Volvo 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

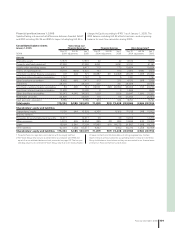

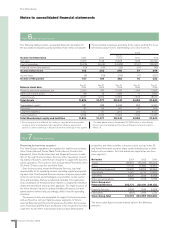

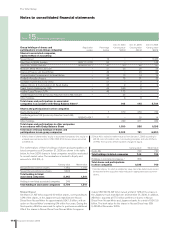

Note 5 Joint ventures

Joint ventures are companies over which Volvo has joint control

together with one or more external parties. Joint ventures are

reported by applying the proportionate consolidation method, in

accordance with IAS 31 Joint ventures. Group holdings of shares in

joint ventures are listed below.

Dec 31, 2006

Holding Holding

Shares in Joint ventures percentage no of shares

Shanghai Sunwin Bus Corp., China 50 –

Xian Silver Bus Corp., China 50 –

Volvo’s share of joint ventures’

income statements 2004 2005 2006

Net sales 492 345 630

Operating income (27) (62) (9)

Income after fi n ancial items (32) (71) (17)

Income of the period (34) (71) (17)

Volvo’s share of joint ventures’

balance sheets 2004 2005 2006

Non-current assets 100 117 99

Current assets 394 386 359

Total assets 494 503 458

Shareholders’ equity 228 207 168

Provisions 6 1 2

Long-term liabilities 0 0 3

Current liabilities 260 295 285

Total shareholders’ equity

and liabilities 494 503 458

At the end of 2006 no guarantees were issued for the benefi t of

joint ventures, neither by Volvo alone or jointly with other venturers.

At the same date Volvo’s share of contingent liabilities issued by its

joint ventures amounted to 0 (0; 6).

2004 2005 2006

Number of of which Number of of which Number of of which

Average number of employees employees women, % employees women, % employees women, %

