Volvo 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information 2006 111

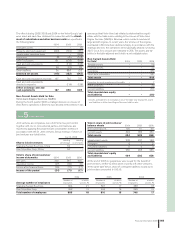

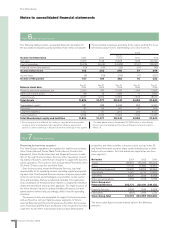

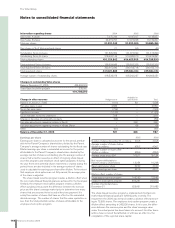

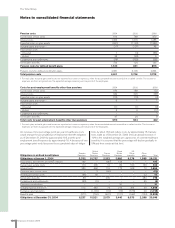

Note 13 Minority interests

Minority interests in income (loss) for the period and in shareholders’ equity consisted mainly of the minority interests in Volvo Aero Norge AS

(22%), in Wuxi da Hao Power Co, Ltd (30%) and in Berliet Maroc S.A (30%).

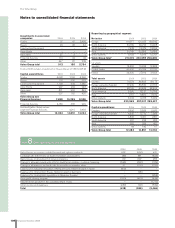

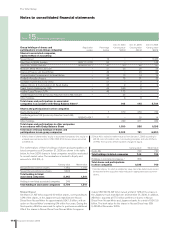

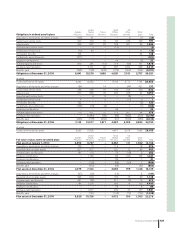

Note 14 Intangible and tangible assets

Entrances

fees,

aircraft Product and Other Total

engine software intangible intangible

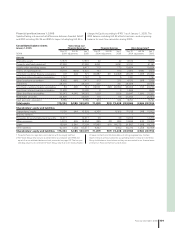

Intangible assets, acquisition costs Goodwill1 programs development assets assets

Value in balance sheet 2004 10,321 2,758 8,585 1,734 23,398

Value in balance sheet 2005 11,072 2,971 11,817 1,784 27,644

Capital expenditures – 121 2,917 28 3,066

Adjustment of goodwill (1,712) – – – (1,712)

Sales/scrapping 0 (11) (203) (13) (227)

Acquired and divested operations

3 0 0 0 (6) (6)

Translation differences (420) 0 (257) (108) (785)

