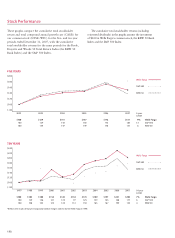

High $ 37.78 $ 37.99 $ 36.49 $ 36.64 $ 36.99 $ 36.89 $ 34.86 $ 32.76

Low 29.29 32.66 33.93 33.01 34.90 33.36 31.90 30.31

Quarter end 30.19 35.62 35.17 34.43 35.56 36.18 33.54 31.94

(1) Results for third quarter 2007 and second quarter 2006 have been revised to reflect $170 million and $95 million, respectively, of litigation expenses associated with

indemnification obligations arising from the Company’s ownership interest in Visa.

(2) On April 25, 2006, the Company’s Board of Directors declared the second quarter 2006 cash dividend payable June 1, 2006. On June 27, 2006, the Board declared a two-for-one

split in the form of a 100% stock dividend on the Company’s common stock and, at the same time, the third quarter 2006 cash dividend payable September 1, 2006.

(3) Based on daily prices reported on the New York Stock Exchange Composite Transaction Reporting System.

130