Volvo 2006 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

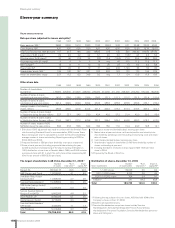

152 Financial information 2006

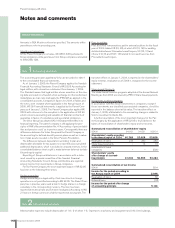

Proposed disposition of unappropriated earnings

AB Volvo SEK M

Retained earnings 34,997

Income for the period 4,349

Total 39,345

The Board of Directors and the President propose that the above

sum be disposed of as follows:

SEK M

To the shareholders, a dividend of SEK 25.00 per share 10,120

To be carried forward 29,225

Total 39,345

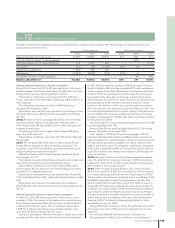

In view of the Board of Director’s proposal to the Annual General

Meeting to be held 4 April 2007 to decide on the distribution of an

ordinary dividend of SEK 25 and on an automatic redemption of

shares, including a reduction of the share capital, and a reduction

of retained earnings, for repayment to the shareholders in amount

corresponding to SEK 25 per share, according to the Chapter 18

Section 4 and Chapter 20 Section 8 of the Swedish Company Act,

the Board hereby makes the following statement.1

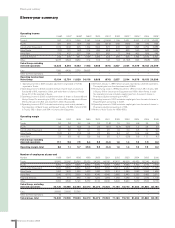

The proposed ordinary dividend and the proposed reduction of

the share capital for repayment to the shareholders reduces the

Company’s solvency from 85.3 percent to 77.4 percent and the

Group’s, excluding Financial Services, solvency from 43.5 percent

to 37.2 percent, calculated as per year end 2006. The Board of

Directors considers this solvency to be satisfactory with regard to

the business in which the Group is active.

According to the Board of Directors’ opinion, the proposed ordi-

nary dividend and the proposed reduction of the share capital for

repayment to the shareholders will not affect the Company’s or the

Group’s ability to fulfi l their payment obligations and the Company

and the Group are well prepared to handle both changes in the

liquidity and unexpected events.

The Board of Directors is of the opinion that the Company and

the Group have capacity to take future business risks as well as to

bear contingent losses. The proposed ordinary dividend and the

proposed reduction of the share capital for repayment to the

shareholders will not negatively affect the Company’s and the

Group’s ability to make further commercially justifi ed investments

in accordance with the Board of Directors’ plans.

Göteborg, February 21, 2007

Finn Johnsson

Peter Bijur Per-Olof Eriksson

Tom Hedelius Leif Johansson Philippe Klein

Louis Schweitzer Ying Yeh

Martin Linder Olle Ludvigsson Johnny Rönnkvist

Our audit report was issued on February 21, 2007

PricewaterhouseCoopers AB

Göran Tidström Olov Karlsson

Authorized Public Accountant Authorized Public Accountant

Lead Partner Partner

In addition to what has been stated above, the Board of Direc-

tors has considered other known circumstances which may be of

importance for the Company’s and the Group’s fi nancial position. In

doing so, no circumstance has appeared that does not justify the

proposed ordinary dividend and the proposed reduction of the

share capital for repayment to the shareholders.

If the Annual General Meeting resolves in accordance with the

Board of Directors’ proposals regarding ordinary dividend, reduc-

tion of the share capital for repayment to the shareholders and

bonus issue, SEK 18,680 M will remain of the Company’s non-

restricted equity, calculated as per year end 2006.

The Board of Directors has the view that the Company’s and the

Group’s shareholders’ equity will, after the proposed ordinary divi-

dend and the proposed reduction of the share capital with repay-

ment to the shareholders, be suffi cient in relation to the nature,

scope and risks of the business.

Had the assets and liabilities not been estimated at their market

value pursuant to Chapter 4, Section 14 of the Swedish Annual

Accounts Act the company’s shareholders’ equity would have been

SEK 475,922,222 less.

1 The Board members Martin Linder, Olle Ludvigsson and Johnny Rönnkvist

opposed the Board of Directors’ proposals concerning dividends and

redemption of shares due to their view that the proposed amounts were

too high because the Company would need the capital for acquisitions

and other investments an to secure the development of the Company in

future downturns in the economy.

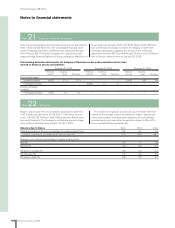

We hereby certify that, to the best of our knowledge, that

– the annual accounts have been prepared in accordance with

good accounting practices for a stock market company;

– the information is, an all material respects, consistent with the

actual conditions; and

– nothing of material importance has been omitted that could

affect the fi n ancial position of the company as presented in the

annual report.2

2 This certifi cation, which has been provided in accordance with Section

3.6.2 of the Swedish Code of Corporate Governance, does not mean that

the board of directors and the President of the Company assumes any

further responsibility than what follows from the Swedish Companies Act

(2005:551).