Wells Fargo 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wells Fargo & Company Annual Report 2007

How we’re working togetherwith our customers to uncover

their financial needs—and create industry-leading products to serve them better.

Troy Ledo, Customer

Alicia Moore, Team Member

Table of contents

-

Page 1

How we're with our customers to uncover their ï¬nancial needs-and create industry-leading products to serve them better. working together Troy Ledo, Customer Alicia Moore, Team Member Wells Fargo & Company Annual Report 2007 -

Page 2

...Our corporate headquarters is in San Francisco, but we're decentralized so all Wells Fargo "convenience points"- stores, regional commercial banking centers, ATMs, Wells Fargo Phone BankSM centers and the internet - are headquarters for satisfying all our customers' ï¬nancial needs and helping them... -

Page 3

... click. Help me manage my ï¬nances and wealth with savvy and integrity. Save me time and money. Reward me for giving you more business. From these conversations with our customers, we discover even better ways to satisfy their needs. This is how new products and services are born at Wells Fargo. It... -

Page 4

... classes. Aggressive subprime mortgage lenders, many of them unregulated brokers, used "teaser" rates and "negative amortization" loans (which add to the unpaid balance) to put many people in homes they could not afford. Easy access to cheap money encouraged excessive risk taking, highly leveraged... -

Page 5

Dick Kovacevich, Chairman (right); John Stumpf, President and CEO 3 -

Page 6

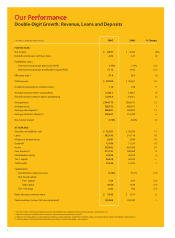

... AT YEAR END Securities available for sale Loans Allowance for loan losses Goodwill Assets Core deposits 3 Stockholders' equity Tier 1 capital Total capital Capital ratios: Stockholders' equity to assets Risk-based capital Tier 1 capital Total capital Tier 1 leverage Book value per common share Team... -

Page 7

...covenant or no-covenant, large, highly leveraged loans and commitments to companies acquired by private equity ï¬rms through leveraged buyouts (LBOs). Our balance sheet strength enables us to take the long view. We have minimal ARM interest rate "reset" risk in the loan portfolios we own because we... -

Page 8

... if they qualify, a 30-day pause in the foreclosure process so we can consider a possible solution to help them to stay in their homes. We're a strong, well-capitalized, well-funded mortgage lender and servicer and can maintain our liquidity for the long term. With our extensive distribution network... -

Page 9

...of 100 commission-free trades through WellsTrade® online brokerage for our Wells Fargo® PMA® Package customers helped us grow self-directed brokerage assets under administration by 35 percent. We also launched The Private Bank online, which generated signiï¬cant new balances. Insurance We're the... -

Page 10

... internet plan their insurance needs, recommend the best product choices, and update them as their needs change. This is an "inbound" service model - triggered by events in our customers' lives and channeled to our insurance sales centers through referrals from our banking stores and our Wells Fargo... -

Page 11

...account packages. This makes it easier for our customers to do business with us and easier for our team members to serve them. We rolled out an automated tool across all our Community Banking states and the Wells Fargo Phone Bank for those situations when we reverse fees. • Fix customers' problems... -

Page 12

...predecessor of Wells Fargo, in 1986 as vice chairman and chief operating ofï¬cer for banking. In the early '80s Norwest had suffered a series of setbacks in agriculture, energy and foreign lending, mortgage write-downs and a ï¬re that destroyed its Minneapolis headquarters. Norwest reported a loss... -

Page 13

...businesses and the staff groups on the vision, values and strategy of Wells Fargo. They make it all happen. To you, our stockholders and also to buy side /sell side equity analysts, thank you for your incredible loyalty to Wells Fargo. Most of you have been stockholders and supporters for many years... -

Page 14

... she could pay by credit card, but the painting company wanted a check. Now she was in a cab to the airport for a Florida business trip, and time was tight. She whipped out her cell phone, connected with Wells Fargo Mobile service, and punched in a few numbers. A quick transfer from savings, and she... -

Page 15

13 -

Page 16

... Fargo banking store through our Wells Fargo ExpressSend remittance service (also available to Mexico, El Salvador, the Philippines, India, China and Vietnam). The money he sends home supports his extended family and also helps them build their retirement savings. "My Wells Fargo bank has employees... -

Page 17

... of The Architecture Company of Tucson, Arizona, Nancy Tom wears all of these hats. To simplify her ï¬nancial role, she chose a Wells Fargo Business Services package, which bundles other products and services with her checking account and offers relationship pricing. She saves time and money, and... -

