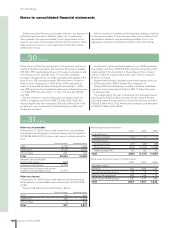

Volvo 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Financial information 2006

The Volvo Group

Notes to consolidated financial statements

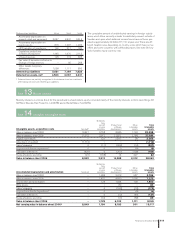

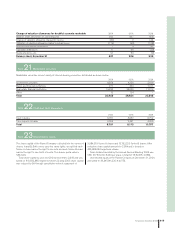

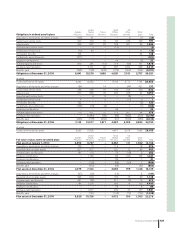

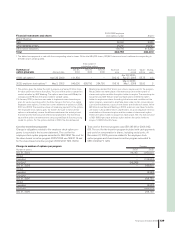

Pension costs 2004 2005 2006

Current year service costs 616 788 870

Interest costs 1,306 1,315 1,285

Expected return on plan assets (931) (1,133) (1,359)

Actuarial gains and losses

1 (17) (107) 48

Past service costs

– Unvested 7 (4) (56)

– Vested 38 (20) 0

Curtailments and settlements (28) (362) (28)

Termination benefi ts 729 124 135

Pension costs for defi ned benefi t plans 1,720 601 895

Pension costs for defi ned contribution plans 2,681 3,135 2,844

Total pension costs 4,401 3,736 3,739

1 For each plan, actuarial gains and losses are reported as income or expenses, when the accumulated amount exceeds the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

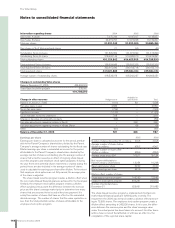

Costs for post-employment benefi ts other than pensions 2004 2005 2006

Current year service costs 196 188 132

Interest costs 349 323 348

Expected return on plan assets (12) (15) (4)

Actuarial gains and losses

1 6 1 1

Past service costs

– Unvested (1) (1) (9)

– Vested 5 4 (17)

Curtailments and settlements – – 3

Termination benefi ts 47 24 8

Total costs for post-employment benefi ts other than pensions 590 524 462

1 For each plan, actuarial gains and losses are reported as income or expenses, when the accumulated amount exceed the so called corridor. The income or

expenses are then recognized over the expected average remaining service period of the employees.

