Volvo 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

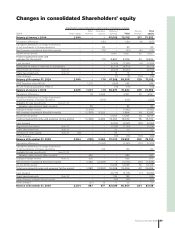

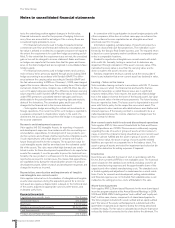

Changes in consolidated Shareholders’ equity

Shareholders’ equity attributable to equity holders of the parent company

Other Translation Retained Minority Total

SEK M Share capital reserves reserve earnings Total interests equity

Balance at January 1, 2004 2,649 – – 69,666 72,315 217 72,532

Translation differences – – (151) – (151) (6) (157)

Translation differences on hedge instruments

of net investments in foreign operations – – 80 – 80 – 80

Net income recognised directly in equity – – (71) – (71) (6) (77)

Income for the period – – – 9,867 9,867 40 9,907

Total recognised income and

expense for the period – – (71) 9,867 9,796 34 9,830

Cash dividend – – – (3,356) (3,356) (9) (3,365)

Distribution of shares in Ainax AB to shareholders – – – (6,310) (6,310) – (6,310)

Repurchase own shares Note 23 – – – (2,532) (2,532) – (2,532)

Share based payments Note 34 – – – 14 14 – 14

Other changes – – – (1) (1) (13) (14)

Balance at December 31, 2004 2,649 – (71) 67,348 69,926 229 70,155

IFRS Transition effect IAS 39 – 1,007 – (659) 348 – 348

IAS 39 Financial guarantees, IFRIC 4 – – – (10) (10) – (10)

Balance at January 1, 2005 2,649 1,007 (71) 66,679 70,264 229 70,493

Translation differences – 24 3,543 – 3,567 24 3,591

Translation differences on hedge instruments

of net investments in foreign operations – – (220) – (220) – (220)

Available-for-sale investments: Note 15, 23

Valuation gains/(losses) taken to equity – 83 – – 83 – 83

Change in hedge reserve – (1,442) – – (1,442) – (1,442)

Net income recognised directly in equity – (1,335) 3,323 – 1,988 24 2,012

Income for the period – – – 13,054 13,054 54 13,108

Total recognised income and expense for the period – (1,335) 3,323 13,054 15,042 78 15,120

Cash dividend – – – (5,055) (5,055) (28) (5,083)

Repurchase own shares Note 23 – – – (1,764) (1,764) – (1,764)

Share based payments Note 34 – – – 23 23 – 23

Decrease of share capital Note 23 (95) – – 95 – – –

Other changes – – – (10) (10) (19) (29)

Balance at December 31, 2005 2,554 (328) 3,252 73,022 78,500 260 78,760

Translation differences – – (2,743) – (2,743) (20) (2,763)

Translation differences on hedge instruments

of net investments in foreign operations – – 149 – 149 – 149

Available-for-sale investments: Note 15, 23

Valuation gains/(losses) taken to equity – 383 – – 383 – 383

Change in hedge reserve Note 23 – 999 – – 999 – 999

Net income recognised directly in equity – 1,382 (2,594) 0 (1,212) (20) (1,232)

Income for the period – – – 16,268 16,268 50 16,318

Total recognised income and expense for the period – 1,382 (2,594) 16,268 15,056 30 15,086

Cash dividend – – – (6,775) (6,775) (7) (6,782)

Share based payments Note 34 – – – 159 159 – 159

Other changes in Nissan Diesel’s equity – – – (65) (65) – (65)

Other changes – (67) 19 77 29 1 30

Balance at December 31, 2006 2,554 987 677 82,686 86,904 284 87,188

Financial information 2006 89