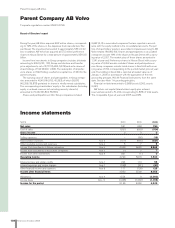

Volvo 2006 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information 2006 133

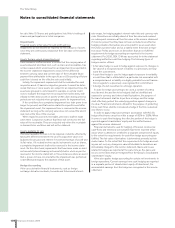

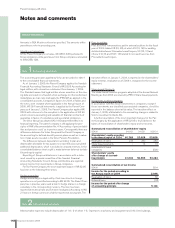

Note 37 Financial instruments

The fi n ancial assets treated within the framework of IAS 39 are clas-

sifi ed either as

• fi n ancial assets at fair value through profi t and loss

• claims under a loan and receivables

• investments held to maturity and

• available-for-sale fi n ancial assets

Transaction expenses are included in the asset’s fair value except in

cases in which the change in value is recognized in the income

statement. The transaction costs arising in conjunction with assum-

ing fi n ancial liabilities are amortized over the term of the loan as a

fi n a ncial cost. Embedded derivatives are detached from the related

main contract, if applicable. Contracts containing embedded deriva-

tives are valued at fair value in the income statement if the contracts

inherent risk and other characteristics indicate a close relation to the

embedded derivative. Classifi cations made of fi nancial instruments

are evaluated each quarter and, if necessary, the classifi cation is

adjusted.

Purchases and sales of fi nancial assets and liabilities are recog-

nized on the transaction date. A fi n ancial asset is derecognized

(extinguished) in the balance sheet when all signifi cant risks and

benefi ts linked to the asset have been transferred to a third party.

The market value of assets is determined based on the market

prices in such cases they exist. If market prices are unavailable, the

fair value is determined for each asset using various valuation tech-

niques.

Financial assets at fair value through profi t and loss

A fi n ancial asset recognized at fair value in the income statement is

categorized as follows: Either (1) it is recognized with the fi n ancial

instruments or in accordance with (2) the so-called fair value option

on initial recognition has been designated as such. For the fi r st cate-

gory to apply, it is required that the asset is acquired with the main

purpose of being sold in the near future and that it is part of a port-

folio and there is a proven pattern of short-term capitalization of

gains. All of Volvo’s fi n ancial assts that are recognized at fair value in

the income statement are in category 1.

Derivatives, included embedded derivatives detached from the

host contract, are classifi ed as held-for-trading if the are part of an

evidently effective hedge accounting or are a fi n ancial guarantee.

Gains and losses on these assets are recognized in the income

statement.

A fi n ancial contract containing one or more embedded derivatives

is classifi ed in its entirety as a fi n ancial asset whose value change is

recognized in the income statement if not:

• the embedded derivative does not affect future cash fl ow attribut-

able to the fi nancial asset.

• separation of the embedded instrument is required.

Short-term investments are valued at fair value and the changes

in this value are recognized in the income statement. Short-term

investments that mainly consist of interest-bearing fi n ancial instru-

ments are reported in Note 21.

Volvo classifi es fi nancial derivatives as fi nancial assets whose

value changes are reported in the income statements if they evi-

dently are not used in hedge accounting. All derivatives are reported

in this note below.

Financial assets held to maturity

Held-to-maturity investments are assets with fi xed payments and

term and that Volvo intends and is able to hold to maturity. After ini-

tial valuation, these assets are valued at accrued acquisition value in

accordance with the effective interest method, with adjustment for

any impairment. Gains and losses are recognized in the income

statement when assets are divested or impaired as well as in pace

with the accrued interested being reported. At year end 2006 Volvo

did not have any fi n ancial instruments classifi ed in this category.

Claims under a loan and receivables

Loans and receivables are non-derivative fi n ancial assets with fi xed

or determinable payments, originated or acquired, that are not

quoted in an active market. After initial recognition, loans and receiv-

ables are valued at accrued acquisition value in accordance with the

effective interest method. Gains and losses are recognized in the

income statement when the loans or receivables are divested or

impaired as well as in pace with the accrued interested being

reported.

Accounts receivable are recognized initially at fair value, which

normally corresponds to the nominal value. In the event that the pay-

ment terms exceed one year, the receivable is recognized at the dis-

counted present value. Provisions for doubtful receivables are made

continuously after assessment of whether the customer’s payment

capacity has changed.

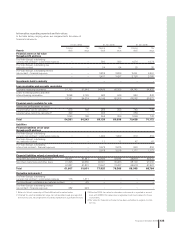

Volvo reports different loans and receivables. Note 16, Long-term

receivables in customer fi nancing operations presented mainly

receivables related to installment purchases and fi n ancial leasing.

Note 17, Other long-term receivable, presents, among other items,

Other loans to external parties. Note 19, Current receivables in cus-

tomer fi nancing operations, presents installment purchases, fi n ancial

leasing and dealer fi nancing and Note 20, Other current receivables,

is mainly accounts receivable.

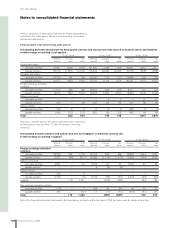

Available-for-sale assets

This category includes assets available for sales or those that have

not been classifi ed in any of the other three categories. These assets

are initially measured at fair value. Fair value changes are recognized

directly in shareholders’ equity. The cumulative gain or loss that was

recognized in equity is recognized in profi t or loss when an available-

for-sale fi nancial asset is sold. Unrealized value declines are recog-

nized in equity, if the decline is not considered temporary. If the value

decline is signifi cant and has lasted for a longer period, the value

impairment is recognized in the income statement. If the event caus-

ing the impairment no longer exists, impairment can be reversed in

the income statement if it does not involve an equity instrument.

Earned or paid interest attributable to these assets is recognized

in the income statement as part of net fi nancial items in accordance

with the effective interest method. Dividends received attributable to

these assts are recognized in the income statement as Earnings

from other shares and participations.

Volvo reports shares and participations in listed companies at

market value on the balance-sheet date, with the exception of

investments classed as associated companies and joint ventures.

Companies listed on fi nancial marketplaces are reported at market

value on the balance-sheet date. Holdings in unlisted companies for

which a market value is unavailable, are recognized at acquisition

value. Volvo classifi es these types of investments as assets available