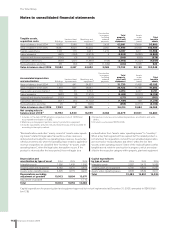

Volvo 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 Financial information 2006

The Volvo Group

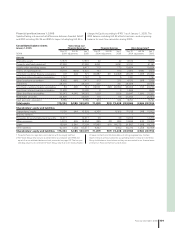

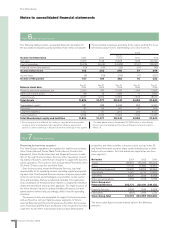

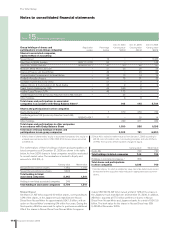

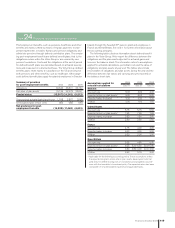

Note 12 Income taxes

Income taxes were distributed as follows:

2004 2005 2006

Current taxes relating to the period (1,854) (2,568) (4,559)

Adjustment of current taxes for

prior periods 288 147 176

Deferred taxes originated or

reversed during the period (1,662) (2,933) (2,116)

Recognition and derecognition of

deferred tax assets 99 446 2,518

Total income taxes (3,129) (4,908) (3,981)

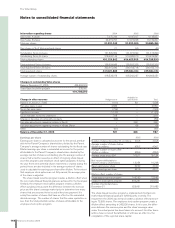

Provisions have been made for estimated tax charges that may arise

as a result of prior tax audits in the Volvo Group. Volvo evaluates tax

processes on a regular basis and makes provisions for possible out-

come when it is probable that Vovo will have to pay more taxes and

when it is possible to make a reasonably assessment of the possible

outcome. Tax claims for which no provision has been deemed neces-

sary of approximately 983 (695; 1,433) were reported as contingent

liabilities.

Deferred taxes relate to income taxes payable or recoverable in

future periods in respect of taxable temporary differences, deduct-

ible temporary differences, unused tax loss carryforwards or unused

tax credit carryforwards. Deferred tax assets are recognized to the

extent that it is probable that the amount can be utilized against

future taxable income. At December 31, 2006, the valuation allow-

ance attributable to deductible temporary differences, unused tax

loss carryforwards and unused tax credit carryforwards for which no

deferred tax asset was recognized amounted to 213 (2,972; 2,592).

Deferred taxes of 265 (negative 129; -) have at December 31,

2006, been accounted for as a direct reduction of equity. It is related

to fair value of derivative instruments

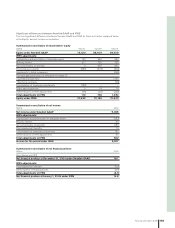

At year-end 2006, the Group had unused tax loss carryforwards

of about 5,900 (6,100; 10,100). These loss carryforwards expire

according to the table below.

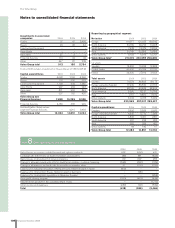

Due date 2004 2005 2006

Within 1 year 200 400 500

Within 2 years 700 500 100

Within 3 years 600 100 100

Within 4 years 300 300 0

Within 5 years 200 100 200

After 6 years 8,100 4,700 5,000

Total 10,100 6,100 5,900

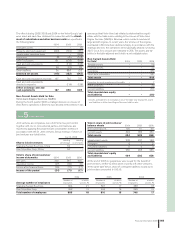

The Swedish corporate income tax rate is 28%. The table below

shows the principal reasons for the difference between this rate and

the Group’s tax rate, based on income after fi nancial items.

2004, % 2005, % 2006, %

Swedish corporate income tax rates 28 28 28

Difference in tax rate in various countries 3 3 2

Capital gains (3) (1) 0

Other non-taxable income (3) (1) (1)

Other non-deductible expenses 2 1 4

Adjustment of current taxes for prior years (2) (1) (1)

Recognition and derecognition of

deferred tax assets (1) (2) (12)

Other, net 0 0 0

Income tax rate for the Group 24 27 20

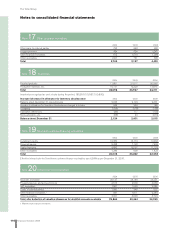

Reversal of reserve for deferred tax receivables

During the third quarter, AB Volvo decided to reverse a valuation

reserve for deferred tax receivables in the Mack Trucks subsidiary.

The decision was based on the fact that Volvo assesses that the

company has a long-term higher profi tability. Reporting of the

deferred tax receivables reduced tax expenses in the income state-

ment in the third quarter by 2,048. In accordance with prevailing

accounting rules, Volvo adjusted goodwill by 1,712, which affected

operating income adversely. The combined earnings effect for the

third quarter was a positive 336.

Most of the valuation reserve for deferred tax receivables that was

reported in Mack Trucks was attributable to the time of the acquisi-

tion of Renault Trucks and Mack Trucks. In accordance with IAS 12,

a reversal of valuation reserves attributable to an acquisition was

adjusted against the earlier reported goodwill. In an acquisition, the

acquired company’s assets and liabilities are valued at fair value. In

the case that the purchase consideration exceeds the revalued net

assets, goodwill is reported. Normally, a so-called acquisition bal-

ance sheet is preliminary for 12 months during which period it may

be changed in the case that another assessment is made in the net

value of the assets. If a change occurs, a corresponding adjustment

is made in goodwill. Changed assessments arising later are adjusted

in the income statement but do not affect the goodwill value. An

exception to this main rule is the case that a valuation reserve has

been reported for deferred tax receivables. If such a valuation

reserve is reversed at a later date, regardless of when in time, such

a reversal shall be reported as if the deferred tax receivables value

was reported at the time of the acquisition and that this value was

included in the acquired company’s net assets. Consequently, this

affects the original goodwill calculation. This means that in the item

Other operating income and expenses, Volvo has reported an

expense in the truck operations for the third quarter for adjustment

of goodwill of 1,712. The Volvo Group’s earnings for the period were

affected positively by 336.

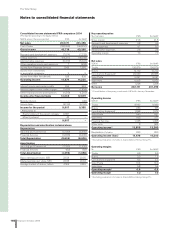

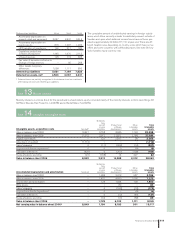

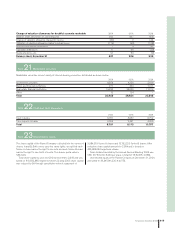

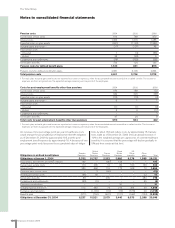

Specifi cation of deferred tax assets

and tax liabilities 2004 2005 2006

Deferred tax assets:

Unused tax loss carryforwards 3,223 2,125 1,935

Other unused tax credits 259 295 248

Intercompany profi t in inventories 294 544 526

Valuation allowance for doubtful

receivables 587 644 463

Provisions for warranties 966 1,449 1,357

Provision for residual value risks 544 576 398

Provisions for

post-employment benefi ts 4,366 4,541 2,701

Provisions for restructuring

measures 220 120 17

Fair value of derivative instruments:

Change of hedge reserves – 224 3

Other deductible temporary

differences 2,347 2,670 2,634

Deferred tax assets before

deduction for valuation

allowance 12,806 13,188 10,282

Valuation allowance (2,592) (2,972) (213)

Deferred tax assets after

deduction for valuation

allowance 10,214 10,216 10,069

Notes to consolidated financial statements