Page 18

... and a target savings amount, set time frames for reaching that goal, and track their progress meter online. A recently hired professor, DeVries soon begins making payments on her student loans, so she set up her My Savings Plan to help her do it. "With each deposit into my savings account, I watch... -

Page 19

17 -

Page 20

... customers, too. Team member Brian McMahon of San Francisco is one of the one million unique customers using Wells Fargo's My Spending Report, our online personal ï¬nancial management tool that collects and summarizes your spending by category, monthly. As product manager in our Internet Services... -

Page 21

..., California, is a hair designer and color specialist whose customers often pay him with checks-checks he once deposited with a teller on his day off. Not anymore. One of his customers, Alicia Moore of Wells Fargo, told him about a new function at Wells Fargo ATMs that could save him time and... -

Page 22

20 -

Page 23

... wait days for checks to clear and deposit reports to trickle in from dozens of banks before fully knowing the company's cash picture. Now, with our Desktop Deposit service, employees at its 450 locations in 44 states scan and send checks safely and securely via the internet to one bank -Wells Fargo... -

Page 24

..., views images of deposited and disbursed checks, and prints and downloads activity reports. It also protects the company's conï¬dential data and helps reduce fraud risks. "We have far-ï¬,ung operations, and the CEO portal gives us the power of a large treasury staff," he said. "We used Wells Fargo... -

Page 25

...such as daily spending limits, and free account alerts. Opening the account led mother and daughter to new conversations about managing money and budgeting - "tools for life," as Tarena puts it. They learn from each other. "I balance my checkbook by hand, but Briani does hers with Wells Fargo Online... -

Page 26

... make our communities better places to live and work. Good for customers. Good for team members. Good for communities. Revitalizing the Railyard Can a city park ï¬,ourish when there isn't enough water? Santa Fe, New Mexico, has a plan, and Wells Fargo is helping to put it into action. Team member... -

Page 27

25 -

Page 28

...partnership between housing nonproï¬ts and mortgage lenders led by Wells Fargo that provides consistent, high-quality homebuyer counseling and education services across the state, and provides community organizations with training, technical and ï¬nancial support. We've been there since day one as... -

Page 29

... the banking terms dictionary from Wells Fargo, the Orange County Small Business Development Center helps Vietnamese-American business owners become ï¬nancially successful. Entrepreneurs such as restaurant owner Kathy Nguyen save time and money by using a full range of Wells Fargo products - time... -

Page 30

... companies to donate to schools. Since opening, it has provided 130 public schools with 1.4 million pencils and other school supplies totaling $9 million. Wells Fargo has given $130,000 to support Schoolhouse Supplies, our team members are active on its board, and in 2007 alone our Portland banking... -

Page 31

...Leave Program Wells Fargo's 30-year-old Volunteer Leave Program is one of the few corporate programs of its kind in the U.S. that offers fully paid sabbaticals for employees to provide community service. We reward selected team members with up to four months off, with full pay and beneï¬ts, to help... -

Page 32

...'s Ratings Service Only bank in the U.S. to be credit-rated "AAA" Global Finance magazine Top 10 World's Safest Banks Community Banking ...Home Mortgage/Home Equity ...Investments & Insurance ...Specialized Lending* ...Wholesale Banking/Commercial Real Estate ...Consumer Finance ...* Credit cards... -

Page 33

... (Packaged foods) Lloyd H. Dean 1, 3 President, CEO Catholic Healthcare West San Francisco, California (Health care) Cynthia H. Milligan 1, 2, 4 Dean College of Business Administration University of Nebraska - Lincoln (Higher education) John G. Stumpf President, CEO Wells Fargo & Company Susan... -

Page 34

..., Real Estate Merchant Banking Wells Fargo Home Mortgage Michael J. Heid, Co-President, Capital Markets, Finance and Administration Cara K. Heiden, Co-President, National Consumer and Institutional Lending Mary C. Cofï¬n, Mortgage Servicing/ Post Closing Susan A. Davis, National Retail Sales/ Ful... -

Page 35

... Exchange: WFC Independent Registered Public Accounting Firm KPMG LLP San Francisco, CA 1-415-963-5100 Common Stock 3,297,102,208 common shares outstanding (12/31/07) Contacts Investor Relations 1-888-662-7865 [email protected] Shareholder Services and Transfer Agent Wells Fargo... -

Page 36

... 5 Securities Available for Sale 6 Loans and Allowance for Credit Losses 7 Premises, Equipment, Lease Commitments and Other Assets 8 Securitizations and Variable Interest Entities 9 Mortgage Banking Activities 10 Intangible Assets 11 Goodwill 12 Deposits 13 Short-Term Borrowings 14 Long-Term Debt... -