Shanghai Sunwin Bus Corp. 604 21 567 17 488 18

Xian Silver Bus Corp. 252 12 243 14 258 15

Total number of employees 856 18 810 16 746 17

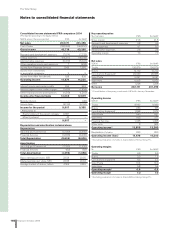

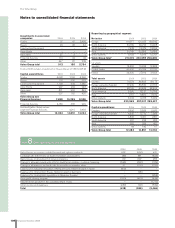

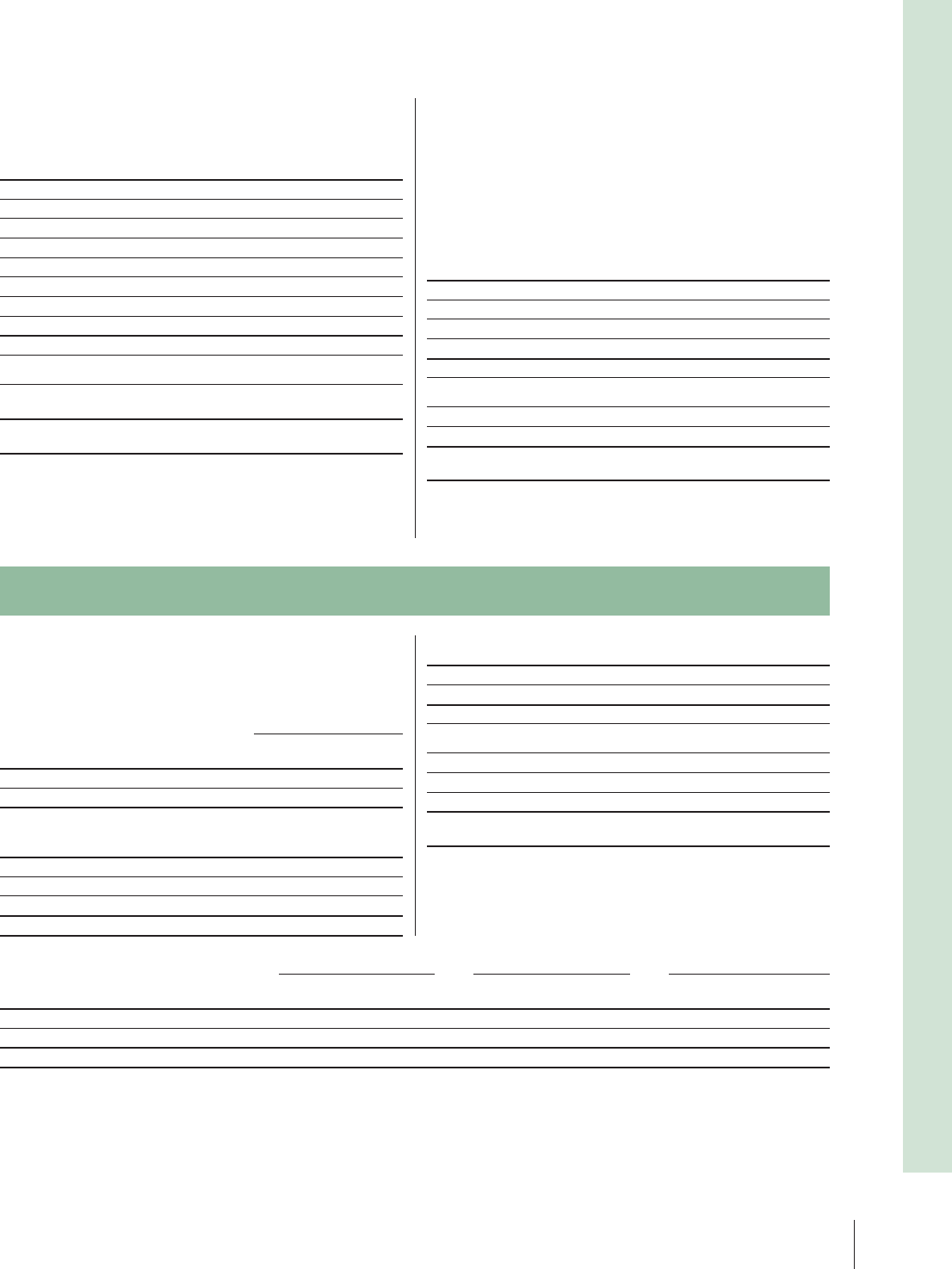

The effects during 2006, 2005 and 2004 on the Volvo Group’s bal-

ance sheet and cash fl ow statement in connection with the divest-

ment of subsidiaries and other business units are specifi ed in

the following table:

2004 2005 2006

Intangible assets – – (2)

Property, plant and equipment (440) (519) (181)

Assets under operating lease – – (369)

Inventories (4) (41) (254)

Other receivables 181 (334) (416)

Cash and cash equivalents – (114) (128)

Provisions 94 (12) 84

Other liabilities 50 888 723

Divested net assets (119) (132) (543)

Cash and cash equivalents received 187 782 797

Cash and cash equivalents,

divested companies – (114) (128)

Effect on Group cash and

cash equivalents 187 668 669

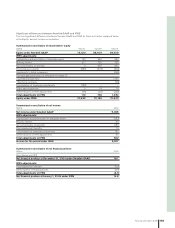

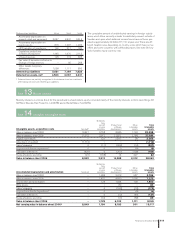

Non-Current Assets Held for Sale

Volvo Aero Engine Services (VAES)

During the fourth quarter 2006 a strategic decision on closure of

Volvo Aero’s operations in Bromma was decided. In November, it was

announced that Volvo Aero had initiated codetermination negoti-

ations with the trade unions relating to the closure of Volvo Aero

Engine Services (VAES) in Bromma, which conducts overhaul of

large aircraft engines. In recent years, the volumes of the engines

overhauled in Bromma have declined sharply. In accordance with the

strategic decision, the operations will be gradually phased out during

2007. Costs for a closure are estimated to 258. The assets and lia-

bilities in the table adjoined are listed to a net realizable value.

Non-Current Assets Held

for Sale1 2004 2005 2006

Tangible assets – – 56

Financial assets – – 22

Inventories – – 480

Short-term recievables – – 247

Total assets – – 805

Provision for post-employment benefi ts – – 7

Other provisions – – 20

Current liabilities – – 253

Total shareholders equity

and liabilities – – 280

1 Assets and liabilities do not balance since the table only display the assets

and liabilities in Volvo Aero Engine Services held for sale.

Financial information 2006 105