Wells Fargo 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

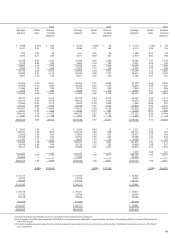

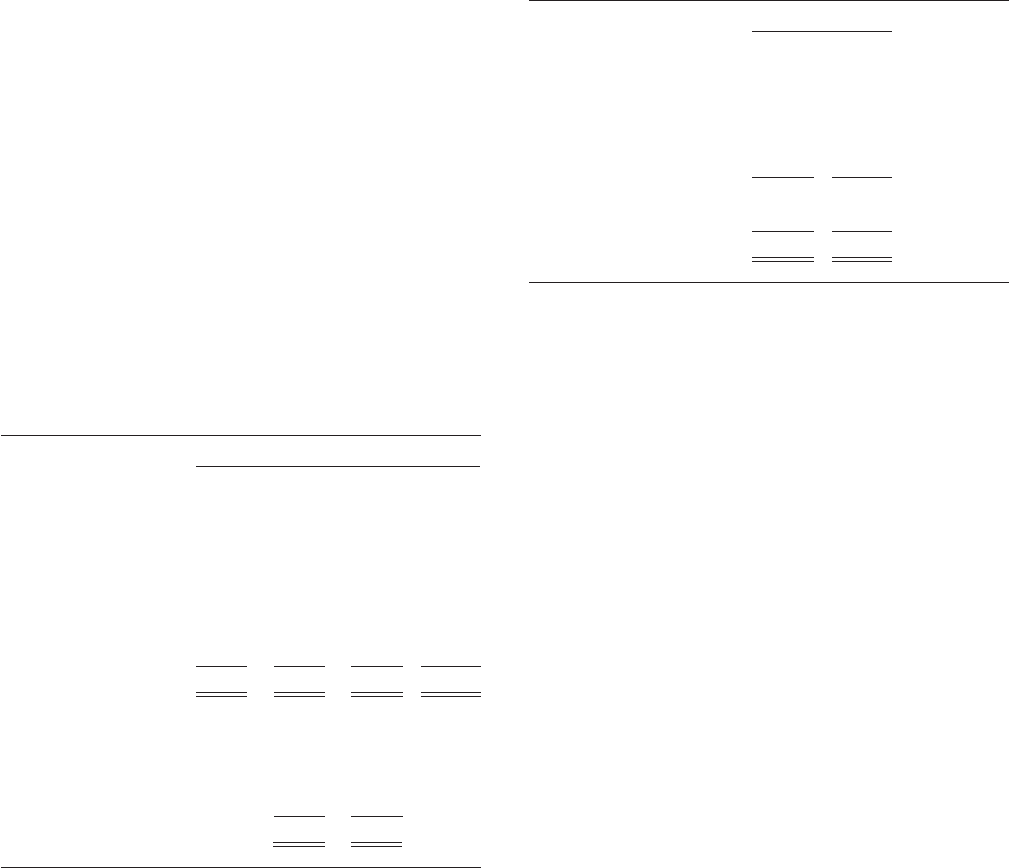

Table 9: Deposits

(in millions) December 31,%

2007 2006 Change

Noninterest-bearing $ 84,348 $ 89,119 (5)%

Interest-bearing checking 5,277 3,540 49

Market rate and

other savings 153,924 140,283 10

Savings certificates 42,708 37,282 15

Foreign deposits (1) 25,474 17,844 43

Core deposits 311,731 288,068 8

Other time deposits 3,654 13,819 (74)

Other foreign deposits 29,075 8,356 248

Total deposits $344,460 $310,243 11

(1) Reflects Eurodollar sweep balances included in core deposits.

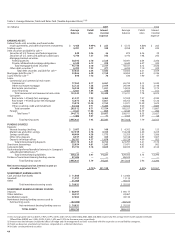

Table 8: Maturities for Selected Loan Categories

(in millions) December 31, 2007

Within After After Total

one one year five

year through years

five years

Selected loan maturities:

Commercial $27,381 $45,185 $17,902 $ 90,468

Other real estate

mortgage 4,828 12,606 19,313 36,747

Real estate construction 9,960 7,713 1,181 18,854

Foreign 770 3,897 2,774 7,441

Total selected loans $42,939 $69,401 $41,170 $153,510

Sensitivity of loans due after

one year to changes in

interest rates:

Loans at fixed interest rates $12,744 $14,727

Loans at floating/variable

interest rates 56,657 26,443

Total selected loans $69,401 $41,170

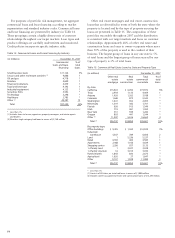

investment grade and were generally underwritten in accor-

dance with our own investment standards prior to the

determination to purchase, without relying on the bond

insurer’s guarantee in making the investment decision. These

securities will continue to be monitored as part of our on-

going impairment analysis of our securities available for sale,

but are expected to perform, even if the rating agencies

reduce the credit rating of the bond insurers.

See Note 5 (Securities Available for Sale) to Financial

Statements for securities available for sale by security type.

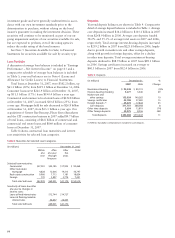

Loan Portfolio

A discussion of average loan balances is included in “Earnings

Performance – Net Interest Income” on page 43 and a

comparative schedule of average loan balances is included

in Table 3; year-end balances are in Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements.

Total loans at December 31, 2007, were $382.2 billion, up

$63.1 billion (20%) from $319.1 billion at December 31, 2006.

Consumer loans were $221.9 billion at December 31, 2007,

up $31.5 billion (17%) from $190.4 billion a year ago.

Commercial and commercial real estate loans of $152.8 billion

at December 31, 2007, increased $30.8 billion (25%) from

a year ago. Mortgages held for sale decreased to $26.8 billion

at December 31, 2007, from $33.1 billion a year ago. Our

acquisitions of Greater Bay Bancorp, Placer Sierra Bancshares

and the CIT construction business in 2007 added $9.7 billion

of total loans, consisting of $8.8 billion of commercial and

commercial real estate loans and $866 million of consumer

loans at December 31, 2007.

Table 8 shows contractual loan maturities and interest

rate sensitivities for selected loan categories.

Deposits

Year-end deposit balances are shown in Table 9. Comparative

detail of average deposit balances is included in Table 3. Average

core deposits increased $34.2 billion to $303.1 billion in 2007

from $268.9 billion in 2006. Average core deposits funded

58.2% and 55.3% of average total assets in 2007 and 2006,

respectively. Total average interest-bearing deposits increased

to $239.2 billion in 2007 from $223.8 billion in 2006, largely

due to growth in market rate and other savings deposits,

along with growth in foreign deposits, offset by a decline

in other time deposits. Total average noninterest-bearing

deposits declined to $88.9 billion in 2007 from $89.1 billion

in 2006. Savings certificates increased on average to

$40.5 billion in 2007 from $32.4 billion in 2006.