Page 37

... very strong and balanced growth in loans, deposits and fee-based products. Many of our businesses continued to post double-digit, year-over-year revenue growth, including business direct, wealth management, credit and debit card, global remittance services, personal credit management, home mortgage... -

Page 38

... was across our businesses, with double-digit increases in debit and credit card fees (up 22%), deposit service charges (up 13%), trust and investment fees (up 15%), and insurance revenue (up 14%). Capital markets and equity investment results were also strong. Mortgage banking noninterest income... -

Page 39

... or acquiring new home equity loans through indirect channels unless they are behind a Wells Fargo first mortgage and have a combined loan-to-value ratio lower than 90%. We also experienced increased net charge-offs in our unsecured consumer portfolios, such as credit cards and lines of credit, in... -

Page 40

... 1 capital Total capital Tier 1 leverage (2) Average balances: Stockholders' equity to assets PER COMMON SHARE DATA Dividend payout (3) Book value Market price (4) High Low Year end 57.9 1.73% 19.52 58.4 1.72% 19.59 57.7 regulatory guidelines of 8% and 4%, respectively, for bank holding companies... -

Page 41

... the staff's views on the accounting for written loan commitments recorded at fair value under U.S. generally accepted accounting principles (GAAP). To make the staff's views consistent with current authoritative accounting guidance, SAB 109 revises and rescinds portions of SAB 105, Application of... -

Page 42

... for improvement in loan credit quality were: • for consumer loans, an 18 basis point decrease in estimated loss rates from actual 2007 loss levels, adjusting for the elevated home equity losses and an improving real estate market for consumers; and • for wholesale loans, nominal change from... -

Page 43

... - is the annual rate at which borrowers are forecasted to repay their mortgage loan principal. The discount rate used to determine the present value of estimated future net servicing income - another key assumption in the model - is the required rate of return investors in the market would expect... -

Page 44

... upon quoted prices for identical instruments traded in active markets. Level 1 instruments include securities traded on active exchange markets, such as the New York Stock Exchange, as well as U.S. Treasury, other U.S. government and agency mortgage-backed securities that are traded by dealers or... -

Page 45

... population of high-quality bonds, adjusted to match the timing and amounts of the Cash Balance Plan's expected benefit payments. We used a discount rate of 6.25% in 2007 and 5.75% in 2006. If we were to assume a 1% increase in the discount rate, and keep the expected long-term rate of return and... -

Page 46

... loans in both years. Total average retail core deposits, which exclude Wholesale Banking core deposits and retail mortgage escrow deposits, for 2007 grew $12.9 billion (6%) from 2006. Average mortgage escrow deposits increased to $21.5 billion in 2007 from $18.2 billion in 2006. Average savings... -

Page 47

...ï¬rst mortgage Real estate 1-4 family junior lien mortgage Credit card Other revolving credit and installment Total consumer Foreign Total loans (5) Other Total earning assets FUNDING SOURCES Deposits: Interest-bearing checking Market rate and other savings Savings certiï¬cates Other time deposits... -

Page 48

...of FIN 46(R), these balances were reflected in long-term debt. See Note 14 (Long-Term Debt) to Financial Statements for more information. (7) Includes taxable-equivalent adjustments primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate was 35% for all... -

Page 49

...mortgage Real estate 1-4 family junior lien mortgage Credit card Other revolving credit and installment Foreign Other Total increase in interest income Increase (decrease) in interest expense: Deposits: Interest-bearing checking Market rate and other savings Savings certiï¬cates Other time deposits... -

Page 50

...other fees Total trust and investment fees Card fees Other fees: Cash network fees Charges and fees on loans All other fees Total other fees Mortgage banking: Servicing income, net Net gains on mortgage loan origination/sales activities All other Total mortgage banking Operating leases Insurance Net... -

Page 51

... compensation and employee benefits. We grew our sales and service force by adding 1,755 team members (full-time equivalents), including 578 retail platform bankers. In 2007, we opened 87 regional banking stores and converted 42 stores acquired from Placer Sierra Bancshares and National City Bank to... -

Page 52

...and marketable equity securities. We hold debt securities available for sale primarily for liquidity, interest rate risk management and long-term yield enhancement. Accordingly, this portfolio primarily includes very liquid, high-quality federal agency and privately issued mortgage-backed securities... -

