Wells Fargo 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

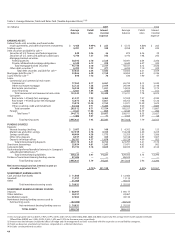

(a payable), against derivative instruments executed with the

same counterparty under the same master netting arrangement.

The provisions of this FSP are effective for the year beginning

on January 1, 2008, with early adoption permitted. We adopted

FSP FIN 39-1 on January 1, 2008, and it did not have a

material effect on our consolidated financial statements.

On September 20, 2006, the FASB ratified the consensus

reached by the EITF at its September 7, 2006, meeting

with respect to Issue No. 06-4, Accounting for Deferred

Compensation and Postretirement Benefit Aspects of

Endorsement Split-Dollar Life Insurance Arrangements (EITF

06-4). On March 28, 2007, the FASB ratified the consensus

reached by the EITF at its March 15, 2007, meeting with

respect to Issue No. 06-10, Accounting for Collateral

Assignment Split-Dollar Life Insurance Arrangements (EITF

06-10). These pronouncements require that for endorsement

split-dollar life insurance arrangements and collateral split-

dollar life insurance arrangements where the employee is

provided benefits in postretirement periods, the employer

should recognize the cost of providing that insurance over

the employee’s service period by accruing a liability for the

benefit obligation. Additionally, for collateral assignment

split-dollar life insurance arrangements, EITF 06-10 requires

an employer to recognize and measure an asset based upon

the nature and substance of the agreement. EITF 06-4 and

EITF 06-10 are effective for the year beginning on January 1,

2008, with early adoption permitted. We adopted EITF 06-4

and EITF 06-10 on January 1, 2008, and reduced beginning

retained earnings for 2008 by $20 million (after tax), pri-

marily related to split-dollar life insurance arrangements

from the acquisition of Greater Bay Bancorp.

On November 5, 2007, the Securities and Exchange

Commission (SEC) issued Staff Accounting Bulletin No. 109,

Written Loan Commitments Recorded at Fair Value Through

Earnings (SAB 109). SAB 109 provides the staff’s views on

the accounting for written loan commitments recorded at

fair value under U.S. generally accepted accounting principles

(GAAP). To make the staff’s views consistent with current

authoritative accounting guidance, SAB 109 revises and

rescinds portions of SAB 105, Application of Accounting

Principles to Loan Commitments. Specifically, SAB 109 states

the expected net future cash flows associated with the servicing

of a loan should be included in the measurement of all written

loan commitments that are accounted for at fair value

through earnings. The provisions of SAB 109, which we

adopted on January 1, 2008, are applicable to written loan

commitments recorded at fair value that are entered into

beginning on or after January 1, 2008.

On December 4, 2007, the FASB issued FAS 141R,

Business Combinations. This statement requires an acquirer

to recognize the assets acquired (including loan receivables),

the liabilities assumed, and any noncontrolling interest in the

acquiree at the acquisition date, to be measured at their fair

values as of that date, with limited exceptions. The acquirer

is not permitted to recognize a separate valuation allowance

as of the acquisition date for loans and other assets acquired

in a business combination. The revised statement requires

acquisition-related costs to be expensed separately from the

acquisition. It also requires restructuring costs that the acquirer

expected but was not obligated to incur, to be expensed

separately from the business combination. FAS 141R should

be applied prospectively to business combinations beginning

with the first annual reporting period beginning on or after

December 15, 2008. Early adoption is prohibited. We are

currently evaluating the impact that FAS 141R may have on

our consolidated financial statements.

On December 4, 2007, the FASB issued FAS 160,

Noncontrolling Interests in Consolidated Financial

Statements, an amendment of ARB No. 51. FAS 160 specifies

that noncontrolling interests in a subsidiary are to be treated

as a separate component of equity and, as such, increases

and decreases in the parent’s ownership interest that leave

control intact are accounted for as capital transactions. It

changes the way the consolidated income statement is pre-

sented by requiring that an entity’s consolidated net income

include the amounts attributable to both the parent and

the noncontrolling interest. FAS 160 requires that a parent

recognize a gain or loss in net income when a subsidiary is

deconsolidated. This statement should be applied prospectively

to all noncontrolling interests, including any that arose before

the effective date. The statement is effective for fiscal years,

and interim periods within those fiscal years, beginning on

or after December 15, 2008. Early adoption is prohibited.

We are currently evaluating the impact that FAS 160 may

have on our consolidated financial statements.