Volvo 2006 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

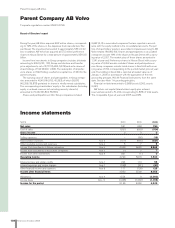

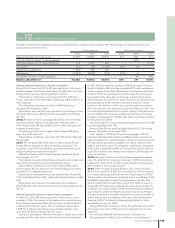

Parent Company AB Volvo

Corporate registration number 556012-5790.

Board of Directors’ report

During the year, AB Volvo acquired 58.2 million shares, correspond-

ing to 19% of the shares, in the Japanese truck manufacturer Nis-

san Diesel. The investment amounted to approximately SEK 2.0 bil-

lion. In addition, AB Volvo has acquired all 57.5 million preference

shares in Nissan Diesel for a total amount of approximately SEK 3.5

billion.

Income from investments in Group companies includes dividends

amounting to 399 (9,161; 101), Group contributions and transfer

price adjustments, net of 8,721 (5,360; 5,673) and write-downs of

shareholdings of 192 (8,420; 1,364). The redemption of all prefer-

ence shares in VNA Holding resulted in a capital loss of 363 for the

parent company.

The carrying value of shares and participations in Group compa-

nies amounted to 40,419 (40,812; 40,393), of which 39,870

(40,298; 39,878) pertained to shares in wholly owned subsidiaries.

The corresponding shareholders’ equity in the subsidiaries (including

equity in untaxed reserves but excluding minority interests)

amounted to 76,232 (67,804; 55,831).

Shares and participations in Non-Group companies included

5,642 (0; 0) in associated companies that are reported in accord-

ance with the equity method in the consolidated accounts. The por-

tion of shareholders’ equity in associated companies accruing to AB

Volvo totaled 180 (85; 90). Shares and participations in associated

companies include 19% of the shares in Nissan Diesel with a carry-

ing value of 2,001. The market price of these shares amounted to

1,341 at year-end. Preference shares in Nissan Diesel with a carry-

ing value of 3,493 are also included. Shares and participations in

non-Group companies include listed shares in Deutz AG with a car-

rying value of 740, corresponding to the quoted market price at year-

end. The holding in Deutz AG is reported at market value as of

January 1, 2005 in accordance with the application of the new

accounting principle, IAS 39 Financial Instruments, from the same

date. See also Note 1 Accounting principles.

Financial net debt amounted to 3,589 (assets 6,052; assets

5,541).

AB Volvo’s risk capital (shareholders’ equity plus untaxed

reserves) amounted to 51,240 corresponding to 89% of total assets.

The comparable fi gure at year-end 2005 was 92%.

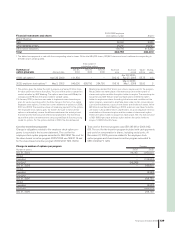

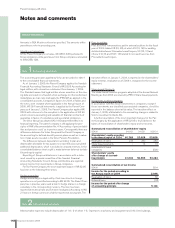

SEK M 2004 2005 2006

Net sales 531 663 764

Cost of sales (531) (663) (764)

Gross income 0 0 0

Selling expenses – (56) (16)

Administrative expenses Note 2 (471) (955) (621)

Other operating income and expenses Note 3 5 7 5

Income from investments in Group companies Note 4 4,409 6,620 8,565

Income from investments in associated companies Note 5 (1) 0 7

Income from other investments Note 6 851 (1) 0

Operating income 4,793 5,615 7,940

Interest income and similar credits Note 7 294 114 56

Interest expenses and similar charges Note 7 (238) (31) (67)

Other fi nancial income and expenses Note 8 111 (108) 126

Income after fi nancial items 4,960 5,590 8,055

Allocations Note 9 1,524 0 (2,000)

Income taxes Note 10 (1,338) (1,230) (1,706)

Income for the period 5,146 4,360 4,349

Parent Company AB Volvo

Income statements

138 Financial information 2006