Volvo 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dongfeng Motor Group, Nissan Motor

and AB Volvo deepen discussions on

possible future cooperation

In January 2007, it was announced that

Dongfeng Motor Group Company Limited

(DFG), Nissan Motor and AB Volvo is deepen-

ing discussions on a possible AB Volvo invest-

ment in the heavy and medium-duty commer-

cial vehicle business currently included in

Dongfeng Motor Co, Ltd (DFL) – the Chinese

joint venture between DFG and Nissan Motor.

Nissan Motor will focus on passenger cars

and light commercial vehicles and has divested

its holding in Nissan Diesel to AB Volvo.

Subsequently, DFG, Nissan Motor and AB Volvo

initiated discussions at the end of 2006 with the

Chinese authorities on the future possible co-

operation of the parties. DFG intends to estab-

lish more competitive alliances with Nissan and

AB Volvo respectively, in order for all parties to

achieve the best development in their special-

ized field.

To move forward on this issue, DFG, Nissan

Motor, DFL and AB Volvo also have signed a

non-binding framework agreement with the

intention of AB Volvo to invest in the heavy and

medium-duty commercial vehicle business and

future engine business, while Nissan Motor

remains committed to the long-term coopera-

tion with DFG regarding passenger vehicles and

the light commercial business. Any future defini-

tive agreement regarding such a transaction will

be subject to approval by Chinese authorities.

Renault Trucks in agreement with Nissan

Motor regarding distribution of light

trucks

Renault Trucks announced in January 2007

that it had signed a distribution agreement cov-

ering the Renault Maxity light-duty vehicle with

the manufacturer Nissan Motor. An agreement

in principle was signed in February 2006.

Renault Maxity is a cab-over-engine light-duty

vehicle developed and produced for Renault

Trucks by Nissan Motor. Sales by Renault

Trucks’ dealers will begin in March 2007.

Renault Maxity complements Renault Trucks’

existing range of light trucks, comprising

Renault Master and Renault Mascott, and is

produced in a range of weight classes from 2.8

to 4.5 tons, with three engine alternatives.

Company information

Annual General Meeting of AB Volvo

At the Annual General Meeting of AB Volvo

held on April 5, 2006, the Board’s proposal to

pay a dividend to the shareholders of SEK

16.75 per share, a total of about SEK 6,775 M,

was approved.

Per-Olof Eriksson, Tom Hedelius, Leif

Johansson, Louis Schweitzer and Finn

Johnsson were re-elected members of the

Board of AB Volvo and Ying Yeh, Philippe Klein

and Peter Bijur were newly elected. Finn

Johnsson was elected Board Chairman.

The Meeting resolved to establish a share-

based incentive program during the second

quarter of 2006 for senior executives in the

Volvo Group. The program mainly involves that

a maximum of 518,000 Series B shares in the

Company could be allotted to a maximum of

240 senior executives, including members of

the Group Executive Committee, during the

first six months of 2007. The allotment shall

depend on the degree of fulfillment of certain

financial goals for the 2006 fiscal year, which

have been set by the Board. For more informa-

tion on share-based incentive programs see

note 34 pages 127 to 129.

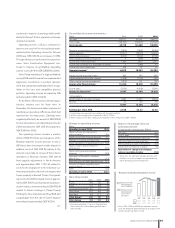

Volvo Board decided on new

financial targets

AB Volvo’s Board

of Directors has de-

cide d to adopt new

financial targets for

the company. The

decision is based on

the Board’s assessment that Volvo today has a

structurally higher profitability, stronger cash

flow and a different risk profile. The Board

focuses on three external financial targets cov-

ering growth, operating margin and capital

structure.

The previous target for operating margin

was 5-7% over a business cycle, including the

operations within Volvo Financial Services. The

new target for operating margin is more than

7% over a business cycle and includes all oper-

ations within the Group except Volvo Financial

Services, which currently contributes approxi-

mately another 1 percentage point. The

restricting ratio for net debt to equity has also

been increased from 30% of shareholders’

equity to 40% of shareholders’ equity. With

regard to the Group’s growth target, the Board

has chosen to retain the target of an annual

growth of at least 10%.

Reversal of reserve for tax receivables

yields positive earnings effect

AB Volvo has decid-

ed to reverse a valu-

ation reserve for

deferred tax receiv-

ables in the Mack

Trucks Inc. subsid-

iary. The decision is based on the fact that Volvo

assesses that the company has a long-term

higher profitability. Reporting of the deferred

tax receivables reduced tax expenses in the

income statement in the third quarter by SEK

2,048 M. In accordance with prevailing

accounting rules, Volvo is adjusting goodwill by

SEK 1,712 M, which affects operating income

adversely. The combined earnings effect for

the third quarter was a positive SEK 336 M.

48 Board of Directors’ Report 2006