Volvo 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170

|

|

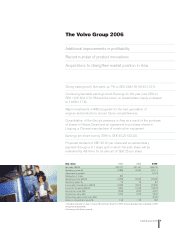

The Volvo Group 2006

Additional improvements in profi tability

Record number of product innovations

Acquisitions to strengthen market position in Asia

Strong sales growth. Net sales up 7% to SEK 248,135 M (231,191).

Continuing favorable earnings trend. Earnings for the year rose 25% to

SEK 16,318 M (13,108) and the return on shareholders’ equity increased

to 19.6% (17.8).

Major investments in R&D programs for the next generation of

engines and products to ensure future competitiveness.

Consolidation of the Group’s presence in Asia as a result of the purchase

of shares in Nissan Diesel and an agreement to purchase shares in

Lingong, a Chinese manufacturer of construction equipment.

Earnings per share rose by 25% to SEK 40.20 (32.22).

Proposed dividend of SEK 25.00 per share and an extraordinary

payment through a 6:1 share split in which the sixth share will be

redeemed by AB Volvo for an amount of SEK 25 per share.

Key ratios 2004 2005 2006

Net sales, SEK M 202,171 231,191 248,135

Operating income, M1 13,859 18,153 22,111

Adjustment of goodwill – – (1,712)

Revaluation of shares 820 – –

Operating income, SEK M 14,679 18,153 20,399

Operating margin, % 7.3 7.9 8.2

Income after financial items, SEK M 13,036 18,016 20,299

Income for the period, SEK M 9,907 13,108 16,318

Earnings per share, SEK 23.58 32.22 40.20

Dividend per share, SEK 12.50 16.75 25.00

2

Extraordinary payment per share, SEK – – 25.00

3

Return on shareholders’ equity, % 13.9 17.8 19.6

1 Excluding revaluation of shares in Scania AB and Henlys Group Plc in 2004 and excluding adjustment of goodwill in 2006.

2 Proposed dividend 2006.

3 According to the Board’s proposal.

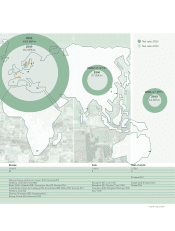

A global group 2006 1