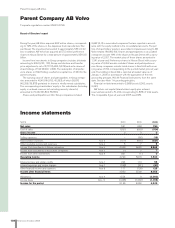

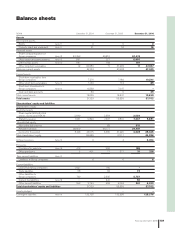

Volvo 2006 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 Financial information 2006

The Volvo Group

Notes to consolidated financial statements

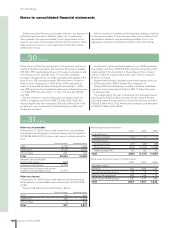

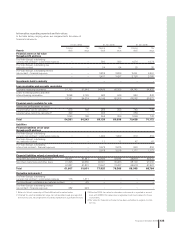

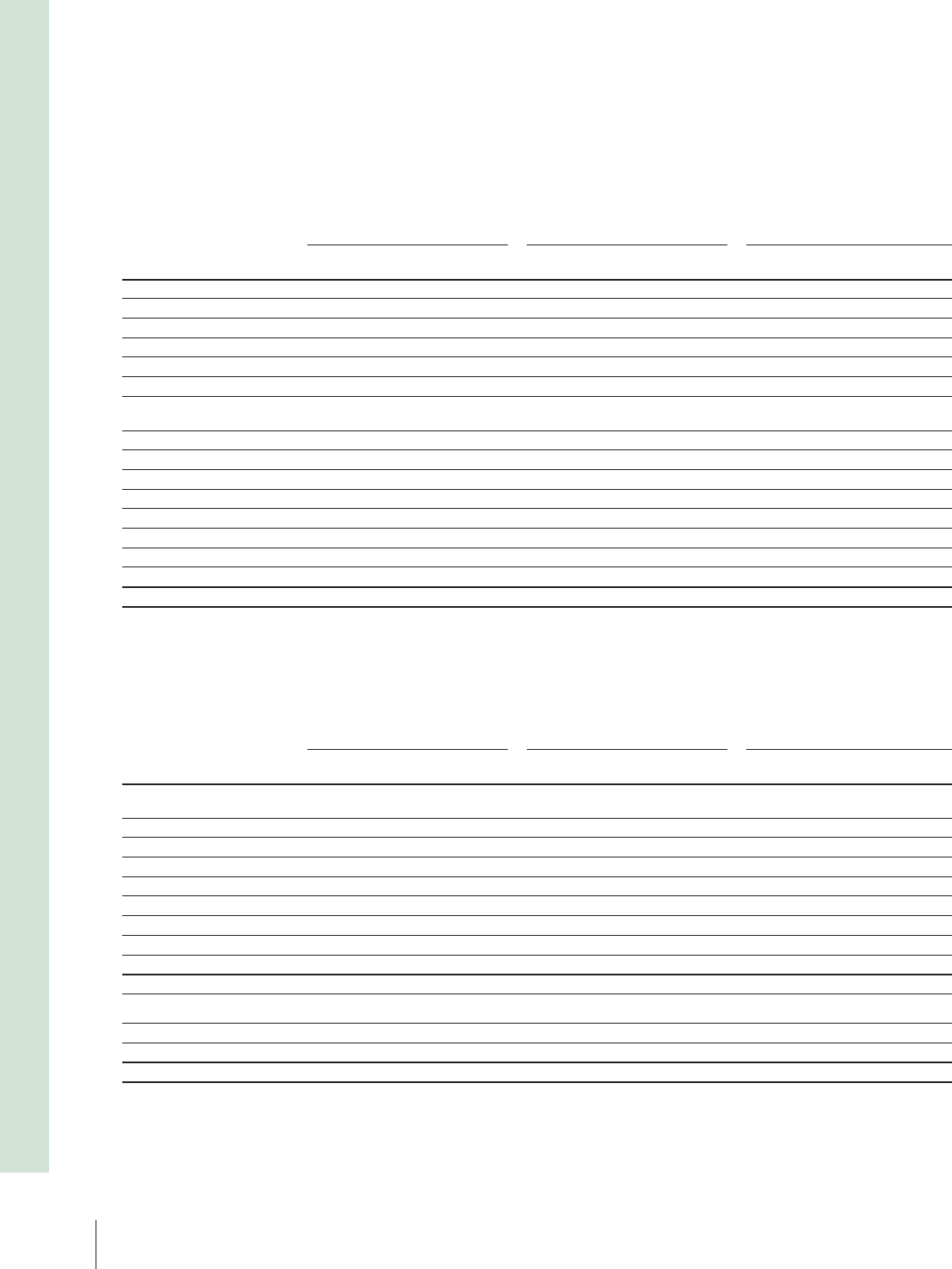

Outstanding derivative instruments for dealing with currency and interest-rate risks related to fi nancial assets and liabilities

to which hedge accounting is not applied

31 dec, 2004 31 dec, 2005 31 dec, 2006

Notional Carrying Fair Notional Carrying Fair Notional Carrying Fair

amount value value amount value value amount value value

Interest-rate swaps

– receivable position 76,667 1,659 2,919 101,483 2,348 2,348 92,651 2,412 2,412

– payable position 68,018 (1,585) (2,144) 116,824 (2,222) (2,222) 30,578 (598) (598)

Forwards and futures

– receivable position 47,156 168 168 29,090 120 120 114,886 209 209

– payable position 30,872 (182) (182) 27,001 (112) (112) 80,331 (197) (197)

Foreign exchange derivative

contracts

– receivable position 17,120 286 286 18,619 355 355 8,077 124 124

– payable position 8,273 (82) (107) 14,474 (331) (331) 18,423 (124) (124)

Options purchased

– receivable position – – – – 0 0 – 21 21

– payable position 200 – (4) 502 (5) (5) 200 (4) (4)

Options written

– receivable position 133 0 0 0 0 0 603 3 3

– payable position 1,946 (12) (12) 822 (5) (5) 442 (5) (5)

Total 252 924 148 148 1,841 1,841

