Volvo 2006 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

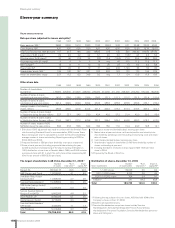

Definitions

Basic earnings per share

Income for the period attributable to shareholders of the parent company

divided by the weighted average number of shares outstanding during

the period.

Capital expenditures

Capital expenditures include investments in property, plant and equip-

ment, intangible assets and assets under operating leases. Investments

in fixed assets included in the Group’s cash flow statement include only

capital expenditures that have reduced the Group’s liquid funds during

the year.

Cash-flow

Combined changes in the Group’s liquid funds during the fiscal year.

Changes inliquid funds are specified with reference to changes in ope-

rations, operating activities, changes depending on investments in

equipment, fixed assets etc and financing acitivites such as changes in

loans and investments.

Diluted earnings per share

Diluted earnings per share is calculated as income for the period attri-

butable to the Parent Company’s shareholders divided by the average

number of shares outstanding plus the average number of shares that

would be issued as an effect of ongoing share-based incentive programs

and employee stock option programs.

Equity ratio

Shareholders’ equity divided by total assets.

Interest coverage

Operating income plus interest income and similar credits divided by

interest expense and similar charges.

Joint ventures

Companies over which the Company has joint control together with one

or more external parties.

Net financial position

Cash and cash equivalents, marketable securities and interest-bearing

short- and long-term receivables reduced by short- and long-term inte-

rest-bearing loans and provisions for post-employment benefits. Net

debt in Financial Services is not included since the interest expense on

these liabilities is charged against operating income and does not affect

consolidated interest net.

Operating margin

Operating income divided by net sales.

Return on shareholders’ equity

Income for the period divided by average shareholders’ equity.

Self-financing ratio

Cash-flow from operating activities (see Cash-flow statement) divided

by net investments in fixed assets and leasing assets as defined in the

cash-flow statement.