Page 53

... are expected to perform, even if the rating agencies reduce the credit rating of the bond insurers. See Note 5 (Securities Available for Sale) to Financial Statements for securities available for sale by security type. Deposits Year-end deposit balances are shown in Table 9. Comparative detail of... -

Page 54

.... Special-purpose entities used in these types of securitizations obtain cash to acquire assets by issuing securities to investors. In a securitization, we record a liability related to standard representations and warranties we make to purchasers and issuers for receivables transferred. Also... -

Page 55

...Guarantees and Legal Actions) to Financial Statements. In our venture capital and capital markets businesses, we commit to fund equity investments directly to investment funds and to specific private companies. The timing of future cash requirements to fund these commitments generally depends on the... -

Page 56

...bearing and noninterest-bearing checking, and market rate and other savings accounts. (2) Includes obligations under capital leases of $20 million. (3) Represents agreements to purchase goods or services. Risk Management Credit Risk Management Process Our credit risk management process provides for... -

Page 57

... used to support property values. In the mortgage industry, it has been common for consumers, lenders, and servicers to purchase mortgage insurance, which can enhance the credit quality of the loan for investors and serves generally to expand the market for home ownership. In our servicing portfolio... -

Page 58

... make or purchase option ARMs or negative amortizing mortgage loans. We have minimal ARM reset risk across our owned mortgage loan portfolios. Table 12: Real Estate 1-4 Family Mortgage Loans by State (in millions) Real estate 1-4 family ï¬rst mortgage California Minnesota Arizona Florida Colorado... -

Page 59

... the largest group of loans secured by one type of property is 3% of total loans. Table 15: Commercial Real Estate Loans by State and Property Type (in millions) Other real Real estate estate mortgage construction By state: California Texas Arizona Colorado Washington Minnesota Florida Utah New York... -

Page 60

... days with respect to real estate 1-4 family first and junior lien mortgages and auto loans) past due for interest or principal (unless both well-secured and in the process of collection); or • part of the principal balance has been charged off. Note 1 (Summary of Significant Accounting Policies... -

Page 61

...-offs on our residential real estate secured consumer loan portfolio. In 2007, net charge-offs in the Home Equity portfolio increased due to a severe decline in housing prices in several of our major geographic markets. The increased level of loss content in the Home Equity portfolio was the primary... -

Page 62

... Mortgage Lending, which addresses issues relating to certain ARM products, will not have a significant impact on Wells Fargo Financial's operations, since many of those guidelines have long been part of our normal business practices. Higher net charge-offs in non-real estate consumer loans (credit... -

Page 63

... rates paid on checking and savings deposit accounts by an amount that is less than the general decline in market interest rates); • short-term and long-term market interest rates may change by different amounts (for example, the shape of the yield curve may affect new loan yields and funding... -

Page 64

... and add to our securities available for sale a portion of the securities issued at the time we securitize mortgages held for sale. 2007 was a challenging year for the financial services industry with the downturn in the national housing market, deterioration in the capital markets, widening credit... -

Page 65

... "natural business hedge." In 2007, the decrease in the fair value of our MSRs net of the gains on free-standing derivatives used to hedge the MSRs increased income by $583 million. Hedging the various sources of interest rate risk in mortgage banking is a complex process that requires sophisticated... -

Page 66

...regulated, deposit-taking banking subsidiaries. Debt securities in the securities available-for-sale portfolio provide asset liquidity, in addition to the immediately liquid resources of cash and due from banks and federal funds sold, securities purchased under resale agreements and other short-term... -

Page 67

... of the Comptroller of the Currency (OCC) regulations. During 2007, Wells Fargo Bank, N.A. issued $26.1 billion in short-term senior notes. Moody's S&P Fitch, Inc. Dominion Bond Rating Service Aa1 AA+ AA AA * low ** middle *** high PARENT. Under SEC rules, the Parent is classified as a "wellknown... -

Page 68

... banking, business direct, wealth management, credit and debit card, corporate trust, commercial banking, asset-based lending, asset management, real estate brokerage, insurance, international, commercial real estate, corporate banking and specialized financial services). We continued to make... -

Page 69

... this Report, in the 2007 Form 10-K, or in other documents we file with the SEC from time to time could cause us to fall short of expectations for our future financial and business performance that we may express in forwardlooking statements. We make forward-looking statements when we use words such... -

Page 70

...in stock market prices could affect the trading activity of investors, reducing commissions and other fees we earn from our brokerage business. For more information, refer to "Risk Management - Asset/Liability and Market Risk Management - Market Risk - Equity Markets" in the Financial Review section... -

