Volvo 2006 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

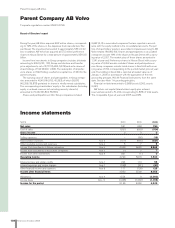

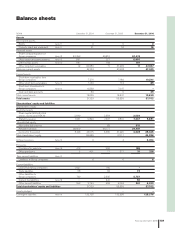

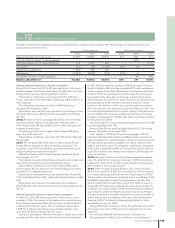

142 Financial information 2006

Parent Company AB Volvo

General information

Amounts in SEK M unless otherwise specifi ed. The amounts within

parentheses refer to preceding year.

Intra-Group transactions

Of the Parent Company’s net sales, 664 (567; 426) pertained to

Group companies while purchases from Group companies amounted

to 380 (356; 126).

Fees to auditors

Fees and other remunerations paid to external auditors for the fi s cal

year of 2006 totaled 28 (31; 26), of which 20 (10; 13) for auditing,

distributed between PricewaterhouseCoopers, 20 (10; 13) and

others, 0 (0; 0), and 8 (21; 13) related to non-audit services from

PricewaterhouseCoopers.

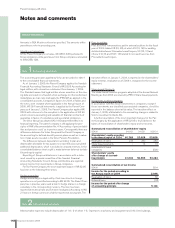

Note 1 Accounting principles

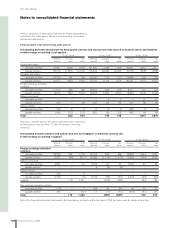

Note 2 Administrative expenses

Administrative expenses include depreciation of 1 (1; 1) of which 1 (1; 1) pertain to machinery and equipment and 0 (0; 0) to buildings.

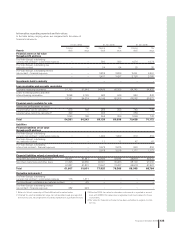

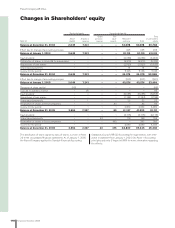

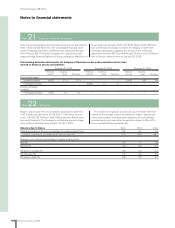

Summarized reconciliation of shareholders’ equity

SEK M 040101 041231 050101

Shareholders’ equity according

to the Annual report of 2004 60,768 53,668 53,668

Revaluation of loans 235 283 283

Share-based payments – 14 14

Investments in listed

companies – – (501)

Shareholders’ equity

after change of account-

ing principle 61,003 53,965 53,464

Summarized reconciliation of net income

SEK M 2004

Income for the period according to

the Annual report of 2004 5,098

Revaluation of loans 66

Deferred taxes (18)

Income for the period after change

of accounting principle 5,146

The accounting principles applied by Volvo are described in Note 1

to the consolidated fi n ancial statements.

As of January 1, 2005, the Parent Company applies the Swedish

Financial Accounting Standards Council’s RR 32:05 Accounting for

legal entities, with retroactive restatement from January 1, 2004.

The Standard means that legal entities whose securities on the clos-

ing date are listed on a Swedish stock exchange or other authorized

marketplace as main rule shall apply the IFRS/IAS as applied in the

consolidated accounts. Comparison fi gures for 2004, in tables and

the notes, were restated where applicable in the Annual report of

2005. IAS 39 Financial Instruments is applied by the Parent Com-

pany as of January 1, 2005. The Parent Company also applies RR

32:06 with reference to the exception in the application of IAS 39

which concerns accounting and valuation of fi nancial contracts of

guarantee in favour of subsidiaries and associated companies.

The Volvo Group has adopted IAS 19 Employee Benefi ts in its

fi n a ncial reporting. The parent company is still applying the prin-

ciples of FAR’s Recommendation No. 4 “Accounting of pension liabil-

ities and pension costs” as in previous years. Consequently there are

differences between the Volvo Group and the Parent Company in

the accounting for defi ned-benefi t pension plans as well as in valua-

tion of plan assets invested in the Volvo Pension Foundation.

The difference between depreciation according to plan and

depreciation allowable for tax purposes is reported as accumulated

additional depreciation, which is included in untaxed reserves. In the

consolidated balance sheet a split is made between deferred tax liab-

ility and equity capital.

Reporting of Group contributions is in accordance with a state-

ment issued by a special committee of the Swedish Financial

Accounting Standards Council. Group contributions are reported

among Income from investments in Group companies.

For the Parent Company the most important impact of RR 32:05

has been in the following three areas:

Hedge accounting

Hedge accounting in a legal entity of net investments in foreign

operations is not permitted according to RR 32:05. The Parent Com-

pany has in previous years used a loan to hedge shares in a foreign

subsidiary in the corresponding currency. This loan has been

reported at historical rate and not been revaluated. According to IAS

21 loans in foreign currencies shall be reported at closing rate. The

transition effect on January 1, 2004, is reported in the shareholders’

equity whereas revaluation as of 2004 is recognized in the income

statement.

Share-based Payments

The share-based incentive programs adopted at the Annual General

Meeting as from 2004 are covered by IFRS 2 Share-based payments.

Investments in other companies

In accordance with IAS 39, all investments in companies, except if

these investments are classifi ed as associated companies, should be

reported in the balance sheet at fair value. The transition effect on

January 1, 2005, attributable to this accounting change is related to

Volvo’s investment in Deutz AG.

A further description of the most important changes for the Par-

ent Company by the application of RR 32:05 is found below in the

tables of reconciliation of shareholders’ equity and net income.

Notes and comments