Wells Fargo 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

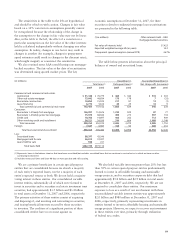

94

Mortgage banking activities, included in the Community

Banking and Wholesale Banking operating segments,

consist of residential and commercial mortgage originations

and servicing.

Effective January 1, 2006, upon adoption of FAS 156,

we remeasured our residential mortgage servicing rights

(MSRs) at fair value and recognized a pre-tax adjustment of

$158 million to residential MSRs and recorded a corresponding

cumulative effect adjustment of $101 million (after tax) to

increase the 2006 beginning balance of retained earnings in

stockholders’ equity. The table below reconciles the

December 31, 2005, and the January 1, 2006, balance of MSRs.

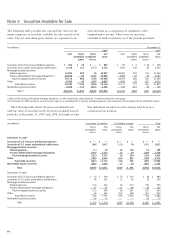

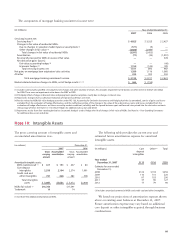

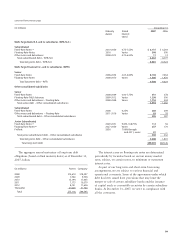

Note 9: Mortgage Banking Activities

(in millions) Residential Commercial Total

MSRs MSRs MSRs

Balance at December 31, 2005 $12,389 $122 $12,511

Remeasurement upon

adoption of FAS 156 158 — 158

Balance at January 1, 2006 $12,547 $122 $12,669

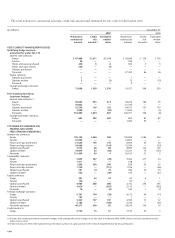

(in millions) Year ended December 31,

2007 2006

Fair value, beginning of year $17,591 $12,547

Purchases 803 3,859

Servicing from securitizations

or asset transfers 3,680 4,107

Sales (1,714) (469)

Net additions 2,769 7,497

Changes in fair value:

Due to changes in valuation

model inputs or assumptions (1) (571) (9)

Other changes in fair value (2) (3,026) (2,444)

Total changes in fair value (3,597) (2,453)

Fair value, end of year $16,763 $17,591

(1) Principally reflects changes in discount rates and prepayment speed

assumptions, mostly due to changes in interest rates.

(2) Represents changes due to collection/realization of expected cash flows

over time.

The changes in residential MSRs measured using the fair

value method were:

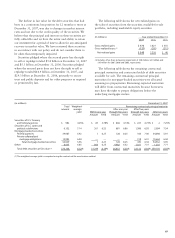

(in millions) Year ended December 31,

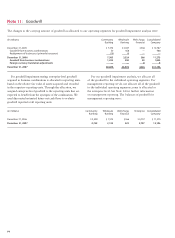

2007 2006 2005

Balance, beginning of year $377 $122 $ 9,466

Purchases (1) 120 278 2,683

Servicing from securitizations

or asset transfers (1) 40 11 2,652

Amortization (71) (34) (1,991)

Other (includes changes

due to hedging) — — 888

Balance, end of year $466 $377 $13,698

Valuation allowance:

Balance, beginning of year $— $ — $ 1,565

Reversal of provision for

MSRs in excess of fair value — — (378)

Balance, end of year $— $ — $ 1,187

Amortized MSRs, net $466 $377 $12,511

Fair value of amortized MSRs:

Beginning of year $457 $146 $ 7,913

End of year 573 457 12,693

(1) Based on December 31, 2007, assumptions, the weighted-average amortization

period for MSRs added during the year was approximately 10.8 years.

The changes in amortized MSRs were:

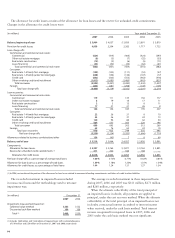

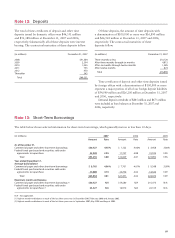

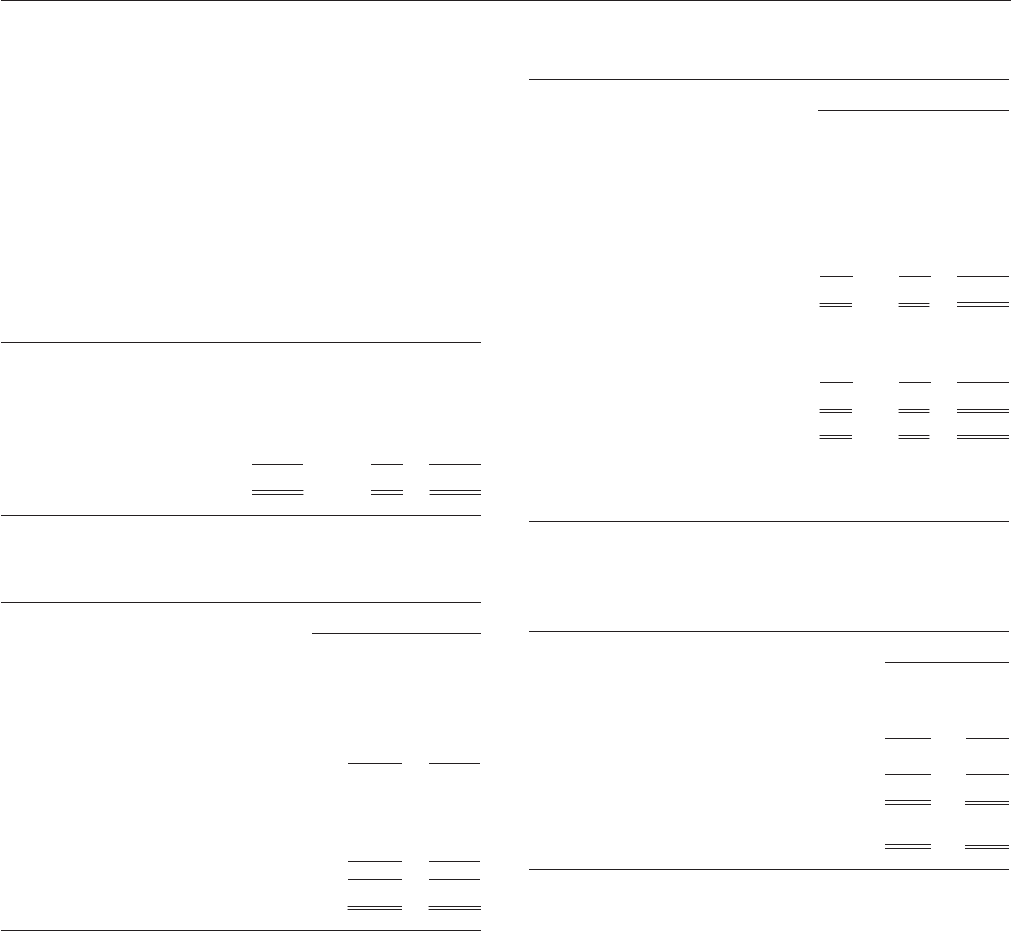

(in billions) December 31,

2007 2006

Loans serviced for others (1) $1,430 $1,280

Owned loans serviced (2) 98 86

Total owned servicing 1,528 1,366

Sub-servicing 23 19

Total managed servicing portfolio $1,551 $1,385

Ratio of MSRs to related loans

serviced for others 1.20% 1.41%

(1) Consists of 1-4 family first mortgage and commercial mortgage loans.

(2) Consists of mortgages held for sale and 1-4 family first mortgage loans.

The components of our managed servicing portfolio were: