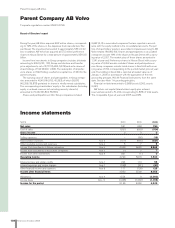

Volvo 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information 2006 131

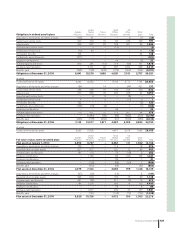

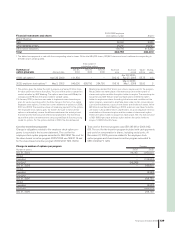

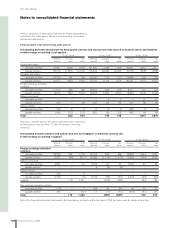

Note 35 Fees to the auditors

Audit fees 2004 2005 2006

Audit fees to PricewaterhouseCoopers 78 78 130

Audit fees to other audit fi rms 2 1 1

Total 80 79 131

Other fees to

PricewaterhouseCoopers

Fees for audit related services 20 28 20

Fees for tax services 16 17 14

Total 36 45 34

Fees and other remuneration to

external auditors total 116 124 165

Auditing assignments involve examination of the annual report and

fi n a ncial accounting and the administration by the Board and the

President, other tasks related to the duties of a company auditor and

consultation or other services that may result from observations

noted during such examination or implementation of such other

tasks. All other tasks are defi ned as other assignments.

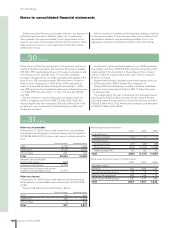

Not 36 Goals and policies in fi nancial risk management

Apart from derivatives, Volvo’s fi nancial instruments consist of bank

loans, fi n ancial leasing contracts, accounts payable, accounts receiv-

able, shares and participations, as well as cash and short-term

investments.

The primary risks deriving from the handling of fi nancial instru-

ments are interest-rate risk, currency risk, liquidity risk and credit

risk. All of these risks are handled in accordance with an established

fi n a ncial policy.

Interest-rate risk

Interest-rate risk refers to the risk that changed interest-rate levels

will affect consolidated earnings and cash fl ow (cash-fl ow risks) or

the fair value of fi nancial assets and liabilities (price risks). Matching

the interest-fi xing terms of fi n ancial assets and liabilities reduces the

exposure. Interest-rate swaps are used to change/infl uence the

interest-fi xing term for the Group’s fi nancial assets and liabilities.

Currency interest-rate swaps permit borrowing in foreign currencies

from different markets without introducing currency risk. Volvo also

has standardized interest-rate forward contracts (futures) and FRAs

(forward-rate agreements). Most of these contracts are used to

hedge interest-rate levels for short-term borrowing or investment.

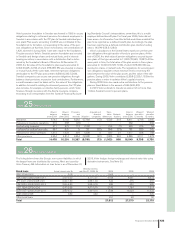

Cash-fl ow risks

The effect of changed interest-rate levels on future currency and

interest-rate fl o ws refers mainly to the Group’s customer fi n ancing

operations and net fi n ancial items. According to the Group’s policy,

the degree of matching for interest-rate fi x ing on borrowing and

lending in the customer-fi nancing operations must exceed 80%. At

year-end 2006, the degree of such matching was 100%. At year-

end 2006, in addition to the assets in its customer-fi nancing oper-

ations, Volvo’s interest-bearing assets consisted primarily of liquid

assets invested in short-term interest-bearing securities. The object-

ive is to achieve an interest-fi xing term of six months for the liquid

assets in Volvo’s industrial operations through the use of derivatives.

On December 31, 2006, after taking derivatives into account, the

average interest on these assets was 3.5%. Apart from loans raised

to fi nance the credit portfolio of the customer-fi nancing operations,

at this same point in time, Volvo’s fi nancial liabilities consisted primar-

ily of provisions for pensions and similar commitments. After taking

derivatives into account, outstanding loans had interest terms corre-

sponding to an interest-rate fi x ing term of six months and the aver-

age interest at year-end amounted to 6.3%.

Price risks

Exposure to price risks as result of changed interest-rate levels refers

to fi nancial assets and liabilities with a lower interest-rate fi x ing term

(fi x ed interest). A comparison of the reported values and the fair val-

ues of all of Volvo’s fi n ancial assets and liabilities, as well as its

derivatives, is given in Note 37, Financial instruments. After the tran-

sition to IFRS 2005, the market values agree with the book values.

Assuming that the market interest rates for all currencies sud-

denly rose by one percentage point (100 interest-rate points) over

the interest-rate level on December 31, 2006, over a 12-month

period, all other variables remaining unchanged, Volvo’s net interest

income would be favorably impacted by 236. Assuming that the mar-

ket interest rates for all currencies fell in a similar manner by one

percentage point (100 interest-rate points) over the interest-rate

level on December 31, 2006, over a 12-month period, all other vari-

ables remaining unchanged, Volvo’s net interest income would be

adversely impacted by a corresponding amount.

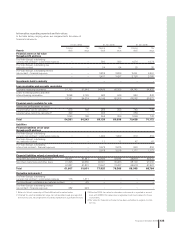

The following table shows the effect on earnings in Volvo’s key

currencies that would result is the interest-rate level were to change

by 1 percentage point.

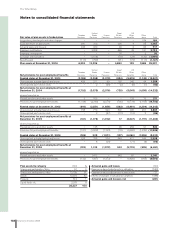

SEK M Effect on earnings

SEK 314.9

USD (1.0)

EUR (17.1)

CAD (9.2)

JPY (8.8)

KRW 13.1

It should be noted that the above sensitivity analysis is based on

assumptions that rarely occur in reality. In reality, market interest

rates usually do not rise or fall at any one point in time. Moreover, the

sensitivity analysis also assumes a parallel shift in the yield curve

and an identical effect of changed market interest rates on the inter-

est-rates of both assets and liabilities. Consequently, the effect of

actual interest-rate changes may deviate from the above analysis.