Volvo 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information 2006 115

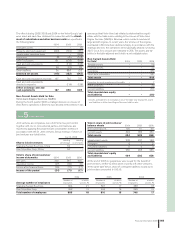

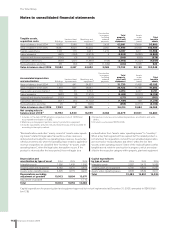

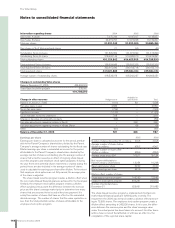

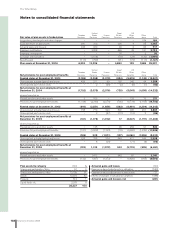

Note 16 Long-term customer-fi nancing receivables

2004 2005 2006

Installment credits 14,726 17,865 17,475

Financial leasing 10,334 12,737 13,980

Other receivables 127 582 634

Total 25,187 31,184 32,089

Effective interest rate for Long-term customer fi n ance receivables was 6.82% as per December 31, 2006.

Long-term customer fi nance receivables maturities

2008 14,205

2009 9,631

2010 5,402

2011 1,944

2012 or later 907

Total 32,089

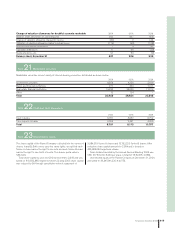

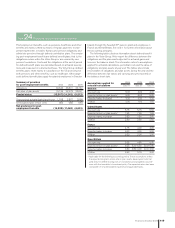

The holding is reported as an associated company, since Volvo

believes that substantial infl uence exists. Executive Vice President

of AB Volvo and Deputy CEO of the Volvo Group, Jorma Halonen,

was appointed Vice Chairman of the Board of Directors of Nissan

Diesel on June 28.

Volvo reports its share in earnings of Nissan Diesel with a time-

lag of one quarter.

Please fi n d further information under Signifi cant events, page 47,

regarding Volvo making a public offer for Nissan Diesel.

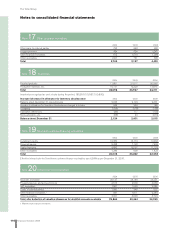

Deutz

During 2006 Volvo has invested additionaly 95 in Deutz AG.

Peach County Holdings Inc

In 2004, as a part of the restructuring of Henlys Group Plc, see

note 11, the convertible debenture loan issued to Henlys was partly

converted into shares in Peach County Holdings (owner of school

bus manufacturer Blue Bird). Volvo’s holding in Peach County Hold-

ings Inc was 42,5%. During the fourth quarter of 2005 Volvo wrote

down its shareholding in Peach County Holdings, Inc. by about 550.

At December 31, 2005 Volvo held 42.5% of the US-based company.

Since its reconstruction in the preceding year, Blue Bird has not

developed well. The write-down was made as a consequence of

Volvo’s decision not to participate in continued fi nancing efforts.

After the write-down, the value is zero. In January 2006, Peach

County Holdings entered into reconstruction proceedings (Chapter

11) and as a consequence of Volvo choosing not to participate in the

continued reconstruction, Volvo’s shares in the company were can-

celled.

Småföretagarinvest AB (previously Arbustum Invest AB)

In 2005, Volvo’s holding in Småföretagarinvest AB decreased to

17% and the company is no longer considered as an associated

company.

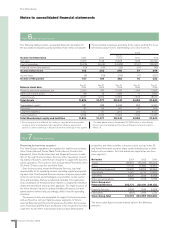

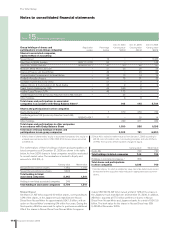

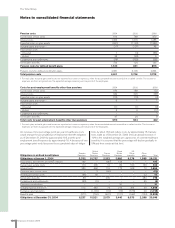

Changes in the Volvo Group’s holdings of shares and participations: 2004 2005 2006

Balance sheet, December 31, preceding year 22,206 2,003 751

IFRS transition effect – (494) –

Acquisitions and divestments, net (20,740) (268) 5,809

Net of write-downs/revaluations 772 (552) (72)

New issue of shares and shareholders’ contributions 45 28 45

Share of income in associated companies 29 (80) 55

Change in Group structure (280) (90) 0

Fair value of shares – 83 392

Translation differences (29) 159 (30)

Dividends 0 (2) (3)

Other 0 (36) (57)

Balance sheet, December 31 2,003 751 6,890