Volvo 2006 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 Financial information 2006

The Volvo Group

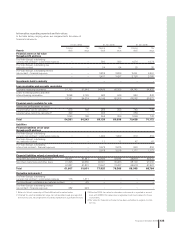

Terms of employment of the CEO

The President and Chief Executive Offi cer, Leif Johansson, is en-

titled to a fi xed annual salary. In addition, he may receive a variable

salary based on operating income and cash fl ow up to a maximum

of 50% of his fi xed annual salary. In 2006, the variable salary corres-

ponded to 48.7% of the fi xed annual salary. Leif Johansson also

participates in the Volvo Group long-term incentive program. In

2006, Leif Johansson received 4,000 shares, since the fi n ancial

goals for 2005 were achieved.

Leif Johansson’s pension benefi ts are a defi ned-contribution pen-

sion, meaning that Leif Johansson’s pension will equal the sum of all

premiums paid with the addition of possible return. A defi ned time

for retirement does not exist. The pensionable salary consists of the

current monthly salary times 12, Volvo’s internal value for company

car, together with the average of the outcome of the variable salary,

maximized to 50% of the salary, for the previous fi v e years. See point

4 above for premiums paid in 2006.

Leif Johansson has a six-month notice of termination on his own

initiative and 12 months notice of termination from AB Volvo. Leif

Johansson is not entitled to severance payments.

Variable salaries

Members of the Group Executive Committee and a number of senior

executives receive variable salaries in addition to fi xed salaries.

Variable salaries are in most cases based on the fulfi lment of certain

improvement targets. The targets are decided by the Board of Direct-

ors in AB Volvo and may relate to operating income and cash fl ow.

A variable salary may amount to a maximum of 50% of the fi xed

annual salary.

Severance payments

The employment contracts for members of the Group Executive

Committee and certain other senior executives contain rules govern-

ing severance payments when the company terminates the employ-

ment. The rules provide that, when the company terminates the

employment, an employee is entitled to severance pay equal to the

employee’s monthly salary for a period of 12 or 24 month, depending

on age at date of severance.

In agreements concluded after the spring of 1993, severance pay

is reduced, in the event the employee gains employment during the

severance period, in an amount equal to 75% of the income from

new employment. In agreements concluded after the spring of 2004,

severance pay is reduced by the full income from the new employ-

ment. Furthermore, age limit at date of notice of termination is

removed and an employee is, with few exceptions, entitled to sever-

ance pay for a period of 12 months.

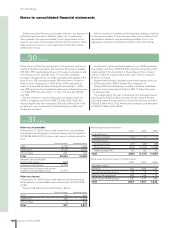

Pensions

Previous pension agreements for certain senior executives stipu-

lated that early retirement could be obtained from the age of 60. The

defi ned pension benefi ts are vested and earned gradually over the

years up to the employee’s retirement age and are fully earned at

age 60. During the period between ages of 60 and 65 the employee

receives a pension equal to 70% of the pensionable salary.

Agreements for retirement at age 60 are no longer signed, and

are instead replaced by a defi ned-contribution plan without a defi nite

time for retirement. The premium constitutes 10% of the pension-

able salary.

Earlier defi ned-benefi t pension plans, which entitled the employee

to 50% of the pensionable salary after normal retirement age, have

also been replaced by a defi ned-contribution plan. The premium

constitutes of SEK 30,000 plus 20% of the pensionable salary over

30 income base amounts.

The pensionable salary consists of the current monthly salary

times 12, Volvo’s internal value for company car, together with the

average of the outcome of the variable salary, maximized to 50% of

the salary, for the previous fi v e years.

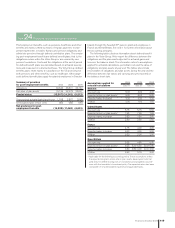

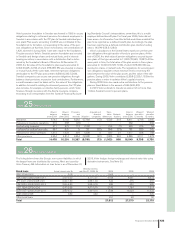

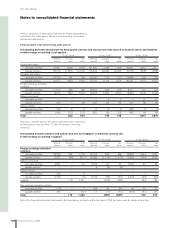

Incentive programs

Volvo currently has two different types of incentive programs for cer-

tain senior executives outstanding, one program for employee stock

options (exercised 2006/2008) and a share-based incentive pro-

gram (allotment in 2007).

Employee stock options program

The period to exercise the employee stock options are ongoing as

from May 2, 2006, up to and including May 1, 2008. The Volvo B

share price, for options exercised during 2006, have in average been

SEK 375 within a range from SEK 322 up to SEK 469.

Share-based incentive program

In 2005 the Annual General Meeting approved a share-based incen-

tive program for certain senior executives within the Volvo Group.

Allotment of a value corresponding to 167,833 shares in the pro-

gram was executed in April 2006 and was based on the fulfi llment

of certain fi n ancial goals determined by the Board for fi s cal year

2005. The allotment was made from Volvo’s treasury stock, with

100,833, and cash payment corresponding to 67,000 shares. The

share price at allotment was SEK 365. The total costs for the share-

based incentive program 2005/2006 amounted to SEK 70 M,

where of SEK 21 M during 2006 and SEK 49 M during 2005 and

pertains to the costs for payments in shares and in cash. The Annual

General Meeting in 2006 decided on a similar program for allotment

in 2007. Allotment will be made in 2007 as certain fi n ancial goals

determined by the Board for fi s cal year 2005 have been fulfi lled by

the company. The cost for Volvo for the incentive program including

social fees will be approximately SEK 248 M, since the price of the

Volvo B shares at the grant date, excluding dividend of SEK 16.75

for 2006 and for 2007, was SEK 341.50 and the share price at

December 31, 2006, was 471.50. The Annual General Meeting

decided that Volvo’s own shares may be used for allotment in this

program.

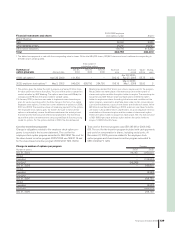

The Board of Directors intends to propose that the Annual Gen-

eral Meeting approve a share-based incentive program for senior

executives within the Volvo Group pertaining to the 2007 fi n ancial

year. The structure of the program corresponds to the programs

approved by the Annual General Meetings in 2006. Accordingly, the

program will result in the number of eligible senior executives

(including members of Group Management) amounting to not more

than to 240 persons and the maximum number of Volvo shares that

may be allotted to 518,000, of which CEO Leif Johansson may

receive a maximum of 8,000 shares and the other participants a

maximum of 2,000–4,000 shares each. The number of shares to be

allotted is proposed to depend upon the fulfi llment of certain fi n an-

cial goals for the company, determined by the Board for the 2007

fi n a ncial year. Assuming the said goals are fulfi lled in full and that

the Volvo share price is SEK 567 at implementation of the program,

Volvo’s costs for the program, including social fees, will be about

SEK 317 M. Another element of the proposal is that treasury shares

held by AB Volvo may be used to fulfi l the company’s commitments

in accordance with the program.

If the Annual General Meeting decides in accordance with the

Board’s proposal of a 6-for-1 share split and an automatic redemp-

tion procedure, the number of shares must be multiplied by fi ve.

Those shareholders not residing in Sweden at the time of allotment

of shares shall in lieu of shares receive a cash payment correspond-

ing to the market value of the shares at the allotment date.

Notes to consolidated financial statements