Volvo 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information 2006 135

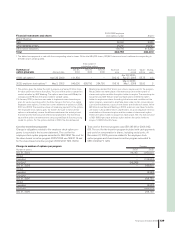

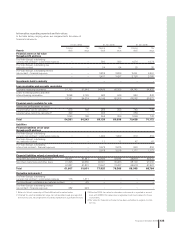

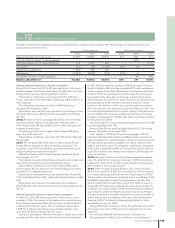

31 dec, 2004 31 dec, 2005 31 dec, 2006

Carying Fair Carying Fair Carying Fair

Assets value value value value value value

Financial assets at fair value

through profi t and loss

The Volvo Group’s outstanding

currency risk contract – commercial exposure – – 560 560 1,074 1,074

The Volvo Group’s outstanding raw

materials contract – – 54 54 25 25

The Volvo Group’s outstanding interest

risk contract – fi nancial exposure – – 2,823 2,823 2,661 2,661

– – 3,437 3,437 3,760 3,760

Investments held to maturity – – – – – –

Loan receivables and accounts receivables

Customer fi nancing receivables 51,193 51,948 64,466 65,365 64,742 64,832

Loans to external parties and other

interest-bearing receivables 2,098 2,126 680 643 840 840

53,291 54,074 65,146 66,008 65,582 65,672

Financial assets available for sale

Shares and participations for which:

a market value can be calculated

1 670 169 253 253 740 740

a market value cannot be calculated

2 420 – 303 – 356 –

1,090 169 556 253 1,096 740

Total 54,381 54,243 69,139 69,698 70,438 70,172

Liabilities

Financial liabilities at fair value

through profi t and loss

The Volvo Group’s outstanding

currency risk contract – commercial exposure – – 1,292 1,292 310 310

The Volvo Group’s outstanding

raw materials contract – – 11 11 47 47

The Volvo Group’s outstanding

interest risk contract - fi nancial exposure – – 2,675 2,675 820 820

– – 3,978 3,978 1,177 1,177

Financial liabilities valued at amortized cost

Long-term bond loans and other loans 40,411 41,441 43,626 43,944 38,818 40,575

Short-term bank loans and other loans 21,396 20,360 30,321 30,463 28,100 27,032

61,807 61,801 73,947 74,407 66,918 67,607

Total 61,807 61,801 77,925 78,385 68,095 68,784

Derivative instruments

3

The Volvo Group’s outstanding

currency risk contract – commercial exposure 176 1,371 – – – –

The Volvo Group’s outstanding raw materials contract – –25 – – – –

The Volvo Group’s outstanding interest

risk contract – fi nancial exposure 252 924 – – – –

1 Refers to Volvo’s ownership of Deutz AG valued to market value.

2 Unlisted for which a reliable fair value can not be determined, are reported

at a historic cost. No single block of shares represents a signifi cant amount.

3 Effective 2005, fair value for derivative instruments is reported in accord-

ance with IAS39. Fair values are in agreement with book values for these

instruments.

4 Fair value for fi n ancial instruments has been estimated in regards to inter-

est risk.

Information regarding reported and fair values

In the table below, carrying values are compared with fair values of

fi n a ncial instruments.