Page 71

... THE VALUE OF OUR MORTGAGE SERVICING RIGHTS AND MORTGAGES HELD FOR SALE, REDUCING OUR EARNINGS. We have a sizeable portfolio of mort- For more information, refer to "Critical Accounting Policies" and "Risk Management - Asset/Liability and Market Risk Management - Mortgage Banking Interest Rate and... -

Page 72

... largest banking state in terms of loans and deposits, continued deterioration in real estate values and underlying economic conditions in those markets or elsewhere in California could result in materially higher credit losses. In addition, deterioration in housing conditions and real estate values... -

Page 73

... Supervision - Dividend Restrictions" and "- Holding Company Structure" in our 2007 Form 10-K and to Notes 3 (Cash, Loan and Dividend Restrictions) and 26 (Regulatory and Agency Capital Requirements) to Financial Statements in this Report. CHANGES IN ACCOUNTING POLICIES OR ACCOUNTING STANDARDS, AND... -

Page 74

...of Wells Fargo businesses to better satisfy our customers' needs. Laws that restrict the ability of our companies to share information about customers could limit our ability to cross-sell products and services, reducing our revenue and earnings. For example, federal financial regulators have issued... -

Page 75

... was effective. KPMG LLP, the independent registered public accounting firm that audited the Company's financial statements included in this Annual Report, issued an audit report on the Company's internal control over financial reporting. KPMG's audit report appears on the following page. 72 -

Page 76

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of the Company as of December 31, 2007 and 2006, and the related consolidated statements of income, changes in stockholders' equity and comprehensive income, and cash flows for each of the years in the... -

Page 77

... EXPENSE Deposits Short-term borrowings Long-term debt Total interest expense NET INTEREST INCOME Provision for credit losses Net interest income after provision for credit losses NONINTEREST INCOME Service charges on deposit accounts Trust and investment fees Card fees Other fees Mortgage banking... -

Page 78

Wells Fargo & Company and Subsidiaries Consolidated Balance Sheet (in millions, except shares) 2007 ASSETS Cash and due from banks Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets Securities available for sale Mortgages held for sale (... -

Page 79

Wells Fargo & Company and Subsidiaries Consolidated Statement of Changes in Stockholders' Equity and Comprehensive Income (in millions, except shares) Number of common shares Preferred stock Common stock Additional paid-in capital Retained earnings Cumulative other comprehensive income $ 950 ... -

Page 80

...Changes in MSRs from purchases and sales Other, net Net cash used by investing activities Cash ï¬,ows from ï¬nancing activities: Net change in: Deposits Short-term borrowings Long-term debt: Proceeds from issuance Repayment Common stock: Proceeds from issuance Repurchased Cash dividends paid Excess... -

Page 81

... of Signiï¬cant Accounting Policies Wells Fargo & Company is a diversified financial services company. We provide banking, insurance, investments, mortgage banking and consumer finance through banking stores, the internet and other distribution channels to consumers, businesses and institutions in... -

Page 82

... quoted prices, if available. Nonmarketable equity securities include venture capital equity securities that are not publicly traded and securities acquired for various purposes, such as to meet regulatory requirements (for example, Federal Reserve Bank and Federal Home Loan Bank stock). We review... -

Page 83

... 90 days (120 days with respect to real estate 1-4 family first and junior lien mortgages and auto loans) past due for interest or principal (unless both well-secured and in the process of collection); or • part of the principal balance has been charged off. Mortgages Held for Sale Mortgages held... -

Page 84

... rate, default rates, cost to service (including delinquency and foreclosure costs), escrow Goodwill and Identifiable Intangible Assets Goodwill is recorded when the purchase price is higher than the fair value of net assets acquired in business combinations under the purchase method of accounting... -

Page 85

... Leased assets are written down to the fair value of the collateral less cost to sell when 120 days past due. rate of return is reasonable, we consider such factors as (1) long-term historical return experience for major asset class categories (for example, large cap and small cap domestic equities... -

Page 86

... provided in the following table as if we accounted for employee stock option plans under the fair value method of FAS 123 in 2005. (in millions, except per share amounts) Net income, as reported Add: Stock-based employee compensation expense included in reported net income, net of tax Less: Total... -

Page 87

... 2005 Certain branches of PlainsCapital Bank, Amarillo, Texas First Community Capital Corporation, Houston, Texas Other (3) July 22 July 31 Various $ 987 190 644 40 874 $ (1) Consists of six acquisitions of insurance brokerage and third party health care payment processing businesses. (2) Consists... -

Page 88

... of credit may require collateral to be held to provide added security to the bank. (For further discussion of risk-based capital, see Note 26.) Dividends paid by our subsidiary banks are subject to various federal and state regulatory limitations. Dividends that may be paid by a national bank... -

