Volvo 2006 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146 Financial information 2006

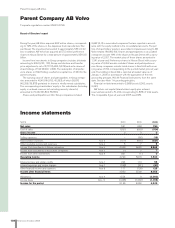

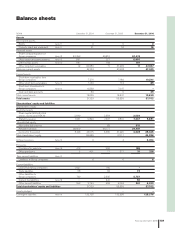

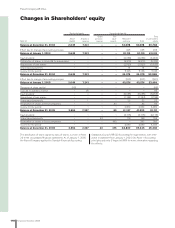

Parent Company AB Volvo

The valuation allowance for doubtful receivables amounted to 5 (5;

5) at the end of the year.

Of other receivables in 2004, 979 pertained to a receivable from

Renault SA. AB Volvo and Renault SA signed a settlement agree-

ment regarding the disagreement the companies have had since

2001 pertaining to Volvo’s acqusition of Renault V.I. According to

this settlement, Renault SA transferred EUR 108 M to AB Volvo on

January 26, 2005.

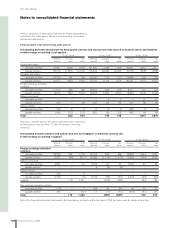

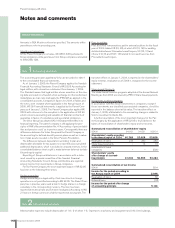

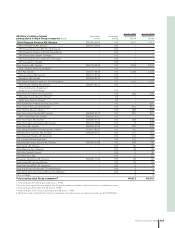

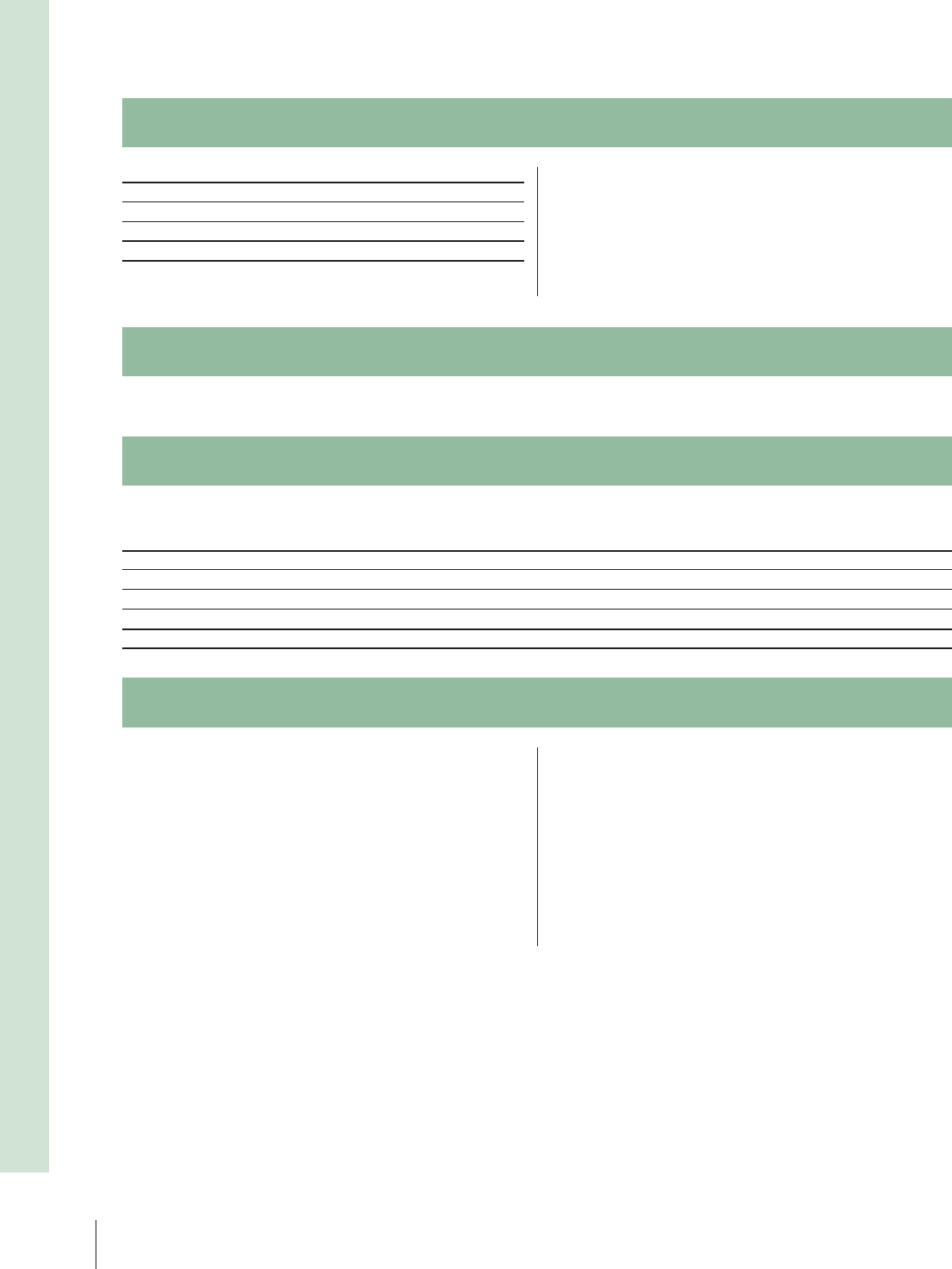

Note 13 Other short-term receivables

2004 2005 2006

Accounts receivable 14 14 17

Prepaid expenses and accrued income 135 72 35

Other receivables 994 28 37

Total 1,143 114 89

Note 14 Short-term investments in Group companies

Short-term investments in Group companies comprise deposits of – (7,047; 6,558) in Volvo Treasury.

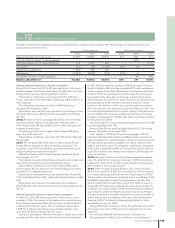

Note 15 Untaxed reserves

Value in Value in Value in

The composition of, and changes balance sheet Allocations balance sheet Allocations balance sheet

in, untaxed reserves 2004 2005 2005 2006 2006

Tax allocation reserve – – – 2,000 2,000

Accumulated additional depreciation

Land 3 – 3 – 3

Machinery and equipment 1 0 1 0 1

