Volvo 2006 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

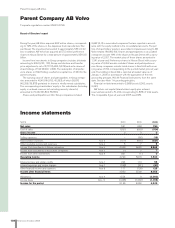

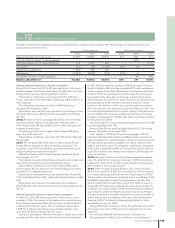

Financial information 2006 143

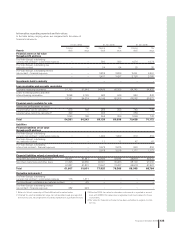

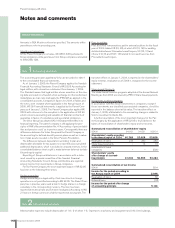

Note 9 Allocations

2004 2005 2006

Allocation to additional depreciation (1) 0 0

Tax allocation reserves 1,525 – (2,000)

Total 1,524 0 (2,000)

Note 7 Interest income and expenses

Interest income and similar credits amounting to 56 (114; 294),

included interest in the amount of 56 (112; 289) from subsidiaries

and interest expenses and similar charges totaling 67 (31; 238),

included interest of 61 (31; 213) to subsidiaries.

In 2004 interest-rate swaps were included in interest income with

53 and in interest expenses with 112. As from 2005 these are dis-

closed net and are included in interest expenses with 1 (3).

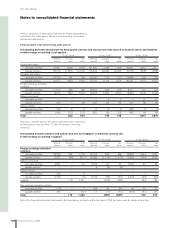

Note 5 Income from investments in associated companies

Income from associated companies that are reported in the Group accounts in accordance with the equity method amounted to 7 and

pertains to a dividend from Nissan Diesel. The participation in Blue Chip Jet HB amounts to 0 (0; neg. 1).

Note 6 Income from other investments

In 2004 revaluation of shareholdings amounted to 820, whereof

reversal of previous year’s write-down of Scania AB, 915 and write-

down of Henlys Group Plc, 95. Divestment of total shares in Bilia AB

resulted in a capital gain of 28.

Note 4 Income from investments in Group companies

Of the income reported, 399 (9,161; 101) pertain to dividends from

Group companies. Of the dividends, 300 pertain to anticipated divi-

dend from Volvo Financial Services AB. The shares in Volvo Informa-

tion Technology AB have been written down by 32 and the shares in

Kommersiella Fordon Europa AB have been written down by 160. In

2005, the shares in Volvo Global Trucks AB were written down by 8,420.

Transfer price adjustments and Group contributions total a net of

8,721 (5,360; 5,673). The redemption of the preference shares in

VNA Holdning Inc has resulted in a capital loss of 363. In 2005, the

sale of total shares in Celero Support AB resulted in a capital gain

of 518.

Note 3 Other operating income and expenses

Other operating income and expenses include profi t sharing payments to employees in the amount of 2 (1; 0).

Note 8 Other fi nancial income and expenses

Other fi nancial income and expenses include exchange rate differ-

ences on loans, guarantee commissions from subsidiaries, costs for

confi rmed credit facilities as well as costs of having Volvo shares

registered on various stock exchanges. In 2004 repayment of inter-

est and residual taxes regarding a judgement in the Administrative

court of appeal and expenses for distribution of the shares in Ainax

AB to Volvo’s shareholders are included. Exchange differences on

loans have been recounted for year 2004 due to new accounting

principles. See Note 1 Accounting principles for more information.