Volvo 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 Financial information 2006

The Volvo Group

Notes to consolidated financial statements

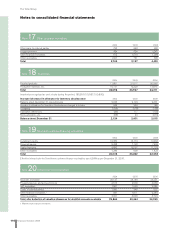

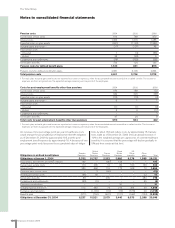

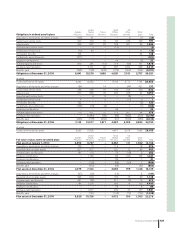

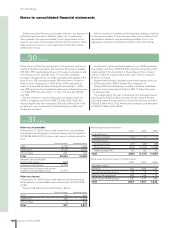

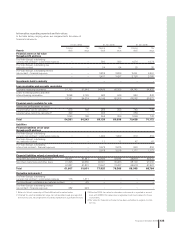

Note 31 Leasing

Volvo as a leaseholder

At December 31, 2006, future rental income from noncancellable

fi n a ncial and operating leases (minimum leasing fees) amounted to

31,808 (34,406; 25,181). Future rental income is distributed as fol-

lows:

Financial leases Operating leases

2007 8,725 3,900

2008–2011 15,338 6,091

2012 or later 281 344

Total 24,344 10,335

Allowance for uncollectible

future rental income (425)

Unearned rental income (2,446)

Present value of future rental income

related to noncancellable leases 21,473

Volvo as a lessee

At December 31, 2006, future rental payments (minimum leasing

fees) related to noncancellable leases amounted to 3,234 (4,396;

4,142).

Future rental payments are distributed as follows:

Financial leases Operating leases

2007 165 841

2008–2011 186 1,508

2012 or later 6 528

Total 357 2,877

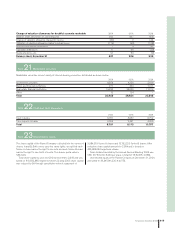

Rental expenses amounted to:

2004 2005 2006

Financial leases:

Contingent rents (30) 0 0

Operating leases:

Contingent rents (27) (34) (38)

Rental payments (910) (1,000) (1,468)

Sublease payments 28 23 15

Total (939) (1,011) (1,491)

Book value of assets subject to fi nance lease:

2004 2005 2006

Acquisition costs:

Buildings 526 459 151

Land and land improvements 66 75 72

Machinery and equipment 236 198 114

Assets under operating lease 1,065 875 888

Total 1,893 1,607 1,225

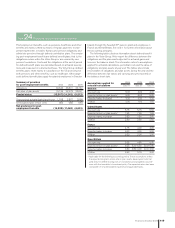

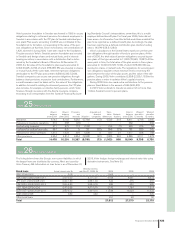

Global actors like Volvo are occasionally involved in tax disputes of

different proportions and in different stages. On a regular basis

Volvo evaluates the exposure related to such disputes and, to the

extent it is possible to reasonably estimate what the outcome will be,

makes provisions when it is more likely than not that there will be

additional tax to pay.

Volvo is involved in a number of other legal proceedings incidental

to the normal conduct of its businesses. Volvo does not believe that

any liabilities related to such proceedings are likely to be, in the

aggregate, material to the fi nancial condition of the Volvo Group.

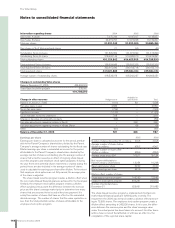

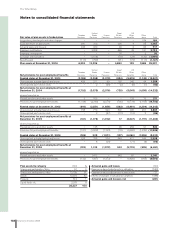

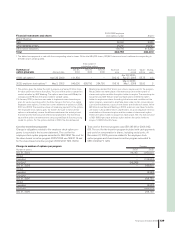

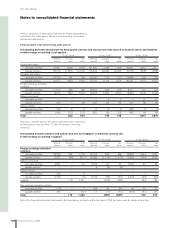

Note 30 Cash-fl ow

Other items not affecting cash pertain to risk provisions and losses

related to doubtful receivables and customer-fi nancing receivables,

476 (602; 551), capital gains/losses on the sale of subsidiaries and

other business units neg. 281 (neg. 717; pos. 95), unrealized

exchange rate gains/losses on trade receivables and payables 143

(neg. 41; pos. 39), incentive program 258 write-down of shares in

Peach County Holdings Inc in 2005 and in 2004 revaluation of

shares in Scania AB and Henlys Group Plc amounting to – (550;

neg. 820), provision for industrial relocation and contractual pension

– (–; 530), IFRS transition effect – (–; neg. 177) and other 56 (21;

neg. 58).

Net investments in customer-fi nancing receivables resulted in

2006 in a negative cash-fl ow of SEK 5.2 billion (7.8; 7.4). In this

respect, liquid funds were reduced by SEK 26.0 billion (23.4; 19.4)

pertaining to new investments in fi nancial leasing contracts and

installment contracts.

Investments of shares and participations, net in 2006 amounted

to a negativ cash-fl ow of SEK 5.8 billion (positive 0.3; positive 15.1),

mainly related to the investment in Nissan Diesel. The net invest-

ments in 2004 are mainly related to the sale of Volvo’s holding of

B-shares in Scania.

Acquired and divested subsidiaries and other business units, net

in 2006 amounted to SEK 0.5 billion (0.6; negative 0.1).

During 2006 interest-bearing receivables including marketable

securities, net increased liquid funds by SEK 7.7 billion (decrease

1.3; decrease 6.4).

The change during the year in bonds and other loans decreased

liquid funds by SEK 2.6 billion (increase 3.6; decrease 8.8). New

borrowing during the year, mainly the issue of bond loans, provided

SEK 69.3 billion (41.6; 19.1). Amortization during the year amounted

to SEK 72.2 billion (33.4; 28.9).