Volvo 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Financial information 2006

The Volvo Group

Notes to consolidated financial statements

Prévost Car Inc.

During the third quarter 2004 the North American bus manufacturer

Prévost Car Inc. became a wholly owned subsidiary of Volvo Bus

Corporation. As part of the restructuring of the bus manufacturer

Henlys Group Plc, Volvo Group reached an agreement to acquire the

remaining 50% of the shares. Prévost Car Inc. was a former 50/50

joint venture between Volvo and Henlys, reported in the Volvo Group

accounts in accordance with the proportionate consolidation

method. The purchase price was USD 83 M including two loans

made available to Prévost Car Inc. by Henlys. Prévost Car Inc. con-

tain the Prévost and Nova brands. Prévost manufactures coaches

and bus shells for luxury mobile homes. Nova Bus manufactures city

buses mainly for the Canadian market.

Axle manufacturing

During the third quarter 2004 Volvo and ArvinMeritor signed a Stra-

tegic Alliance Agreement for the supply of axels. As a consequence

of the strategic alliance ArvinMeritor acquired the Volvo’s axle plant

and foundry in Lyon, France.

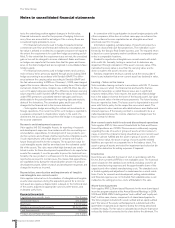

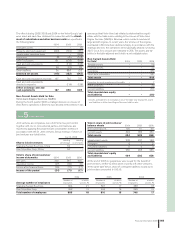

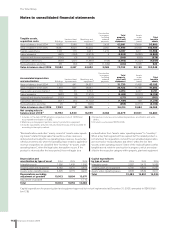

The effects during 2006, 2005 and 2004 on the Volvo Group’s bal-

ance sheet and cash fl ow statement in connection with the acquisi-

tion of subsidiaries and other business units are specifi ed in the

following table:

2004 2005 2006

Intangible assets (599) 20 0

Property, plant and equipment 300 124 73

Assets under operating lease 115 0 0

Shares and participations (260) (80) 5

Inventories 630 129 131

Current receivables 958 257 91

Cash and cash equivalents 180 42 8

Other assets 62 3 0

Minority interests (20) (45) 0

Provisions (63) (4) (24)

Loans (347) (115) (20)

Liabilities (448) (203) (69)

Acquired net assets 508 128 195

Cash and cash equivalents paid (508) (60) (167)

Cash and cash equivalents according

to acquisition analysis 180 42 8

Effect on Group cash and

cash equivalents (328) (18) (159)

The effects during 2006, 2005 and 2004 includes wholly owned

subsidiaries that previously were accounted for according to the

equity method.

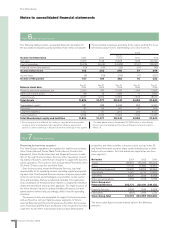

AB Volvo’s holding of shares in subsidiaries as of December 31,

2006 is shown in the table on pages 149–151, AB Volvo’s holding

of shares. Signifi cant acquisitions, formations and divestments

within the Group are listed below.

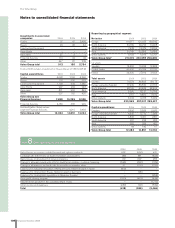

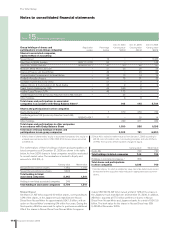

Shandong Lingong Construction Machinery Co.

Volvo Construction Equipment (Volvo CE) has made an equity invest-

ment of 70% in Shandong Lingong Construction Machinery Co.

China is the world’s largest market for wheel loaders. The total mar-

ket for 2005 was approximately 110,000 units. Lingong is the fourth

largest producer of wheel loaders in China with a comprehensive

dealer network throughout the country. In addition to 16 different

models of wheel loaders, Lingong also has a smaller range of back-

hoe loaders, road rollers and excavators.

In January 2007, it was announced that Volvo Construction Equip-

ment (Volvo CE) had received all necessary regulatory approvals for

an equity investment of 70% in Lingong and the deal is now closed.

Volvo CE has invested RMB 328 M, corresponding to just over SEK

300 M, in exchange for 70% of the equity in Lingong. In 2005 Lin-

gong’s operating income was RMB 10 M on revenue of RMB 2 B

and had around 1,800 employees. The deal has no material impact

on Volvo’s fi n ancial position.

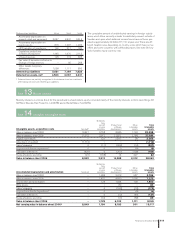

Celero Support AB

In November 2005 Volvo sold Celero Support AB to Coor Service

Management for 680 before deduction for the company’s net debt.

The sale resulted in a gain of about 430. Celero Support AB is a

service company with operations that include various offi ce and

workplace sevices as well as maintenance of industrial plants and

properties. Celero Support had 1,100 employees and net sales of

approximately 1.4 billion when sold.

Properties

In February 2005, Volvo Financial Services, via the Volvo Group’s

real estate company, Danafjord AB, entered an agreement on the

sale of two wholly owned companies, which own properties in Tors-

landa and Kalmar valued at about 515. The sale yielded a capital

gain of 188.

L.B. Smith (SABA Holding Inc.)

On May 2, 2003 Volvo Construction Equipment purchased the

assets amounting to USD 189 M associated with the Volvo distribu-

tion business of L.B. Smith Inc. in the US. No goodwill or real estate

was included in the deal. The major part of the dealerships was

divested during 2004.

Renault V.I. and Mack

During the fourth quarter 2004 AB Volvo and Renault signed a set-

tlement agreement regarding the disagreement the companies have

had since 2001 pertaining to Volvo’s acquisition of Renault V.I./

Mack and the value of certain of the acquired assets and certain

warranty claims. The settlement, EUR 108 M has reduced the good-

will amount pertaining to the acquisition of Renault V.I.

Note 4 Acquisition and divestments of shares in subsidiaries