Volvo 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional social costs are reported as a liability, revalued at each bal-

ance sheet date in accordance with URA 46, issued by the Swedish

Financial Accounting Standards Council’s Emergency Issue Task

Force. The cash settled payment is revalued at each balance sheet

day and is reported as an expense during the vesting period and as a

short term liability. An assessment whether the terms of payment will

be fulfi lled is made continuously. If the assessment changes, the

expense will be adjusted. The equity-settled part was earlier account ed

for at fair value and provided for as an accrued expense over the vest-

ing period with a ”true-up” each reporting date.

Pensions and similar obligations (Postemployment benefi ts)

Volvo applies IAS 19, Employee Benefi ts, for pensions and similar

obligations. In accordance with IAS 19, actuarial calculations should

be made for all defi ned-benefi t plans in order to determine the

present value of obligations for benefi ts vested by its current and

former employees. The actuarial calculations are prepared annually

and are based upon actuarial assumptions that are determined close

to the balance sheet date each year. Changes in the present value of

obligations due to revised actuarial assumptions are treated as actu-

arial gains or losses which are amortized over the employees’ aver-

age remaining service period to the extent these exceed the corridor

value for each plan. Deviations between expected return on plan

assets and actual return are treated as actuarial gains or losses.

Provisions for post-employment benefi ts in Volvo’s balance sheet

correspond to the present value of obligations at year-end, less fair

value of plan assets, unrecognized actuarial gains or losses and

unrecognized unvested past service costs.

In accordance with the IFRS transition rules, the carrying amount

of the liability is determined at January 1, 2004 in accordance with

IAS 19 and the actuarial gains and losses set at zero. As a supple-

ment to IAS 19, Volvo applies URA 43 in accordance with the

recommendation from the Swedish Financial Accounting Standards

Council in calculating the Swedish pension liabilities.

For defi ned contribution plans premiums are expensed as incurred.

Provisions for residual value risks

Residual value risks are attributable to operational leasing contracts

and sales transactions combined with buy-back agreements or

residual value guarantees. Residual value risks are the risks that

Volvo in the future would have to dispose used products at a loss if

the price development of these products is worse than what was

expected when the contracts were entered. Provisions for residual

value risks are made on a continuing basis based upon estimations

of the used products’ future net realizable values. The estimations of

future net realizable values are made with consideration of current

prices, expected future price development, expected inventory turn-

over period and expected variable and fi x ed selling expenses. If the

residual value risks are pertaining to products that are reported as

tangible assets in Volvo’s balance sheet, these risks are refl ected by

depreciation or write-down of the carrying value of these assets. If

the residual value risks are pertaining to products, which are not

reported as assets in Volvo’s balance sheet, these risks are refl ected

under the line item short-term provisions.

Warranty expenses

Estimated costs for product warranties are charged to operating

expenses when the products are sold. Estimated costs include both

expected contractual warranty obligations as well as expected good-

will warranty obligations. Estimated costs are determined based

upon historical statistics with consideration of known changes in

product quality, repair costs or similar. Costs for campaigns in con-

nection with specifi c quality problems are charged to operating

expenses when the campaign is decided and announced.

Restructuring costs

Restructuring costs are reported as a separate line item in the

income statement if they relate to a considerable change of the

Group structure. Other restructuring costs are included in Other

operating income and expenses. A provision for decided restructur-

ing measures is reported when a detailed plan for the implementa-

tion of the measures is complete and when this plan is communi-

cated to those who are affected.

Deferred taxes, allocations and untaxed reserves

Tax legislation in Sweden and other countries sometimes contains

rules other than those identifi ed with generally accepted accounting

principles, and which pertain to the timing of taxation and measure-

ment of certain commercial transactions. Deferred taxes are pro-

vided for on differences that arise between the taxable value and

reported value of assets and liabilities (temporary differences) as

well as on tax-loss carryforwards. However, with regards to the valu-

ation of deferred tax assets, that is, the value of future tax reduc-

tions, these items are recognized provided that it is probable that the

amounts can be utilized against future taxable income.

Deferred taxes on temporary differences on participations in sub-

sidiaries and associated companies are only reported when it is

probable that the difference will be recovered in the near future.

Tax laws in Sweden and certain other countries allow companies

to defer payment of taxes through allocations to untaxed reserves.

These items are treated as temporary differences in the consolidat ed

balance sheet, that is, a split is made between deferred tax liability

and equity capital (restricted reserves). In the consolidated income

statement an allocation to, or withdrawal from, untaxed reserves is

divided between deferred taxes and net income for the year.

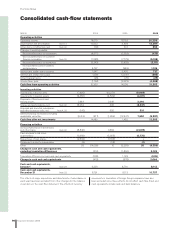

Cash-fl ow statement

The cash-fl ow statement is prepared in accordance with IAS 7, Cash

Flow Statement, indirect method. The cash-fl ow statements of for-

eign Group companies are translated at the average rate. Changes

in Group structure, acquisitions and divestments, are reported net,

excluding cash and cash equivalents, in the item Acquisition and

divestment of subsidiaries and other business units and are included

in Cash Flow from Investing Activities. The reported operating cash

fl o w for 2005 was affected by the adoption of IAS 39. The adjusted

opening value at January 1, 2005 was used in calculating cash fl o w.

Cash and cash equivalents include cash, bank balances and parts

of Marketable Securities, which date of maturity are within three

months at the time for investment. Marketable Securities comprise

interest-bearing securities, the majority of which with terms exceed-

ing three years. However, these securities have high liquidity and can

easily be converted to cash. In accordance with IAS 7, certain invest-

ment in marketable securities are excluded from the defi nition of

cash and cash equivalents in the cash-fl ow statement if the date of

maturity of such instruments is later than three months after the

investment was made.

Earnings per share

Earnings per share is calculated as the income for the period attrib-

uted to the shareholders of the parent company, divided with the aver-

age number of outstanding shares per reporting period. To calculate

the diluted earnings per share, the average number of shares is

adjusted with the value of the share based incentive program and

employee stock option program recalculated to number of shares.

Financial information 2006 95