Page 89

... securities Other Total debt securities Marketable equity securities Total (2) $ 962 6,128 34,092 20,026 54,118 8,185 69,393 2,878 $72,271 898 82 980 45 1,180 172 $1,352 27,463 4,046 31,509 6,026 41,833 796 $42,629 (1) Most of the private collateralized mortgage obligations are AAA-rated bonds... -

Page 90

... to secure trust and public deposits and for other purposes as required or permitted by law. The following table shows the net realized gains on the sales of securities from the securities available-for-sale portfolio, including marketable equity securities. (in millions) Year ended December... -

Page 91

... Valley and several Southern California metropolitan statistical areas, experienced more severe value adjustments. Some of our real estate 1-4 family mortgage loans, including first mortgage and home equity products, include an interest-only feature as part of the loan terms. At December 31, 2007... -

Page 92

...The OCC examinations occur throughout the year and target various activities of our subsidiary national banks, including both the loan grading system and specific segments of the loan portfolio (for example, commercial real estate and shared national credits). The Parent and our nonbank subsidiaries... -

Page 93

... real estate Consumer: Real estate 1-4 family ï¬rst mortgage Real estate 1-4 family junior lien mortgage Credit card Other revolving credit and installment Total consumer Foreign Total loan recoveries Net loan charge-offs Allowances related to business combinations/other Balance, end of year... -

Page 94

... equity investments, including all federal bank stock, were accounted for at cost. (2) Consistent with regulatory reporting requirements, foreclosed assets include foreclosed real estate securing GNMA loans. Both principal and interest for GNMA loans secured by the foreclosed real estate... -

Page 95

...warranties we make to purchasers and issuers. The amount recorded for this liability was not material to our consolidated ï¬nancial statements at year-end 2007 or 2006. In response to the reduced liquidity in the capital markets, for certain sales and securitizations of nonconforming mortgage loans... -

Page 96

... retained some AAA-rated ï¬,oating-rate mortgagebacked securities. The fair value at the date of securitization was determined using quoted market prices. The key (in millions) economic assumptions at December 31, 2007, for these securities related to residential mortgage loan securitizations are... -

Page 97

...% Fair value, beginning of year Purchases Servicing from securitizations or asset transfers Sales Net additions Changes in fair value: Due to changes in valuation model inputs or assumptions (1) Other changes in fair value (2) Total changes in fair value Fair value, end of year Loans serviced for... -

Page 98

... for MSRs in excess of fair value Net derivative gains (losses): Fair value accounting hedges (4) Economic hedges (5) Total servicing income, net Net gains on mortgage loan origination/sales activities All other Total mortgage banking noninterest income Market-related valuation changes to MSRs, net... -

Page 99

... of businesses (primarily insurance) December 31, 2006 Goodwill from business combinations Foreign currency translation adjustments December 31, 2007 Community Banking $ 7,374 30 (19) 7,385 1,224 - $8,609 Wholesale Banking $ 3,047 458 19 3,524 550 - $4,074 Wells Fargo Consolidated Financial Company... -

Page 100

... 30 days. (in millions) Amount As of December 31, Commercial paper and other short-term borrowings Federal funds purchased and securities sold under agreements to repurchase Total Year ended December 31, Average daily balance Commercial paper and other short-term borrowings Federal funds purchased... -

Page 101

... trusts formed for the sole purpose of issuing trust preferred securities (the Trusts). The junior subordinated debentures held by the Trusts are included in the Company's long-term debt. (7) On December 5, 2006, Wells Fargo Capital X issued 5.95% Capital Securities and used the proceeds to purchase... -

Page 102

... our long-term and short-term borrowing arrangements, we are subject to various ï¬nancial and operational covenants. Some of the agreements under which debt has been issued have provisions that may limit the merger or sale of certain subsidiary banks and the issuance of capital stock or convertible... -

Page 103

...in connection with contracts between the customers and third parties. Standby letters of credit assure that the third parties will receive speciï¬ed funds if customers fail to meet their contractual obligations. We are obligated to make payment if a customer defaults. Standby letters of credit were... -

Page 104

... longer accounted for as fair value hedges under FAS 133, but as economic hedges. Net derivative gains and losses related to our residential mortgage servicing activities are included in "Servicing income, net" in Note 9. We use interest rate swaps to convert certain of our fixedrate long-term debt... -

Page 105

... hedges is recorded in "Net gains (losses) on debt securities available for sale" in the income statement. For fair value hedges of long-term debt and certificates of deposit, commercial real estate loans, franchise loans and debt securities, all parts of each derivative's gain or loss due to the... -

