Volvo 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

value. Translation differences are charged against earnings for the

year. Currently, Volvo has no subsidiaries with a functional currency

that could be considered a hyperinfl ationary currency.

Receivables and liabilities in foreign currency

In the individual Group companies as well as in the consolidated

accounts, receivables and liabilities in foreign currency are valued at

period-end exchange rates. Translation differences on operating

assets and liabilities are recognized in operating income, while trans-

lation differences arising in fi nancial assets and liabilities are

charged to other fi n ancial income and expenses.

Currency swap contracts are reported at fair value, unrealized

gains on exchange rates are reported as short term receivables and

unrealized losses on exchange rates are reported as short term

l iabilities.

Exchange rate differences on loans and other fi n ancial instru-

ments in foreign currency, which are used to hedge net assets in for-

eign subsidiaries and associated companies, are offset against

translation differences in the shareholders’ equity of the respective

companies.

Exchange rate gains and losses on payments during the year and

on the valuation of assets and liabilities in foreign currencies at year-

end are credited to, or charged against, income in the year they

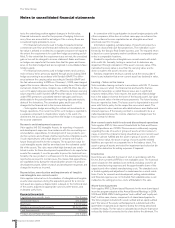

arise. The more important exchange rates applied are shown above.

Net sales and revenue recognition

The Group’s reported net sales pertain mainly to revenues from

sales of goods and services. Net sales are reduced by the value of

discounts granted and by returns.

Income from the sale of goods is recognized when signifi cant

risks and rewards of ownership have been transferred to external

parties, normally when the goods are delivered to the customers. If,

however, the sale of goods is combined with a buy-back agreement

or a residual value guarantee, the sale is accounted for as an operat-

ing lease transaction if signifi cant risks of the goods are retained in

Volvo. Income from the sale of workshop services is recognized

when the service is provided. Rental revenues and interest income in

conjunction with fi n ancial leasing or installment contracts are recog-

nized during the underlying contract period. Revenue for mainte-

nance contracts are recognized according to how costs associated

with the contracts are distributed during the contract period.

Interest income is recognized on a continuous basis and dividend

income when it is received.

Leasing – Volvo as the lessor

Leasing contracts are defi ned in two categories, operational and

fi n a ncial, depending on the contract’s fi n ancial implications. Oper-

ational leasing contracts are reported as non-current assets in Assets

in operational leases. Income from operational leasing is reported

equally distributed over the leasing period. Straight-line depreciation

is applied to these assets in accordance with the terms of the under-

taking and the deprecation amount is adjusted to correspond to the

estimated realizable value when the undertaking expires. Assessed

impairments are charged in the income statement. The product’s

assessed realizable value at expiration of the undertaking is

reviewed continually on an individual basis.

Financial leasing agreements are reported as Non-current

respective Short-term receivables in the customer fi n ancing oper-

ations. Income from fi nancial leasing contracts is distributed between

interest income and amortization of the receivable in the customer

fi n a ncing operations.

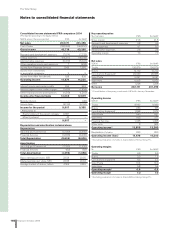

In accordance with IAS 14, Segment reporting, operational leasing

contracts should be reclassifi ed to fi nancial in the segment reporting

of Volvo Financial Services if the residual value in these contracts is

guaranteed to Volvo Financial Services by another Volvo business

area. In the Volvo Group’s consolidated balance sheet, these leasing

agreements are still reported as operating leases. Reclassifi cation

from operational to fi nancial leasing contract also affects the income

statement with regards to sales and depreciation. Volvo Financial

Service’s sales are reduced as a result of the reclassifi cation as well

as depreciation, which affect cash fl ow from operating activities.

However, the Volvo consolidated balance sheet and income state-

ment still recognizes leasing contracts as operational and, accord-

ingly, reports higher sales and depreciation.

Investments in other companies

Volvo accounts for all investments in companies, except if these

investments are classifi ed as associated companies in accordance

with IAS 39, Financial Instruments: Recognition and Measurement.

Companies listed on a fi nancial exchange should be reported in the

balance sheet to market value. Under IAS 39, unrealized gains and

losses attributable to the change in market value of investments are

reported in a separate component of shareholders’ equity except

when the decline in value is signifi cant or other than temporary. If the

value decline is considered other than temporary, the value should

be written down through the income statement. IAS 39 is applied by

Volvo as of January 1, 2005 and the difference in valuation com-

pared with Swedish GAAP and the 2004 accounting principles is

that all such investments have been carried at their cost of acquisi-

tion unless there has been a permanent decrease in value. The dif-

ference between the valuation at December 31, 2004 and January

1, 2005 is reported in shareholders’ equity. Unlisted shares, for

which a reliable fair value can not be determined, should be reported

at a historical cost reduced in appropriate cases by write-downs.

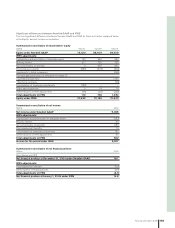

Reporting of fi nancial assets and liabilities

Volvo reports marketable securities in accordance with IAS 39

based on classifi cation of these assets into a category valued at fair

value through profi t and loss.

As of January 1, 2005, Volvo applies IAS 39, regarding the time

that fi n ancial assets should be derecognized from the balance sheet.

This occurs when substantially all risks and rewards have been

transferred to an external party. Corresponding principles are

applied regarding fi n ancial assets in Volvo’s segment reporting.

Under Swedish GAAP, for the 2004 comparison year, fi n ancial assets

should be derecognized at settlement or if the ownership of the

fi n a ncial assets had been transferred to an external party.

Financial liabilities are reported at historical value reduced by

amortization. Transaction cost in connection with raising fi nancial

l iabilities are amortized over the fi n ancial loan’s duration as a fi n an-

cial expense.

Receivables

Accounts receivables are initially recognized at fair value, normally

equal with the nominal amount. In cases in which the payment terms

exceed one year, the receivable is carried at its discounted present

value. Provisions for doubtful receivables are made on a current

basis after an assessment of whether the customer’s ability to pay

has changed.

Hedge accounting

In accordance with IAS 39, which is applied by Volvo as of January

1, 2005, certain fi n ancial instruments shall be reported at fair value

in the balance sheet. In order to apply hedge accounting, the follow-

ing criteria must be met: the position being hedged is identifi ed and

exposed to market value movements, for instance related to

exchange-rate or interest-rate movements, the purpose of the loan/

instrument is to serve as a hedge and the hedging effectively pro-

Financial information 2006 93