Volvo 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

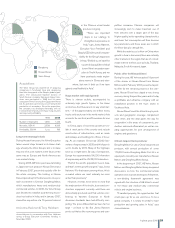

Nissan Diesel

Volvo Group

Dongfeng

Acquisitions

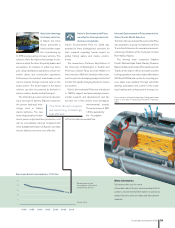

The Volvo Group has experience of acquiring

companies in Southeast Asia and developing

them into strong parts of the Group’s global organi-

zation. The construction-machine division of

South Korean company Samsung Heavy Indu–

stries was purchased in 1998 and its name

changed to Volvo Construction Equipment Korea

Ltd. Its operations are mostly concerned with the

production of excavators. Since the acquisition,

the company has developed favorably, with an

increased rate of product renewal, rising volumes

and improved profitability.

1998 2006

Number of employees 1,565 1,443

Net sales, SEK M 2,028 9,395

Profitability, SEK M Loss 765

Long-term strategy in Asia

During the past few years, the Volvo Group has

taken several steps forward in its Asian strat-

egy, whereby the Volvo Group’s aim is to make

Asia one of its core markets in the future, in the

same way as Europe and North America are

core markets today.

During 2006, AB Volvo purchased a holding

in Japanese truck producer Nissan Diesel and

in February 2007, presented a public offer for

the whole company. The holding in Nissan

Diesel opened up for the discussions on a pos-

sible investment in Chinese Dongfeng Motor,

which manufactures heavy and medium-duty

commercial vehicles. In 2006, the Volvo Group

also decided to establish a partnership to pro-

duce bus bodies in India, and in January 2007,

closed the acquisition of a 70-percent interest

petition increases, Chinese companies will

increasingly wish to make maximum use of

their vehicles over a larger part of the day.

Higher quality, better operating characteristics

and lower fuel consumption will then become

key parameters, and these areas are in which

the Volvo Group’s strength lies.

While the main focus is often on China when

growth in Asia is discussed, there are naturally

other markets in the region that are of consid-

erable interest to Volvo, such as India, Thailand,

Malaysia, South Korea and Japan.

Public offer for Nissan Diesel

During the year, AB Volvo acquired 19 percent

of the shares in Nissan Diesel from Nissan

Motors and in February 20 07, presented a pub-

lic offer for the remaining shares in the com-

pany. Nissan Diesel has staged a very strong

recovery during the past few years and is today

a profitable and attractive company with an

established position in the truck sector in

Southeast Asia.

Nissan Diesel’s and the Volvo Group’s prod-

ucts and geographic coverage complement

each other, and the deal paves the way for

cooperation in the areas of components, pro-

duction, sales and aftermarket, as well as cre-

ating opportunities for joint development of

engines and gearboxes.

China’s largest truck producer

Dongfeng Motor Co Ltd. is China’s largest t ruck

producer, with annual production of some

170,000 trucks. Dongfeng Motor Co Ltd. is in

equal parts owned by car manufacturer Nissan

Motors and Dongfeng Motor Group.

In the beginning of 2007, AB Volvo, Nissan

Motors and Dongfeng Motor Group deepened

discussions on how the commercial-vehicle

operations best can be developed. At that time,

a non-binding framework agreement was

signed with the intention of AB Volvo to invest

in the heavy and medium-duty commercial

vehicle and engine business.

“If handled properly, the opportunities that

could open up for us are enormous. To be a

global company, it is simply essential to have

production and growing sales in Asia,” says

Jorma Halonen.

in the Chinese wheel loader

producer Lingong.

“These are important

steps in our strategy to

strengthen our presence in

Asia,” says Jorma Halonen,

Executive Vice President and

Deputy CEO with specific respon-

sibility for the Group’s expansion

in Asia. “Behind us, we have the

successful a c quisition of w h at

is now Volvo’s excavator oper-

ation in South Korea, and we

have previously made explor-

atory moves in China and else-

where, but now it feels as if we have

gained a real foothold in Asia.”

Huge market with rapid growth

There is intense activity, accompanied by

extremely high growth figures, in the Asian

economies. And these are in no way small mar-

kets – of the approximately one million heavy

trucks sold each year in the world market, Asia

accounts for one third, and China alone for one

fourth.

In China, signs of economic growth are vis-

ible in most parts of the country and include

construction of infrastructure, such as roads

and railways, and buildings for offices or hous-

ing. As an example, China had 35,000 kilo-

meters of expressway in 2006 and this figure is

set to double by 2010. Many of the highways

have six or eight lanes. By way of comparison,

Europe has approximately 54,000 kilometers

of expressway and the US 85,000 kilometers.

“Half of the world’s population lives in Asia,

and that’s where growth is largest,” says Jorma

Halonen. “For that reason, among others, this is

a market where we must naturally be more

active than previously.”

However, it needs to be borne in mind that

the major portion of the trucks, buses and con-

struction equipment currently sold there are

domestically produced, and that vehicles con-

forming to Western European or North

American standards have had difficulty com-

peting. The price differential has been far too

large – at least so far. But Jorma Halonen

points out that as the economy grows and com-

Jorma Halonen & Tony Helsham

Jorma Halonen in conversation with Tony Helsham

during a Group Executive Committee meeting in

November 2006. A global group 2006 29