Volvo 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

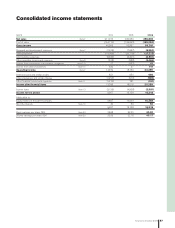

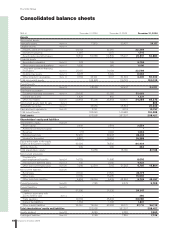

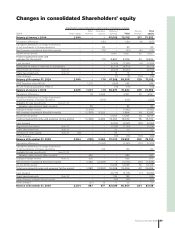

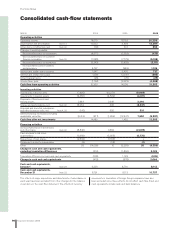

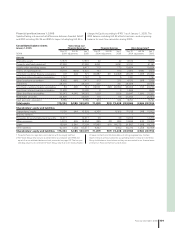

Amounts in SEK M unless otherwise specifi ed. The amounts within parentheses refer to the preceding years, 2005 and 2004.

The consolidated fi n ancial statements for AB Volvo and its subsidiar-

ies have been prepared in accordance with International Financial

Reporting Standards (IFRS) issued by the International Accounting

Standards Board (IASB), as adopted by the EU. Those portions of

IFRS not adopted by the EU have no material effect on this report.

This annual report is prepared in accordance with IAS 1 Presenta-

tion of Financial Statements and in accordance with the Swedish

Companies Act. In addition, RR30 Supplementary Rules for Groups,

was applied, issued by the Swedish Financial Accounting Standards

Council.

In the preparation of these fi nancial statements, the company

management has made certain estimates and assumptions that

affect the value of assets and liabilities as well as contingent liabil-

ities at the balance sheet date. Reported amounts for income and

expenses in the reporting period are also affected. The actual future

outcome of certain transactions may differ from the estimated out-

come when these fi nancial statements were issued. Any such differ-

ences will affect the fi nancial statements for future fi s cal periods.

Changes of accounting principles

Effective in 2005 Volvo has applied International Financial Reporting

Standards (IFRS) in its fi nancial reporting. In accordance with the

IFRS transition rules in IFRS 1, Volvo applies retroactive application

from the IFRS transition date at January 1, 2004. The general rule is

that restatement of fi nancial reporting for periods after the transition

date should be made as if IFRS has been applied historically. All

comparison fi g ures from 2004, in tables and the notes, have been

restated. There are certain exceptions from the general rule of which

the most signifi cant for Volvo are:

– IAS 39 Financial instruments: Recognition and measurement

which is applicable from January 1, 2005.

– Non-amortization of intangible assets with indefi nite useful lives

(e.g. goodwill) in accordance with IFRS 1 should be applied retro-

actively only from the transition date January 1, 2004.

The transition from Swedish GAAP to IFRS was made according

to a regulation applicable to all listed companies within the European

Union as of 2005. Refer to Note 3, Transition to IFRS for a more

detailed overview of the transition.

Refer to the 2004 Annual Report for a description of the previous

Swedish accounting principles applied by Volvo.

New accounting principles in 2005

The following IFRS standards were applied as of 2005, in accord-

ance with the respective standards transition rules or in accordance

with IFRS 1, IAS 39: Financial Instruments: Recognition and Meas-

urement, and IFRS 5, Non-Current Assets Held for Sale and Discon-

tinued Operations. Neither of these standards requires retroactive

reporting. Accordingly, the comparison year 2004 is not restated

with regard to these standards. Volvo decided to early adopt the

amended IAS 39 regarding hedging of commercial cash fl ows, relat-

ing to intra-group forecasted transactions, from January 1, 2005.

New accounting principles in 2006

As of 2006, applies the updated standard IAS 21, Effects of

Changes in Foreign Exchange Rates, which does not have any sig-

nifi cant effect on Volvo’s fi n ancial position. With regard to applica-

tion of IFRIC 4, Determining whether an arrangement contains a

lease, and the supplement to IAS 39, Financial Instruments: Recog-

nition and Measurement, pertaining to fi nancial guarantee contracts,

the comparison year is restated. The effect on Volvo’s shareholders’

equity amounts to a negative SEK 10 M on the opening balance for

2005 and a positive SEK 2 M for the income for the 2005 period.

IFRIC 5 Rights to interests arising from Decommissioning, Restor-

ation and Environmental Rehabilitation Funds, IFRIC 6 Liabilities

arising from participating in a Specifi c Market – Waste Electrical and

Electronic Equipment, have not affected Volvo’s fi nancial position

signifi cantly.

New accounting principles 2007

In preparing the consolidated accounts at December 31, 2006, a

number of standards and interpretations were published but have as

yet not become effective. The following is a preliminary assessment

of the effect implementation of these standards and statements

could have on the Volvo Group’s fi n ancial statements.

IAS 1 supplement – Presentation of Financial statements:

Information about capital

The supplement became effective on January 1, 2007. At this time, it

is assessed that this supplement results in increased supplementary

information, including defi nition of capital, capital structure and pol-

icies for management of capital.

IFRS 7 Financial Instruments: Disclosure

The standard became effective as of January 1, 2007. It is assessed

that for the Volvo Group this standard requires further provision of

supplementary disclosures in the form of risk analysis linked to the

Group’s fi n ancial instruments.

IFRS 8 Operating segments*

The standard becomes effective on January 1, 2009 and applies for

the fi s cal years beginning on that date. The standard addresses the

distribution of the company’s operations in different segments. In

accordance with the standard, the company shall adopt an approach

based on the internal reporting structure and determine the report-

able segments based on this structure. Volvo does not expect the

adoption of IFRS 8 to result in any change in the number of segments.

IFRIC 7 Applying the Restatement Approach under IAS 29

Financial reporting in Hyperinfl ationary Economies

The interpretation became effective on March 1, 2006 and applies

to fi scal years beginning after March 1, 2006. The Group currently

does not have operations in any countries in which the transition to

high-infl ation accounting applies.

IFRIC 8 Scope of IFRS 2

The interpretation became effective on May 1, 2006 and applies to

fi s c al years beginning after May 1, 2006. In accordance with IFRS 8,

the rules in IFRS 2 apply to goods and services received in

exchange for own equity instruments even if these goods or serv-

ices, partly or wholly, cannot be identifi ed specifi cally, This statement

is not expected to be applicable to the Group since transactions of

this type does not occur.

IFRIC 9 Reassessment of Embedded Derivatives

The interpretation became effective on June 1, 2006 and applies to

Notes to consolidated financial statements

Note 1 Accounting principles

*These standards/interpretations have not been adopted by the EU at this time.

Financial information 2006 91