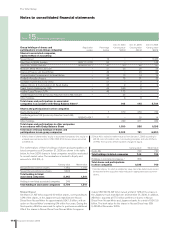

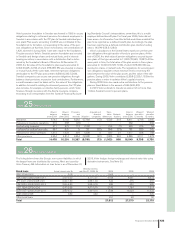

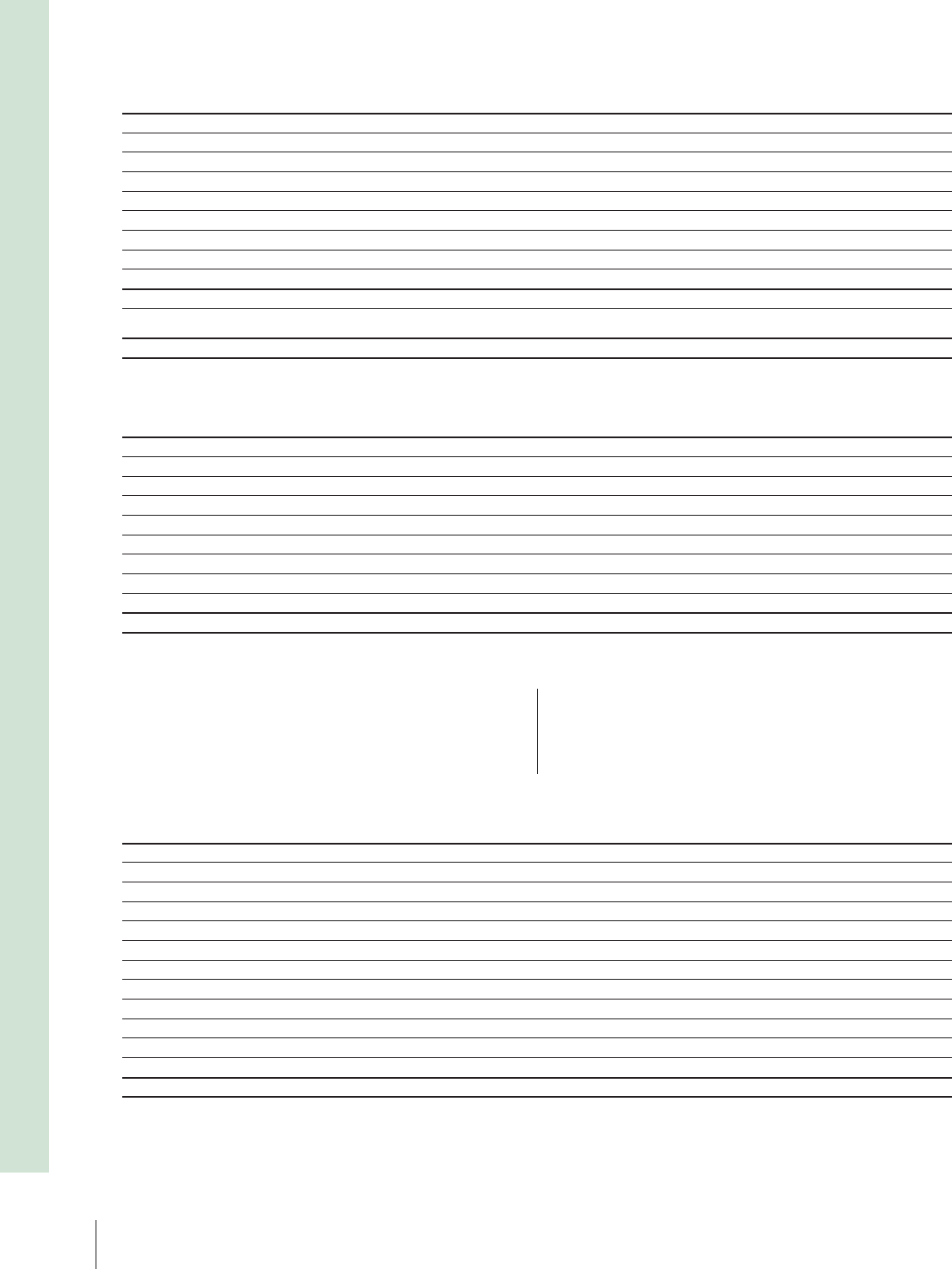

An increase of one percentage point per year in healthcare costs

would change the accumulated post-employment benefi t obligation

as of December 31, 2006 by approximately 193, and the post-

employment benefi t expense by approximately 18. A decrease of one

percentage point would decrease the accumulated value of obliga-

tions by about 164 and reduce costs by approximately 15. Calcula-

tions made as of December 31, 2006 show an annual increase of

10% in the weighted average per capita costs of covered healthcare

benefi ts; it is assumed that the percentage will decline gradually to

5% and then remain at that level.

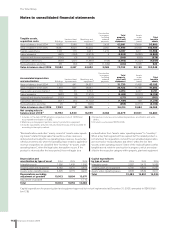

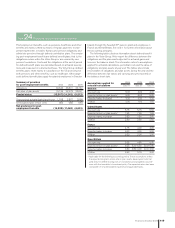

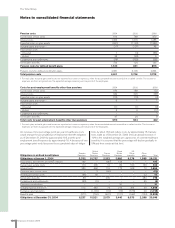

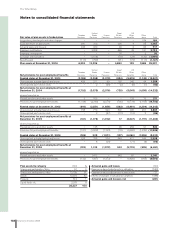

United Great US

Sweden States France Britain Other Other

Obligations in defi ned benefi t plans Pensions Pensions Pensions Pensions benefi ts plans Total

Obligations at January 1, 2004 5,332 10,707 2,333 2,986 6,278 1,595 29,231

Acquisitions, divestments and other changes 140 – (85) 138 – – 193

Current year service costs 176 206 19 82 193 136 812

Interest costs 280 668 115 172 348 72 1,655

Unvested past service costs – 3 (66) – – – (63)

Vested past service costs (46) 66 – – – 22 42

Termination benefi ts 88 – 205 – – 483 776

Curtailments and settlements (35) (5) – – – 35 (5)

Employee contributions – – – 30 – 1 31

Actuarial (gains) and losses 573 683 74 215 364 39 1,948

Exchange rate translation – (1,103) (19) (76) (576) 29 (1,745)

Benefi ts paid (271) (704) (497) (101) (532) (124) (2,229)

Obligations at December 31, 2004 6,237 10,521 2,079 3,446 6,075 2,288 30,646