Volvo 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

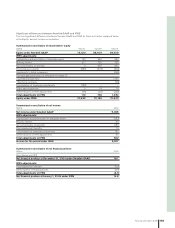

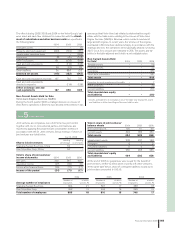

Credit loss reserves

The establishment of credit loss reserves on customer fi n ancing

receivables is dependent on estimates including assumptions

regarding past dues, repossession rates and the recovery rate on

the underlying collateral. At December 31, 2006, the total credit loss

reserves in Volvo Financial Services amounted to 2.01% of the total

credit portfolio, SEK 77 billions.

Pensions and other post-employment benefi ts

Provisions and costs for post-employment benefi ts, i.e. mainly pen-

sions and health-care benefi ts, are dependent on assumptions used

by actuaries in calculating such amounts. The appropriate assump-

tions and actuarial calculations are made separately for each popu-

lation in the respective countries of Volvo’s operations. The assump-

tions include discount rates, health care cost trends rates, infl ation,

salary growth, long-term return on plan assets, retirement rates,

mortality rates and other factors. Discount rate assumptions are

based on long-term high quality corporate bond and government

bond yields available at year-end. Health care cost trend assump-

tions are developed based on historical cost data, the near-term out-

look, and an assessment of likely long-term trends. Infl ation assump-

tions are based on an evaluation of external market indicators. The

salary growth assumptions refl ect the long-term actual experience,

the near-term outlook and assumed infl ation. Retirement and mortal-

ity rates are based primarily on offi cially available mortality statistics.

We review our actuarial assumptions on an annual basis and make

modifi cations to them when it is deemed appropriate to do so. Actual

results that differ from management’s assumptions are accumulated

and amortized over future periods and, therefore, generally affect the

recognized expense and recorded provisions in such future periods.

See Note 24 for more information regarding costs and assumptions

for post-employment benefi ts. At December 31, 2006 net provisions

for post-employment benefi ts amounted to 6,651.

Product warranty costs

Estimated costs for product warranties are charged to cost of sales

when the products are sold. Estimated warranty costs include con-

tractual warranty and goodwill warranty (warranty cover in excess of

contractual warranty or campaigns which is accepted as a matter of

policy or normal practice in order to maintain a good business rela-

tion with the customer). Warranty provisions are estimated with con-

sideration of historical claims statistics, the warranty period, the

average time-lag between faults occurring and claims to the com-

pany and anticipated changes in quality indexes. Differences

between actual warranty claims and the estimated claims generally

affect the recognized expense and provisions in future periods.

Refunds from suppliers, that decrease Volvo’s warranty costs, are

recognized to the extent these are considered to be virtually certain.

At December 31, 2006 warranty cost provisions amounted to 8.411.

Legal proceedings

Volvo only recognizes liabilities in the accounts where Volvo has a

present obligation from a past event, a transfer of economic benefi ts

is probable and Volvo can make a reliable estimate of the size of the

amount. In instances such as these, a provision is calculated and

recognized in the balance sheet. In instances where these criteria

are not met, a contingent liability may be disclosed in the notes to

the accounts. A contingent liability will be disclosed when a possible

obligation has arisen but its existence will only be confi rmed by

future events not wholly within Volvo’s control or in circumstances

where an obligating event has occurred but it is not possible to

quantify the size or likelihood of that obligation crystallizing. Realiza-

tion of any contingent liabilities not currently recognized or disclosed

in the fi n ancial statements could have a material effect on Volvo’s

fi n a ncial condition. Volvo regularly reviews signifi cant outstanding

legal cases following developments in the legal proceedings in order

to assess the need for provisions in our fi n ancial statements. Among

the factors that Volvo considers in making decisions on provisions

are the nature of the litigation, claim or assessment, the legal proc-

esses and potential level of damages in the jurisdiction in which the

litigation, claim or assessment has been brought, the progress of the

case (including progress after the date of the fi n ancial statements

but before those statements are issued), the opinions or views of

legal counsel and other advisers, experience in similar cases, and

any decision of Volvo’s management as to how Volvo intends to

respond to the litigation, claim or assessment. To the extent the

determinations at any time do not refl ect subsequent developments

or the eventual outcome of any claim, our future fi n ancial statements

may be materially affected, with an adverse impact upon our results

of operation, fi n ancial position and liquidity.

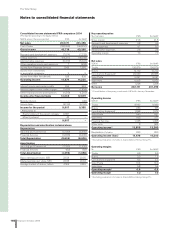

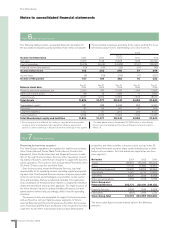

Note 3 Transition to IFRS

This note is included in the 2006 year’s annual report for the read-

ers convenience and describes the transition made in 2005 to IFRS.

Reporting in accordance with IFRS as from 2005

The Volvo Group’s fi nancial reporting is up to 2004 prepared in

accordance with generally accepted accounting principles in Sweden

(“Swedish GAAP”). Effective from 2005, all listed companies within

the European Union (“the EU”) are required to prepare their consoli-

dated fi nancial reporting in accordance with International Financial

Reporting Standards (“IFRS”), as adopted by the EU. The purpose of

the presentations on the following pages is to describe and explain

the expected impact on Volvo’s fi n ancial reporting as a consequence

of transition to IFRS. Volvo Group’s previous accounting principles

are described in Note 1 of the 2004 Annual Report. The presenta-

tion below focuses on the areas in which the transition to IFRS

resulted in a change in accounting principles for Volvo.

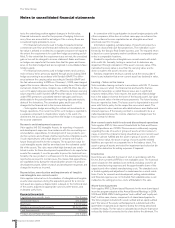

Restatements and transition effects

In accordance with the IFRS transition rules (IFRS 1), Volvo applies

IFRS as of January 1, 2005, with retroactive application from the

IFRS transition date at January 1, 2004. The general rule is that

restatement of fi nancial reporting for periods after the transition

date should be made as if IFRS has been applied historically. There

are certain exceptions from the general rule of which the most sig-

nifi cant for Volvo are:

– IAS 39 Financial instruments: Recognition and measurement

which can be applied from January 1, 2005.

– Non-amortization of intangible assets with indefi nite useful lives

(e.g. goodwill) in accordance with IFRS should be applied retro-

actively only from the transition date January 1, 2004.

– IFRS 3 Business Combinations which can be applied from January

1, 2004, without restatements of previous acquisitions.

– IFRS 2 Share-based payments are applied for share-based pay-

ments granted after November 7, 2002.

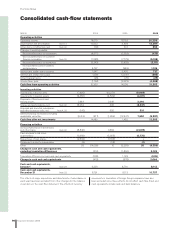

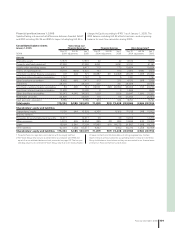

The enclosed income statements and other specifi cations prepared

in accordance with IFRS therefore include restatements and transi-

tion effects as follows:

Financial information 2006 97