Wells Fargo 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

Risk Factors

An investment in the Company has risk. We discuss below

and elsewhere in this Report and in other documents we file

with the SEC various risk factors that could cause our finan-

cial results and condition to vary significantly from period to

period. We refer you to the Financial Review section and

Financial Statements and related Notes in this Report for

more information about credit, interest rate and market risks

and to the “Regulation and Supervision” section of our 2007

Form 10-K for more information about legislative and regu-

latory risks. Any factor described below or elsewhere in this

Report or in our 2007 Form 10-K could, by itself or together

with other factors, have a material negative effect on our

financial results and condition and on the value of an invest-

ment in Wells Fargo. Refer to our quarterly reports on Form

10-Q that we will file with the SEC in 2008 for material

changes to the discussion of risk factors.

In accordance with the Private Securities Litigation

Reform Act of 1995, we caution you that one or more of the

factors discussed below, in the Financial Review section of

this Report, in the Financial Statements and related Notes

included in this Report, in the 2007 Form 10-K, or in other

documents we file with the SEC from time to time could

cause us to fall short of expectations for our future financial

and business performance that we may express in forward-

looking statements. We make forward-looking statements

when we use words such as “believe,” “expect,” “antici-

pate,” “estimate,” “will,” “may,” “can” and similar expres-

sions. Do not unduly rely on forward-looking statements.

Actual results may differ significantly from expectations.

Forward-looking statements speak only as of the date made.

We do not undertake to update them to reflect changes or

events that occur after that date.

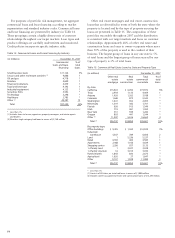

rates above 5% at year-end 2006, our cumulative sales of

ARMs and debt securities from mid-2004 to mid-2006 had a

positive impact on our net interest margin and net interest

income. We completed our sales of over $90 billion of

ARMs since mid-2004 with the sales of $26 billion of ARMs

in second quarter 2006. Average earning assets grew 8%

from 2005, or 17% excluding 1-4 family first mortgages (the

loan category that includes ARMs). Our net interest margin

was 4.83% for 2006, compared with 4.86% in 2005.

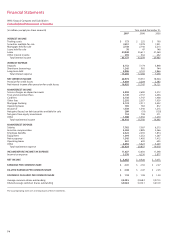

Noninterest income increased 9% to $15.7 billion in

2006 from $14.4 billion in 2005. Growth in noninterest

income was driven by growth across our businesses, with

particular strength in trust and investment fees (up 12%),

card fees (up 20%), insurance fees (up 10%) and gains on

equity investments (up 44%).

Revenue, the sum of net interest income and noninterest

income, increased 8% to a record $35.7 billion in 2006 from

$32.9 billion in 2005. Home Mortgage revenue decreased

$704 million (15%) to $4.2 billion in 2006 from $4.9 billion

in 2005. Combined revenue in businesses other than Home

Mortgage grew 12% from 2005 to 2006, with double-digit

revenue growth in virtually every major business line other

than Home Mortgage.

Noninterest expense was $20.8 billion in 2006, up 10%

from $19.0 billion in 2005, primarily due to continued

investments in new stores and additional sales and service-

related team members. We began expensing stock options on

January 1, 2006. Total stock option expense reduced 2006

earnings by approximately $0.025 per share.

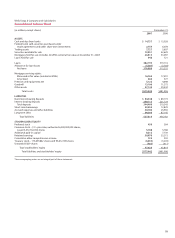

During 2006, net charge-offs were $2.25 billion (0.73%

of average total loans), compared with $2.28 billion (0.77%)

during 2005. Net charge-offs for auto loans increased $160

million in 2006 partially due to growth and seasoning, but

largely due to collection capacity constraints and restrictive

payment extension practices that occurred when Wells Fargo

Financial integrated its prime and nonprime auto loan businesses

during 2006. Net charge-offs for 2005 included $171 million

of incremental fourth quarter bankruptcy losses and increased

net charge-offs of $163 million in first quarter 2005 to con-

form Wells Fargo Financial’s charge-off practices to more

stringent Federal Financial Institutions Examination Council

guidelines. The provision for credit losses was $2.20 billion

in 2006, down $179 million from $2.38 billion in 2005. The

2005 provision for credit losses also included $100 million

for estimated charge-offs related to Hurricane Katrina. We

subsequently realized approximately $50 million of Katrina-

related losses. Because we no longer anticipated further credit

losses attributable to Katrina, we released the remaining

$50 million reserve in 2006. The allowance for credit losses,

which consists of the allowance for loan losses and the reserve

for unfunded credit commitments, was $3.96 billion, or

1.24% of total loans, at December 31, 2006, compared

with $4.06 billion (1.31%) at December 31, 2005.

At December 31, 2006, total nonaccrual loans were

$1.67 billion (0.52% of total loans), up from $1.34 billion

(0.43%) at December 31, 2005. Total nonperforming assets

were $2.42 billion (0.76% of total loans) at December 31,

2006, compared with $1.53 billion (0.49%) at December 31,

2005. Foreclosed assets were $745 million at December 31,

2006, compared with $191 million at December 31, 2005.

Foreclosed assets, a component of total nonperforming assets,

included an additional $322 million of foreclosed real estate

securing GNMA loans at December 31, 2006, due to a

change in regulatory reporting requirements effective January 1,

2006. The foreclosed real estate securing GNMA loans of

$322 million represented 10 basis points of the ratio of

nonperforming assets to loans at December 31, 2006.