Reclassifi cations and other (91) (168) 14 327 82

Value in balance sheet 2006 8,849 2,913 14,288 2,012 28,062

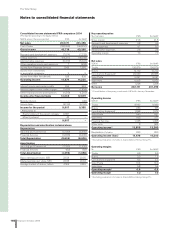

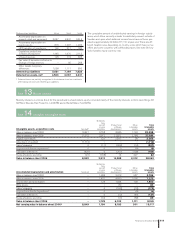

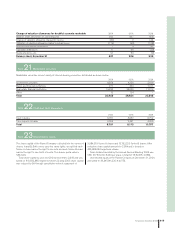

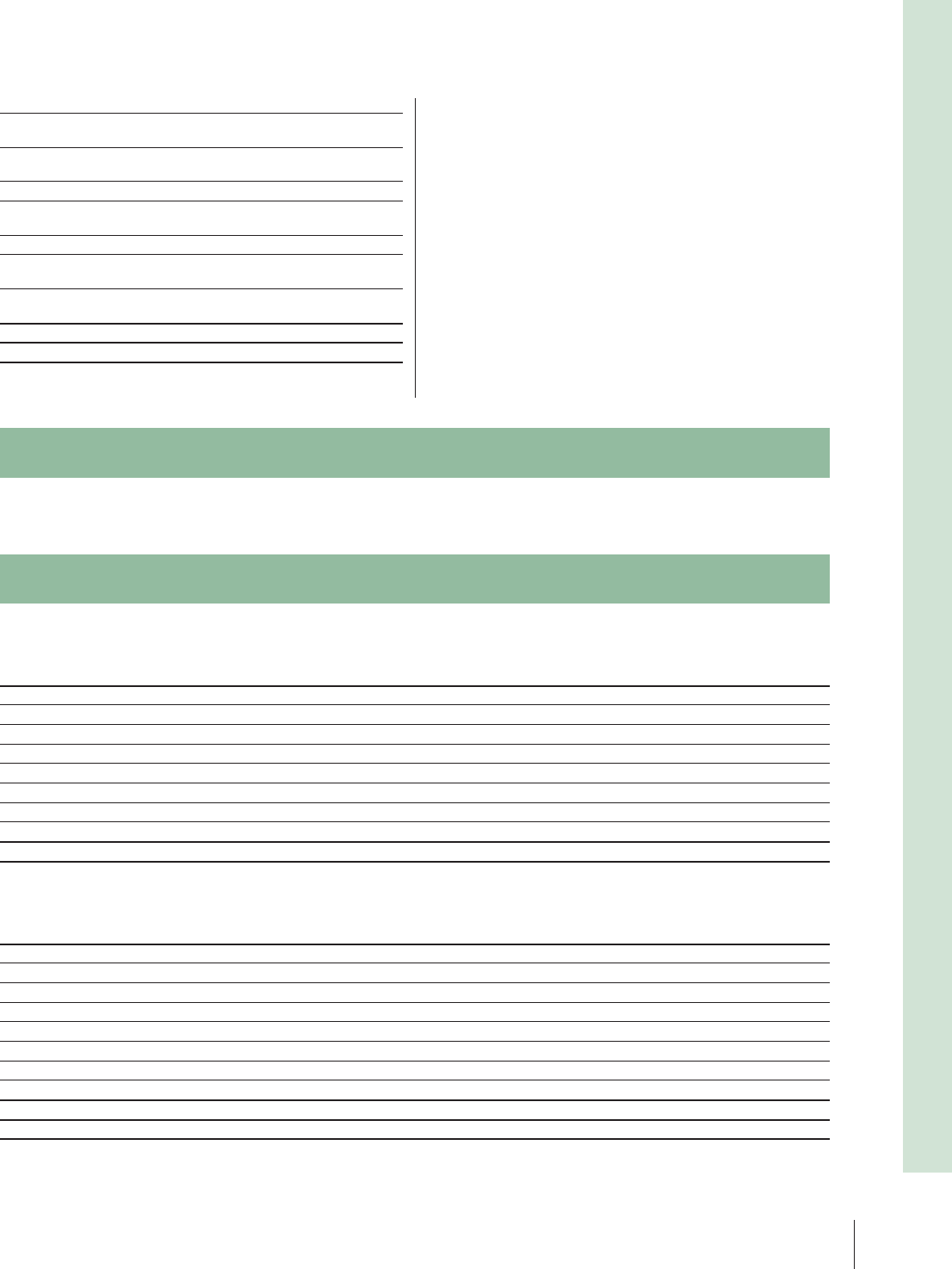

Deferred tax liabilities: 2004 2005 2006

Accelerated depreciation on

property, plant and equipment 2,047 2,347 2,514

Accelerated depreciation on

leasing assets 815 1,297 1,226

LIFO valuation of inventories 160 217 182

Capitalized product and

software development 1,445 1,970 2,113

Untaxed reserves 126 112 635

Fair value of derivative instruments:

Change of hedge reserves – 95 268

Other taxable temporary

differences 1,058 1,111 890

Deferred tax liabilities 5,651 7,149 7,828

Deferred tax assets, net

1 4,563 3,067 2,241

1 Deferred taxes are partially recognized in the balance sheet on a net basis

after taking into account offsetting possibilities.

The cumulative amount of undistributed earnings in foreign subsid-

iaries, which Volvo currently intends to indefi nitely reinvest outside of

Sweden and upon which deferred income taxes have not been pro-

vided is approximately 29 billion (17; 12) at year end. There are dif-

ferent taxation rules depending on country, some which have no tax

effect and some countries with withholding taxes. See note 36 how

Volvo handles equity currency risk.

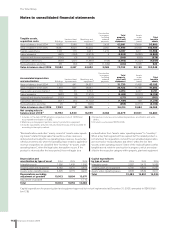

Entrances

fees,

aircraft Product and Other Total

engine software intangible intangible

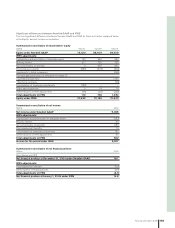

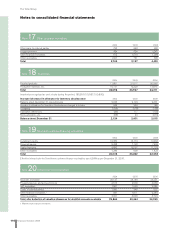

Accumulated depreciation and amortization Goodwill programs development assets assets

Value in balance sheet 2004 – 1,386 3,413 987 5,786

Value in balance sheet 2005 – 1,437 4,690 1,096 7,223

Depreciation and amortization – 128 1,584 138 1,850

Write-downs – – 80 – 80

Sales/scrapping – 0 (160) (12) (172)

Acquired and divested operations

3 – 0 – (4) (4)

Translation differences – 0 (72) (49) (121)

Reclassifi cations and other – 164 (17) (58) 89

Value in balance sheet 2006 – 1,729 6,105 1,111 8,945

Net carrying value in balance sheet 2006

4 8,849 1,184 8,183 901 19,117