Volvo 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

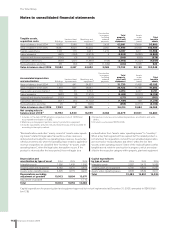

118 Financial information 2006

The Volvo Group

Notes to consolidated financial statements

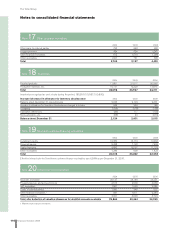

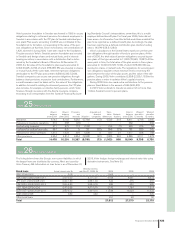

Earnings per share

Earnings per share is calculated as income for the period, attribut-

able to the Parent Company’s shareholders, divided by the Parent

Company’s average number of shares outstanding for the fi s cal year.

Diluted earnings per share is calculated as income for the period

attributable to the Parent Company’s shareholders divided by the

average number of shares outstanding plus the average number of

shares that would be issued as in effect of ongoing share-based

incentive programs and employee stock option programs. If during

the year there were potential shares redeemed or expired during the

period, these are also included in the average number of shares

used to calculate the earnings per share after dilution. To the extent

that employee stock options are not fully earned, the average price

of the share is adjusted.

The share-based incentive program creates a dilution effect when

the non-market-based fi nancial goals are achieved for the fi s cal year.

Similarly, the employee stock option program creates a dilution

effect by taking into account the difference between the exercise

price and the share’s average market price to determine how many

shares that are assumed to be issued without any payment. It is

solely this number of shares that have an effect on the calculated

diluted earnings. The number of shares that this value symbolizes is

less than the total potential number of shares attributable to the

employee stock option program.

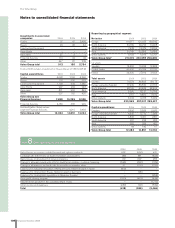

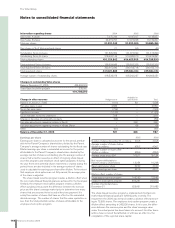

Available for

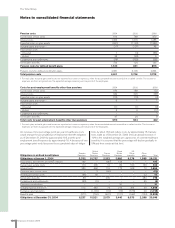

Change in other reserves Hedgereserve sale-reserve Total

Balance at January 1, 2006 (411) 83 (328)

Fair value gains in year 2,583 – 2,583

Tax on fair value gains (723) – (723)

Transfers to income (1,122) – (1,122)

Tax on transfers to income statement 314 – 314

Change in fair value of commodity contracts (53) – (53)

Fair value adjustments regarding holding in Deutz – 392 392

Fair value adjustments regarding holding in Nissan Diesel – (9) (9)

Other (67) – (67)

