Wells Fargo 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

Because of our Responsible Mortgage Lending Principles and

our Responsible Mortgage Servicing Principles, our foreclosure

rate in our home mortgage servicing portfolio in 2007 was more

than 20 percent better than the industry average. Less than one

in every 100 loans in our servicing portfolio was in foreclosure.

We contact customers with impending ARM resets, offer

a toll-free number they can call to discuss solutions with a

Wells Fargo expert, and provide credit management education

programs. In 2007 across the mortgage industry, almost one

of every two foreclosures involving a customer with an ARM

occurred before the loan was reset at a higher rate, mostly due

to too much debt, lower income or a decline in the home’s market

value. For those borrowers in financial trouble, about half never

contacted their servicer. So, our message to any of our customers

struggling to make payments is loud and clear: Call us! If they

do, we can work with them to try to find options to help them

stay in their home or find other alternatives to avoid foreclosure.

We also must protect the interests of investors who own the

mortgage-backed securities and who depend on a flow of

payments from those securities. Of the 10 million home

mortgages we service, about three percent are adjustable-rate

mortgages for customers with less than prime credit whose

rates are expected to increase sometime before the end of 2008.

At this time, it appears eight to nine of every 10 of these

customers are expected to pay in full, refinance, manage the

payment or benefit from a solution.

To help keep more of our customers in their homes, we

launched in 2006 a free program called Steps to SuccessSM for

all our new mortgage customers who have less than prime credit.

It provides credit reports and credit scores, access to advice from

credit education specialists, financial education and access to

automatic mortgage payment programs to help consumers

better manage their credit. We’ve signed up 20,000 customers

for this program, and they appear to have a lower likelihood of

delinquency than our customers not enrolled in this program.

We’re a leader in Hope Now, a new national alliance of

mortgage counselors, mortgage servicers, capital markets investors

and the government to help at-risk homeowners facing foreclosure

or higher ARM resets. The industry campaign includes direct

mail to millions of at-risk borrowers, encouraging them to contact

servicers or counselors for help and a toll-free customer hotline.

In late 2007 — partnering with other large mortgage servicers, the

U.S. Treasury Department and the American Securitization

Forum — we announced our support for a “fast-track” solution

for many subprime ARMs scheduled to reset to higher rates in

2008 and 2009. In February 2008, as part of an alliance with

our large peers and the U.S. Treasury, we sent letters to both our

nonprime and prime customers 90 days or more late in their

mortgage payments, offering them, if they qualify, a 30-day

pause in the foreclosure process so we can consider a possible

solution to help them to stay in their homes.

We’re a strong, well-capitalized, well-funded mortgage

lender and servicer and can maintain our liquidity for the long

term. With our extensive distribution network and our strong

relationships with Realtors®

, builders and joint venture partners,

we have the opportunity to grow mortgage market share

responsibly at a time when some of our competitors have gone

out of business or are struggling — and we’re hiring highly

successful salespeople from our competitors. We’ve been the

nation’s #1 retail mortgage originator for 15 consecutive years.

Credit Quality: What We Did Wrong

Our risk management performance in 2007 was not perfect. We

made some mistakes. We took on too much risk — and did not

price sufficiently for it — in the home equity loans we purchased

through indirect channels such as mortgage brokers, bankers

and other mortgage companies. Too many of our home equity

loans had “loan-to-value” ratios that were too high — the ratio

of loans to the fair market value of the property. Sometimes we

did not require full documentation for these home equity loans

we purchased from brokers because these were prime borrowers

who had high credit scores with lower expected risk of default.

When home prices in parts of California and other areas of

the country fell dramatically, the severity of the losses was much

higher than we or anyone else expected. We should not have

offered such lenient loan terms through indirect channels, and

we made the mistake of taking on too much risk. We should

have known better.

In third quarter 2007, we stopped purchasing home equity

loans from third-party correspondents. In fourth quarter, we

stopped purchasing loans through wholesalers when the

borrowers were not Wells Fargo mortgage customers. We’ve also

exited the nonprime wholesale and correspondent channels for

first mortgages. In fourth quarter 2007, we placed $11.9 billion

of such loans — about three percent of our total loans outstanding

— into a liquidating portfolio, and added $1.4 billion to our

credit loss reserves primarily for losses incurred in this portfolio.

We continue to accept loan applications in the home equity

wholesale channel, but only for loans behind a Wells Fargo first

mortgage and that have a combined loan-to-value ratio below

90 percent.

Balance Sheet and Capital Strength

In addition to credit quality, another important attribute of

an outstanding financial services company is capital, or what’s

left for shareholders after subtracting a company’s liabilities

from its assets. At Wells Fargo, our #1 financial goal is to have

a conservative financial structure as measured by asset quality,

capital levels, diversity of revenue sources and dispersing risk

by geography, loan size and industry. We want to maintain

such a strong balance sheet that our customers would put

their money in our banks even if there was no FDIC insurance.

Capital measurements show how much a bank depends on

borrowing and how much “cushion” it has to absorb losses.

Wells Fargo’s capital ratios are among the strongest in our peer

group. You can see one of the most important measures of capital

strength on the opposite page. Our capital levels as a percent

of our tangible assets outpace our peers. This is one reason we

have the only bank in the U.S. rated Triple A by both Moody’s

Investors Service and Standard & Poor’s Ratings Service.

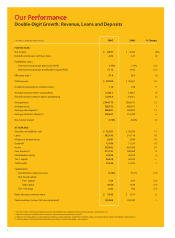

Our 2007 Performance

Despite the disappointing earnings-per-share results in 2007, our

businesses’ core performance in 2007 was strong. Wells Fargo

achieved double-digit revenue growth, up 10.4 percent, something

very few financial institutions were able to accomplish. Our