Page 106

...Includes hedges of long-term debt and certiï¬cates of deposit, commercial real estate and franchise loans, and debt and equity securities, and, for 2005, residential MSRs. Upon adoption of FAS 156, derivatives used to hedge our residential MSRs are no longer accounted for as fair value hedges under... -

Page 107

... exchange contracts: Swaps Forwards CUSTOMER ACCOMMODATION, TRADING AND OTHER FREE-STANDING DERIVATIVES Interest rate contracts: Swaps Futures Floors and caps purchased Floors and caps written Options purchased Options written Forwards Commodity contracts: Swaps Futures Floors and caps purchased... -

Page 108

...nancial instruments not recorded at fair value (FAS 107 disclosures). Assets SHORT-TERM FINANCIAL ASSETS Short-term ï¬nancial assets include cash and due from banks, federal funds sold and securities purchased under resale agreements and due from customers on acceptances. These assets are carried... -

Page 109

...using discount rates that reï¬,ect our current pricing for loans with similar characteristics and remaining maturity. For real estate 1-4 family ï¬rst and junior lien mortgages, fair value is calculated by discounting contractual cash ï¬,ows, adjusted for prepayment and credit loss estimates, using... -

Page 110

... representations and warranties) under our residential mortgage loan contracts. Short sale liabilities are priced based upon quoted prices in active exchange markets of the underlying security and are classiï¬ed as Level 1. The value of the repurchase obligations is determined using a cash ï¬,ow... -

Page 111

... or portfolios at year end. Year ended December 31, 2007 Total losses $ (76) (35) (3,080) (52) (90) (3) Carrying value at December 31, 2007 Total Level 1 Level 2 Level 3 Mortgages held for sale Loans held for sale Loans (1) Private equity investments Foreclosed assets (2) Operating lease assets... -

Page 112

... ASSETS Mortgages held for sale (1) Loans held for sale Loans, net Nonmarketable equity investments (cost method) FINANCIAL LIABILITIES Deposits Long-term debt (2) $ 1,817 948 376,888 5,855 2007 Estimated fair value $ 1,817 955 377,219 6,076 with our deposit, credit card and trust customers... -

Page 113

...authorization. ESOP CUMULATIVE CONVERTIBLE PREFERRED STOCK All shares of our ESOP (Employee Stock Ownership Plan) Cumulative Convertible Preferred Stock (ESOP Preferred Stock) were issued to a trustee acting on behalf of the Wells Fargo & Company 401(k) Plan (the 401(k) Plan). Dividends on the ESOP... -

Page 114

... FAS 123(R), Share-Based Payment, using the "modiï¬ed prospective" transition method. FAS 123(R) requires that we measure the cost of employee services received in exchange for an award of equity instruments, such as stock options or restricted share rights (RSRs), based on the fair value of the... -

Page 115

.... Various factors determine the amount and timing of our share repurchases, including our capital requirements, the number of shares we expect to issue for acquisitions and employee beneï¬t plans, market conditions (including the trading price of our stock), 112 and legal considerations. These... -

Page 116

... term (in years) Risk-free interest rate $4.03 4.05 13.3% 3.4 4.2 4.6% $4.03 4.67 15.9% 3.4 4.3 4.5% $3.75 3.13 16.1% 3.4 4.4 4.0% Employee Stock Ownership Plan Under the Wells Fargo & Company 401(k) Plan (the 401(k) Plan), a deï¬ned contribution ESOP, the 401(k) Plan may borrow money to purchase... -

Page 117

... 1, 2008, employees become vested in their Cash Balance Plan accounts after completing three years of vesting service or reaching age 65, if earlier. We did not make a contribution in 2007 to our Cash Balance Plan because a contribution was not required and the Plan was well-funded. Although we... -

Page 118

... plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Employer contribution Plan participants' contributions Beneï¬ts paid Foreign exchange impact Fair value of plan assets at end of year Funded status at end of year Amounts recognized in the balance sheet at end... -

Page 119

...long-term rate of return with a prudent level of risk given the beneï¬t obligations of the pension plans and their funded status. We target the Cash Balance Plan's asset allocation for a target mix range of 40-70% equities, 20-50% ï¬xed income, and approximately 10% in real estate, venture capital... -

Page 120

... (1) long-term historical return experience for major asset class categories (for example, large cap and small cap domestic equities, international equities and domestic ï¬xed income), and (2) forward-looking return expectations for these major asset classes. To account for postretirement health... -

