Volvo 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information 2006 113

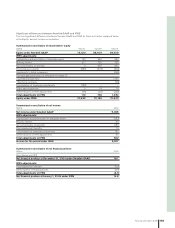

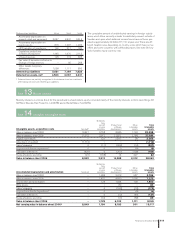

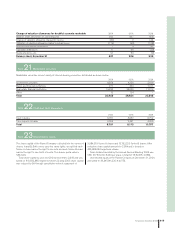

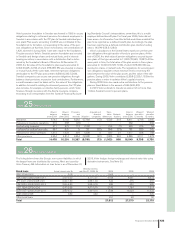

Goodwill

AB Volvo decided during the third quarter 2006 to reverse a valua-

tion allowance for deferred tax receivables in the Mack Trucks

subsidiary. The decision is based on the fact that Volvo assesses

that the company has a long-term higher profi tability. Reporting of

the deferred tax receivables reduced tax expenses in the income

statement in the third quarter by 2,048. In accordance with prevail-

ing accounting rules, Volvo adjusted goodwill by 1,712. The adjust-

ment decreases book value of goodwill for the three truck brands

with the same share that was used in the original allotment. The

remaining deviation in book value compared to the previous year

mainly consists of revaluation effects caused by differences in cur-

rency rates.

Annually, in connection with the annual closing, or more frequently

if required, Volvo’s operations are evaluated and compared with its

carrying value in order to identify any impairment of goodwill assets.

Volvo’s evaluation model is based on a discounted cash-fl ow model,

with a forecast period of four years. Evaluation is made on cash-gen-

erating units, identifi ed as Volvo’s operational areas or business

areas. Goodwill assets are allocated to these cash generating units

on the basis of anticipated future utility. The evaluation is based on

management’s best judgment of the operations’ development. The

basis for this judgment is long-term forecasts of the market’s

growth, two to four percent, in relation to the development of Volvo’s

operations. In the model, Volvo is expected to maintain stable capital

effi ciency over time. The evaluation is made on nominal value and

the general rate of infl ation, in line with the European target, is used.

Volvo uses a discounting factor calculated to 12% before tax for

2006.

During 2006, the value of Volvo’s operations has exceeded the

carrying value of goodwill for all operational areas, and accordingly,

no impairment was recognized. For the specifi ed cash generating

units Volvo has evaluated the value of goodwill with reasonable

changed assumptions, negatively adjusted with one percentage

point, where of no adjustment, individually, would have such a big

effect that there would be an impairment.

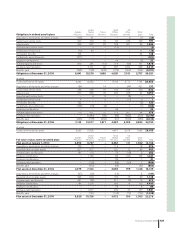

Goodwill per Business Area 2005 2006

Volvo Trucks 4,096 3,129

Renault Trucks 2,007 1,391

Mack Trucks 982 592

Buses 1,134 1,055

Construction Equipment 2,480 2,329

Other 373 353

Total goodwill value 11,072 8,849

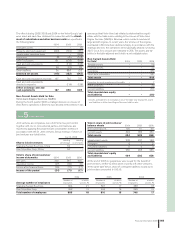

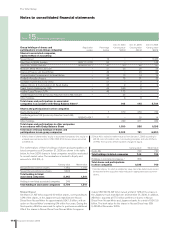

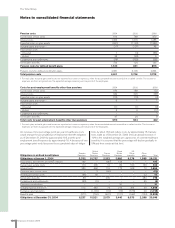

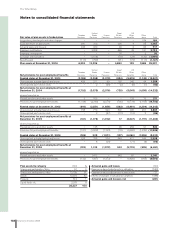

Investment property

Investment property is property owned for the purpose of obtaining

rental income and/or appreciation in value. The acquisition cost of

investment property was 1,633 (1,534; 1,859) at year-end. Capital

expenditures during 2006 amounted to 81 (15; 20). Accumulated

depreciation was 523 (463; 472) at year-end, whereof 55 (53; 68)

during 2005. The estimated fair value of investment property was

SEK 1,9 billion (1,9; 2,2) at year-end, based on the yield. The

required return is based on current property market conditions for

comparable properties in comparable locations. All investment prop-

erties were leased out during the year. Net income for the year was

affected by 281 (272; 332) in rental income from investment prop-

erties and 50 (45; 66) in direct costs.