Total 4 0 4 2,000 2,004

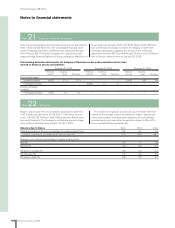

Note 16 Provisions for pensions

Provisions for pensions and similar benefi ts correspond to the actu-

arially calculated value of obligations not insured with third parties or

secured through transfers of funds to pension foundations. The

amount of pensions falling due within one year is included. AB Volvo

has insured the pension obligations with third parties. Of the amount

reported, 0 (0; 26) pertains to contractual obligations within the

framework of the PRI (Pension Registration Institute) system. The

exchange in 2005 of defi ned-benefi t pension plans by defi ned-con-

tribution plans for certain senior executives has resulted in a

decrease of provisions for pensions. For further information see

Note 34 to the consolidated fi n ancial statements.

The Volvo Pension Foundation was formed in 1996. Plan assets

amounting to 224 were contributed to the foundation at its forma-

tion, corresponding to the value of the pension obligations at that

time. Since its formation, net contributions of 25 have been made to

the foundation.

AB Volvo’s pension costs amounted to 90 (93; 79).

The accumulated benefi t obligation of all AB Volvo’s pension obli-

gations at year-end 2006 amounted to 576, which has been secured

in part through provisions for pensions and in part through funds in

pension foundations. Net asset value in the Pension Foundation,

marked to market, accruing to AB Volvo was 71 higher than corre-

sponding pension obligations.

Notes to financial statements