Page 121

... Tax Liabilities Mortgage servicing rights Leasing Mark to market, net Net unrealized gains on securities available for sale Other Total deferred tax liabilities Net Deferred Tax Liability The tax beneï¬t related to the exercise of employee stock options recorded in stockholders' equity was $210... -

Page 122

..., options to purchase 13.8 million, 6.7 million and 9.7 million shares, respectively, were outstanding but not included in the calculation of diluted earnings per common share because the exercise price was higher than the market price, and therefore they were antidilutive. Year ended December 31... -

Page 123

... and hedging activities: Net unrealized gains arising during the year Reclassiï¬cation of net losses (gains) on cash ï¬,ow hedges included in net income Net unrealized gains arising during the year Deï¬ned beneï¬t pension plans: Amortization of net actuarial loss and prior service cost included... -

Page 124

...nance operations specialize in purchasing sales ï¬nance contracts directly from auto dealers and making loans secured by autos in the United States, Canada and Puerto Rico. Wells Fargo Financial also provides credit cards and lease and other commercial ï¬nancing. The Consolidated Company total of... -

Page 125

... liabilities to fund its assets, a funding charge based on the cost of excess liabilities from another segment. In general, Community Banking has excess liabilities and receives interest credits for the funding it provides to other segments. (2) The Consolidated Company balance includes unallocated... -

Page 126

... Consolidated Company Financial Canada Corporation (WFFCC), WFFI's wholly-owned Canadian subsidiary. WFFCC has continued to issue term debt securities and commercial paper in Canada, unconditionally guaranteed by the Parent. The Wells Fargo Financial business segment for management reporting... -

Page 127

... (beneï¬t) Equity in undistributed income of subsidiaries NET INCOME Year ended December 31, 2005 Dividends from subsidiaries: Bank Nonbank Interest income from loans Interest income from subsidiaries Other interest income Total interest income Deposits Short-term borrowings Long-term debt Total... -

Page 128

...for sale Mortgages and loans held for sale Loans Loans to subsidiaries: Bank Nonbank Allowance for loan losses Net loans Investments in subsidiaries: Bank Nonbank Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Deposits Short-term borrowings Accrued expenses and other liabilities Long... -

Page 129

... Other Consolidated consolidating Company subsidiaries/ eliminations Cash ï¬,ows from operating activities: Net cash provided by operating activities Cash ï¬,ows from investing activities: Securities available for sale: Sales proceeds Prepayments and maturities Purchases Loans: Increase in banking... -

Page 130

... consolidating Company subsidiaries/ eliminations Year ended December 31, 2005 Cash flows from operating activities: Net cash provided (used) by operating activities Cash flows from investing activities: Securities available for sale: Sales proceeds Prepayments and maturities Purchases Loans... -

Page 131

.../servicer, Wells Fargo Bank, N.A., through its mortgage banking division, is required to maintain minimum levels of shareholders' equity, as speciï¬ed by various agencies, including the United States Department of Housing and Urban Development, Government National Mortgage Association, Federal Home... -

Page 132

Report of Independent Registered Public Accounting Firm The Board of Directors and Stockholders Wells Fargo & Company: We have audited the accompanying consolidated balance sheet of Wells Fargo & Company and Subsidiaries ("the Company") as of December 31, 2007 and 2006, and the related consolidated ... -

Page 133

... after provision for credit losses NONINTEREST INCOME Service charges on deposit accounts Trust and investment fees Card fees Other fees Mortgage banking Operating leases Insurance Net gains (losses) on debt securities available for sale Net gains from equity investments Other Total noninterest... -

Page 134

...ï¬rst mortgage Real estate 1-4 family junior lien mortgage Credit card Other revolving credit and installment Total consumer Foreign Total loans (5) Other Total earning assets FUNDING SOURCES Deposits: Interest-bearing checking Market rate and other savings Savings certiï¬cates Other time deposits... -

Page 135

... stockholder return and total compound annual growth rate (CAGR) for our common stock (NYSE: WFC) for the ï¬ve- and ten-year periods ended December 31, 2007, with the cumulative total stockholder returns for the same periods for the Keefe, Bruyette and Woods 50 Total Return Index (the KBW 50 Bank... -

Page 136

... y ayudarlos a tener éxito en el área financiera. NOTRE VISION: Satisfaire tous les besoins ï¬nanciers de nos clients et les aider à atteindre le succès ï¬nancier. Wells Fargo & Company 420 Montgomery Street San Francisco, California 94104 1-866-878- 5865 wellsfargo.com 25% Cert no. SCS...