Balance at December 31, 2006 521 466 987

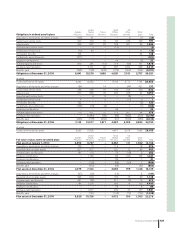

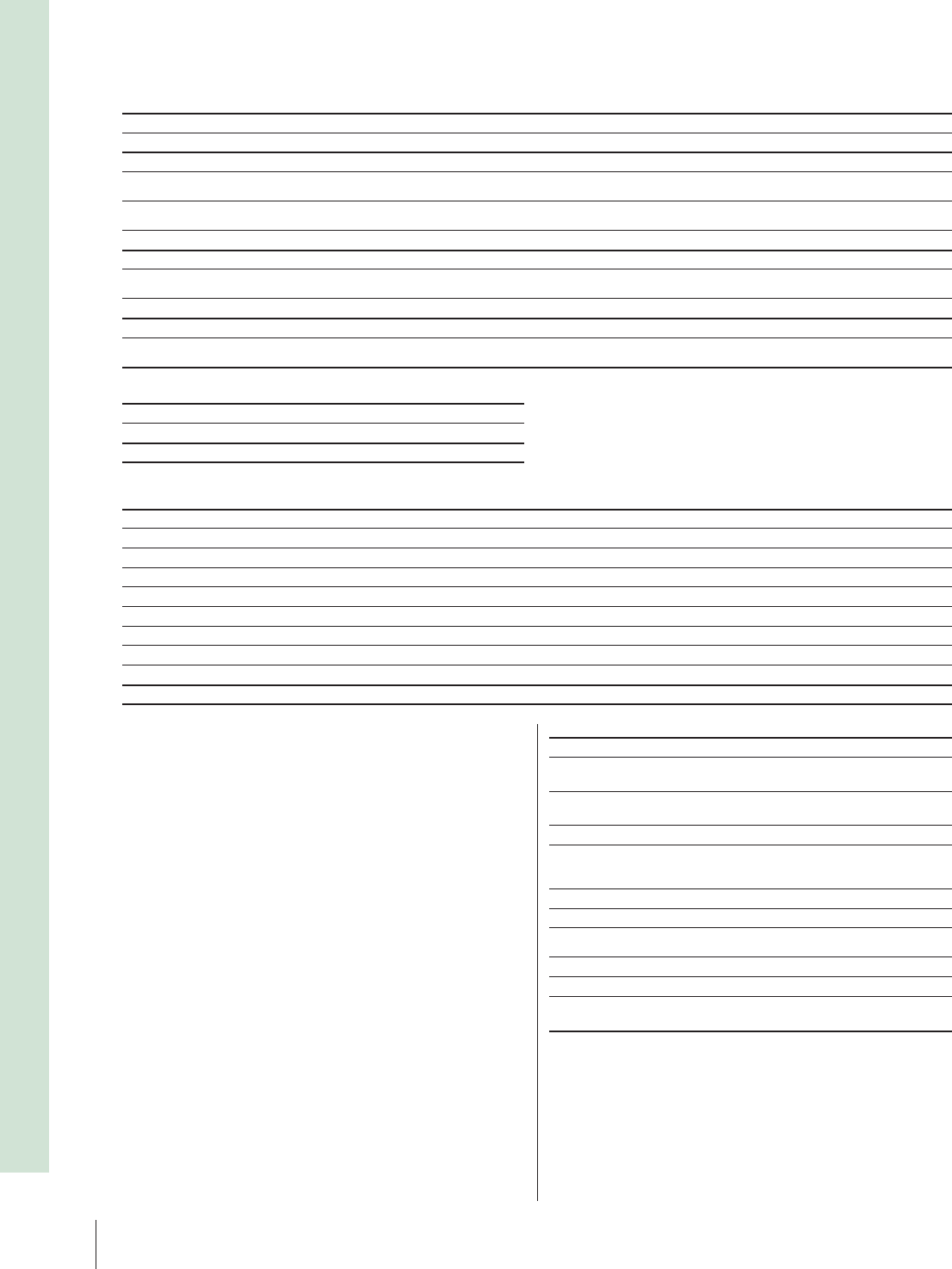

2005 2006

Number of shares, December 31, in millions 404.5 404.8

Average number of shares before

dilution in millions 405.2 404.7

Average number of shares after

dilution in millions 405.9 405.0

Average share price, SEK 319,11 391,94

Net income attributable to

Parent Company shareholders 13,054 16,268

Basic earnings per share 32.22 40.20

Diluted earnings per share 32.16 40.17

Dilution effect, number of shares

Share-based incentive program 166,250 72,583

Employee stock option program 459,241 242,900

Number of potential shares,

December 31 625,491 315,483

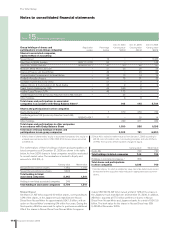

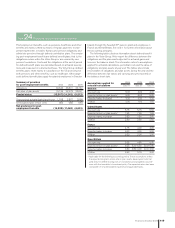

The share-based incentive program is implemented if certain non-

market based fi n ancial goals are fulfi lled partly or wholly. The

requirement for 2006 was met and creates a dilution effect amount-

ing to 72,583 shares. The employee stock option program create a

dilution effect amounting to 242,900 shares. In this case, the differ-

ence between the exercise price and the share’s average value

under the actual period has been taken into account. No other trans-

actions have occurred that affected, or will have an effect on, the

compilation of the reported share capital.

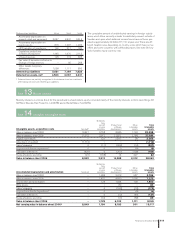

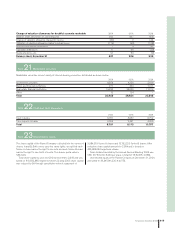

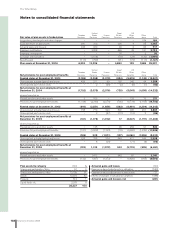

Information regarding shares 2004 2005 2006

Own Series A shares 7,075,246 4,145,627 4,145,627

Own Series B shares 24,315,797 17,074,908 16,739,827

Total own shares 31,391,043 21,220,535 20,885,454

Own shares in % of total registered shares 7,1 5,0 4,9

Outstanding Series A shares 131,529,699 131,374,699 131,374,699

Outstanding Series B shares 278,600,143 273,088,810 273,423,891

Total outstanding shares 410,129,842 404,463,509 404,798,590

Total registered Series A shares 138,604,945 135,520,326 135,520,326

Total registered Series B shares 302,915,940 290,163,718 290,163,718

Total registered shares 441,520,885 425,684,044 425,684,044

Average number of outstanding shares 418,528,078 405,242,037 404,663,051

Changes in outstanding Volvo shares

Balance December 31, 2005 404,463,509

Share-based incentive program 335,081

404,798,590