Various categories of fi nancial instruments are treated separately as

specifi ed in the notes above. Below is an accounting of derivative

instruments and options.

Financial assets at fair value through profi t and loss

Changes in market value on the above instruments are reported in

net fi n ancial income, see Note 11, Other fi n ancial income and

expenses.

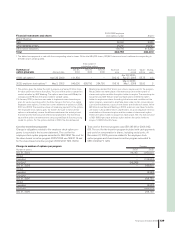

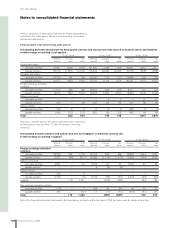

Outstanding forward contracts and option contracts for hedging of commercial currency risk,

to which hedge accounting is applied

31 dec, 2004 31 dec, 2005 31 dec, 2006

Notional Carrying Fair Notional Carrying Fair Notional Carrying Fair

amount value value amount value value amount value value

Foreign exchange derivative

contracts

– receivable position 26,203 264 1,775 37,754 536 536 28,930 1,034 1,034

– payable position 9,982 (88) (511) 36,980 (1,272) (1,272) 18,494 (304) (304)

Options purchased

– receivable position 2,831 – 112 4,769 51 51 5,423 54 54

– payable position – – – 3 (3) (3) – – –

Options written

– receivable position 233 – 0 – – – – – –

– payable position 2,729 – (5) 4,142 (44) (44) 4,394 (20) (20)

Subtotal 176 1,371 (732) (732) 764 764

Raw materials derivative contract

– receivable position (10) – 7 394 54 54 94 25 25

– payable position 243 – (32) 71 (11) (11) (510) (47) (47)

Total 176 1,346 (689) (689) 742 742

Out of the fi nancial instruments disclosed in the table above, contracts with a fair value of 754 has been used for hedge accounting.