Volvo 2006 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

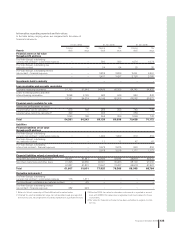

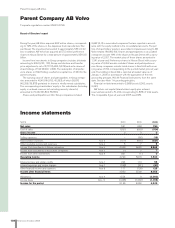

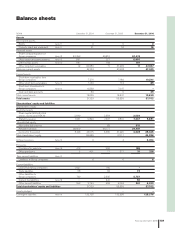

134 Financial information 2006

The Volvo Group

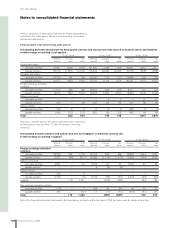

Notes to consolidated financial statements

for sale. Note 15 Shares and participations lists Volvo’s holdings of

shares and participations in listed companies.

Impairments

Financial assets at fair value through profi t and loss

Impairments do not need to be reported for this category of assets

since they are continuously revalued at their fair value in the income

statement.

Assets that are valued at amortized cost

Volvo conducts routine controls to ensure that the carrying value of

assets valued at amortized cost, such as loans and receivables, has

not decreased, which would result in an impairment loss reported in

the income statement. Impairments consist of the difference

between carrying value and current value of the estimated future

payment fl o w attributable to the specifi c asset. Discounting of future

cash fl o w is based on the effective rate used initially.

Initially, the impairment requirement shall be evaluated for each

respective asset. If, based on objective grounds, it cannot be deter-

mined that one or more assets are subject to an impairment loss, the

assets are grouped in units based, for example, on similar credit

risks to evaluate the impairment loss requirement collectively. Indi-

vidually written down assets or assets written down during previous

periods are not included when grouping assets for impairment test.

If the conditions for a completed impairment loss later prove to no

longer be present, and that can be related to a specifi c event after

the impairment event, the impairment loss is reversed in the income

statement as long as the carrying value does not exceed the amort-

ized cost at the time of the reversal.

When regard to accounts receivable, provisions shall be made

when there is objective evidence that Volvo will not receive the full

value of the receivable. They are excluded only when the receivable

is deemed to be worthless and will not be obtained.

Assets available for sale

If an asset available for sale is to be impaired, it shall be effected by

taking the difference between the asset’s acquisition value cost

(adjusted for any accrued interest if it involves that type of asset) and

its fair value. If it instead involves equity instruments such as shares,

a completed impairment shall not be reversed in the income state-

ment. On the other hand, impairments that have been made on debt

instruments (interest-bearing instruments) shall in whole or part be

reversed in the income statement, in those instances where an event

that is proven to have occurred after the impairment was performed

is identifi ed and impacts the valuation of that asset.

Hedge Accounting

Volvo uses derivative fi nancial instruments, such as foreign

exchange derivative contracts, forwards and futures and interest-

rate swaps, for hedging against interest-rate risks and currency-rate

risks. Derivatives are initially valued at their fair value and revalued

on subsequent occasions at their fair value in the income statement,

if it can be proven that they have not been included in an effective

hedging situation. Derivatives are accounted for as an asset when

they have a positive value and as a liability when they have a nega-

tive value. Profi ts and losses on derivatives that do not fulfi ll the

requirements for hedge accounting are reported in the income

statement. For 2006, SEK 10 M was accounted for in the statement

regarding ineffective cash fl ow hedging. The following types of

hedges can be utilized:

• A fair value hedge is used to hedge against exposure to changes in

fair value of a recognized asset or liability or a previously unrecog-

nized fi rm commitment.

• A cash fl ow hedge is used to hedge against exposure to variability

in cash fl o ws that is attributable to a particular risk associated with

a recognized asset or liability or a highly probable forecast transac-

tion in regards to a previously unrecognized fi r m commitment.

• A hedge of a net investment in a foreign operation.

In order for hedge accounting to be used, a number of criteria

must be met: the position to be hedged shall be identifi ed and

exposed to currency and interest rate fl u ctuations, the purpose of

the loan/instrument shall be to perform a hedge, and the hedge

shall effectively protect the underlying position against changes in

its value. Financial instruments utilized for the purpose of protecting

future cash fl ows shall be considered a hedge if the fl o w is deemed

very likely to occur.

In order to apply hedge accounting in accordance with IAS 39,

hedge effectiveness must be within a range of 80% to 125%. When

it comes to cash fl o w hedging, the effective portion of the hedge is

reported against shareholders’ equity and the ineffectiveness

against the income statement.

Financial instruments used for hedging of forecast commercial

cash-fl ows and electricity consumption have been reported at fair

value, which is debited or credited to a separate component of equity

to the extent the requirements for cash-fl ow hedge accounting are

fulfi lled. The fair value of derivatives is determined primarily by their

market value. To the extent that the requirements for hedge account-

ing are not met, any changes in value attributable to derivatives are

immediately charged to the income statement. Gains and losses

related to hedges are reported at the same time as the gains and

losses on the items that are hedged effect the Group’s consolidated

shareholders’ equity.

Volvo also applies hedge accounting for certain net investments in

foreign operations. Current earnings from such hedging are reported

in a separate portion of shareholders’ equity. At divestment, the

accumulated earnings from the hedge are recognized in the income

statement.