Volvo 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Financial information 2006

The Volvo Group

Notes to consolidated financial statements

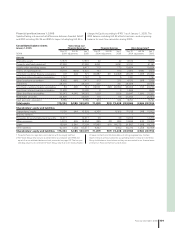

Exchange rates Average rate Year-end rate

Country Currency 2004 2005 2006 2004 2005 2006

Brasil BRL 2.5388 3.0947 3.3927 2.5125 3.4215 3.2190

Canada CAD 5.6495 6.1864 6.5096 5.4635 6.8435 5.9235

Denmark DKK 1.2285 1.2471 1.2420 1.2126 1.2651 1.2146

Euro EUR 9.1408 9.2943 9.2649 9.0163 9.4393 9.0593

Great Britain GBP 13.4515 13.5849 13.5822 12.7163 13.7388 13.4938

Japan JPY 0.0680 0.0679 0.0635 0.0638 0.0679 0.0579

Norway NOK 1.0926 1.1611 1.1516 1.0890 1.1770 1.0955

South Korea KRW 0.0065 0.0073 0.0077 0.0064 0.0079 0.0074

United States USD 7.3655 7.4791 7.3791 6.6138 7.9538 6.8738

fi s c al years beginning after June 1, 2006. The statement is a clarifi -

cation of IAS 39 regarding embedded derivatives, mainly with regard

to assessment of embedded derivatives as a result of market condi-

tions changing.

IFRIC 10 Interim Financial Reporting and Impairment

The interpretation became effective on November 1, 2006 and

applies to fi scal years beginning after that date. The interpretation

concludes that where an entity has recognized an impairment loss in

an interim period, that impairment may not be reversed in subse-

quent interim fi n ancial statements or in annual fi n ancial statements.

The Group will apply IFRIC 10 as of January 1, 2007, but this is not

expected to have any impact on the Group’s fi n ancial statements.

IFRIC 11 IFRS 2 Group and Treasury Share Transactions

The interpretation becomes effective on March 1, 2007 and applies

to fi scal years beginning after that date. The interpretation clarifi es

treatment regarding classifi cation of share-based payments in which

the company repurchases shares to settle its undertaking and

reporting of options programs in subsidiaries that apply IFRS. The

Group will apply IFRIC 11 as of January 1, 2008, but this is not

expected to have any impact on the Group’s fi n ancial statements.

IFRIC 12 Service Concession Arrangements

The interpretation becomes effective on January 1, 2008 and

applies to fi scal years beginning after that date. IFRIC 12 addresses

arrangements in which a private company shall establish an infra-

structure to provide public service for a specifi ed period. The com-

pany is paid for this service during the term of the contract. The

Group will apply IFRIC 12 as of January 1, 2008, but this is not

expected to have any impact on the Group’s fi n ancial statements.

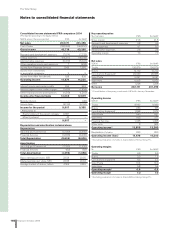

Consolidated fi nancial statements

The consolidated fi n ancial statements comprise the Parent Com-

pany, subsidiaries, joint ventures and associated companies. Subsid-

iaries are defi ned as companies in which Volvo holds more than 50%

of the voting rights or in which Volvo otherwise has a controlling

interest. Joint ventures are companies over which Volvo has joint

control together with one or more external parties. Associated com-

panies are companies in which Volvo has a signifi cant infl uence,

which is normally when Volvo’s holding equals to at least 20% but

less than 50% of the voting rights.

The consolidated fi n ancial statement have been prepared in

accordance with the principles set forth in IAS 27, Consolidated and

Separate Financial Statements. Accordingly, intra-Group transactions

and gains on transactions with associated companies are eliminated.

All business combinations are accounted for in accordance with

the purchase method. Volvo applies IFRS 3, Business Combinations

for acquisitions after January 1, 2004, in accordance with the IFRS 1

transition rules. Volvo decided not to restate prior acquisitions. Volvo

values acquired identifi able assets, tangible and intangible, and

l iab ilities at fair value. Surplus amounts compared with the purchase

consideration are reported as goodwill. Any lesser amount, so-called

negative goodwill, is reported in the income statement.

Companies that have been divested are included in the consoli-

dated fi nancial statements up to and including the date of divest-

ment. Companies acquired during the year are consolidated as of

the date of acquisition.

Joint ventures are reported by use of the proportionate method of

consolidation.

Holdings in associated companies are reported in accordance

with the equity method. The Group’s share of reported income in

such companies is included in the consolidated income statement in

Income from investments in associated com panies, reduced in appro-

priate cases by depreciation of surplus values and the effect of apply-

ing different accounting principles. Income from associated com-

panies are included in operating income due to that the investments

are of operating nature.

For practical reasons, most of the associated companies are

included in the consolidated accounts with a certain time lag, nor-

mally one quarter. Dividends from associated companies are not

included in consolidated income. In the consolidated balance sheet,

the book value of shareholdings in associated companies is affected

by Volvo’s share of the company’s net income, reduced by depreci-

ation of surplus values and by the amount of dividends received.

Translation to Swedish kronor when

consolidating companies using foreign currencies

AB Volvo’s functional currency is the Swedish krona. All reporting in

group companies for group purposes is made in the currency where

the company has the majority of their revenues and expenses; nor-

mally the currency of the country where the company is located. AB

Volvo’s and The Volvo Group’s reporting currency is Swedish kronor.

In preparing the consolidated fi n ancial statements, all items in the

income statements of foreign subsidiaries and joint ventures (except

subsidiaries in highly infl ationary economies) are translated to Swed-

ish kronor at the average exchange rates during the year (average

rate). All balance sheet items are translated at exchange rates at the

respective year-ends (year-end rate). The differences in consolidated

shareholders’ equity arising as a result of variations between year-

end exchange rates are charged or credited directly to shareholders’

equity as a separate component.

The accumulated translation difference related to a certain sub-

sidiary, joint venture or associated company is reversed to income as

a part of the gain/loss arising from the divestment or liquidation of

such a company.

IAS 29, Financial Reporting in Hyperinfl ationary Economies, is

applied to fi nancial statements of subsidiaries operating in highly

infl ationary economies. Volvo applies reporting based on historical